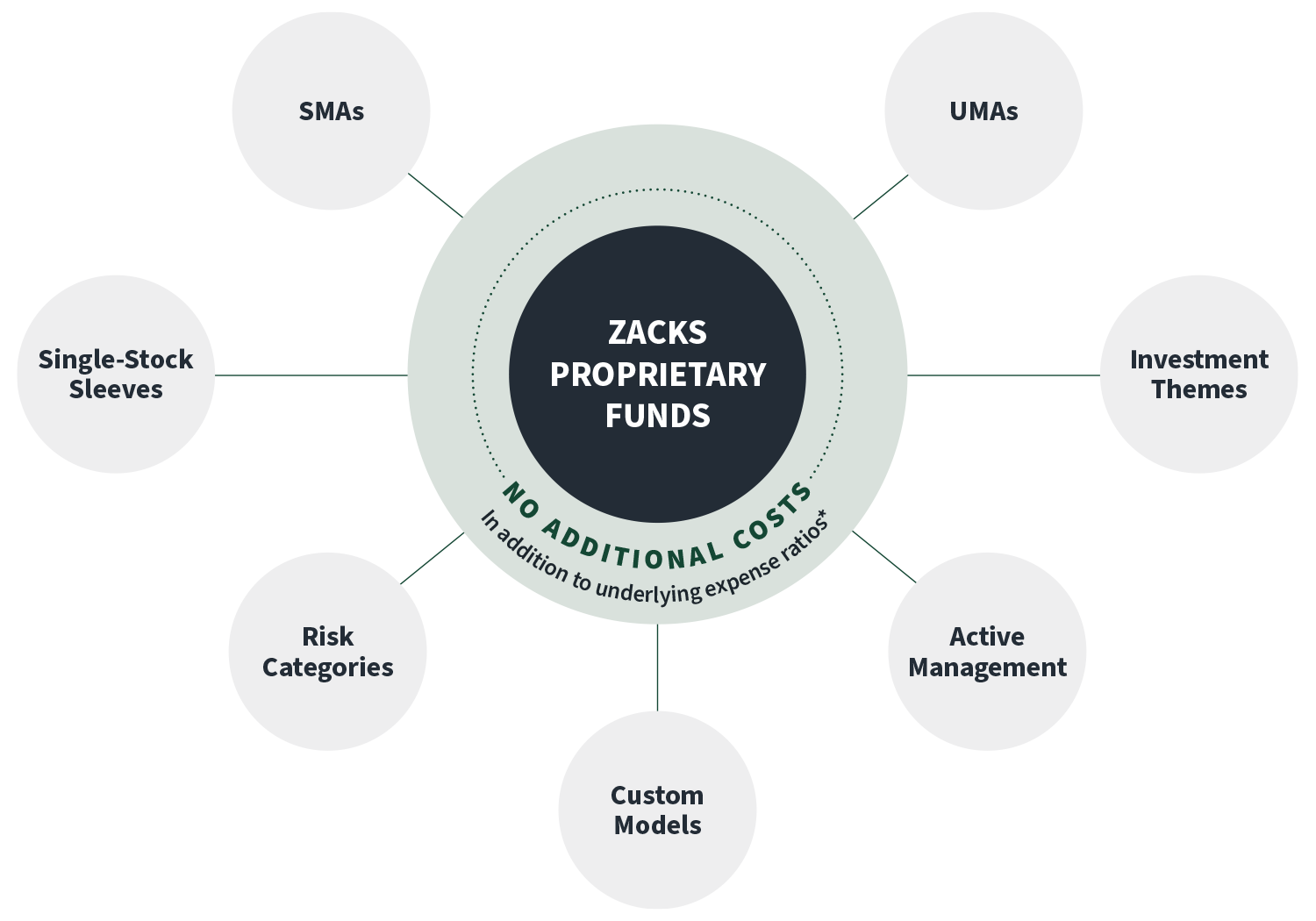

Advisors looking to grow need access to premium features without taking on ever-increasing costs. Zacks Model Portfolios offer advisors a range of solutions for a diverse client base, while limiting the cost of investing to underlying expense ratios*.

The portfolios, strategies and custom Models are designed by the Zacks Portfolio Management Team and are managed in accordance with our long-running methodology and proprietary quantitative models. The Team is headed by Mitch Zacks, a known expert on corporate earnings and quantitative investing.

Please complete the form below to access.

Please complete the form below for more information.