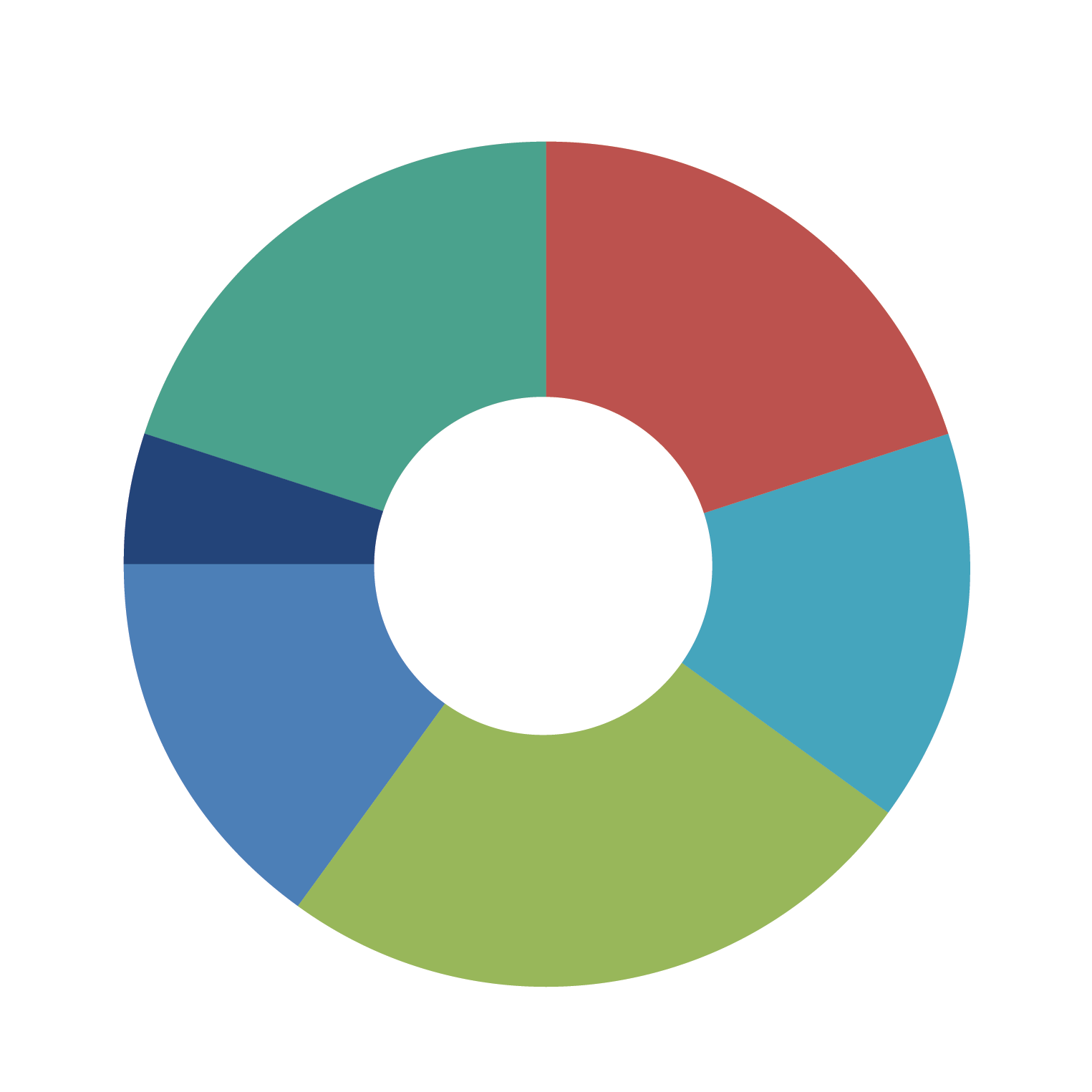

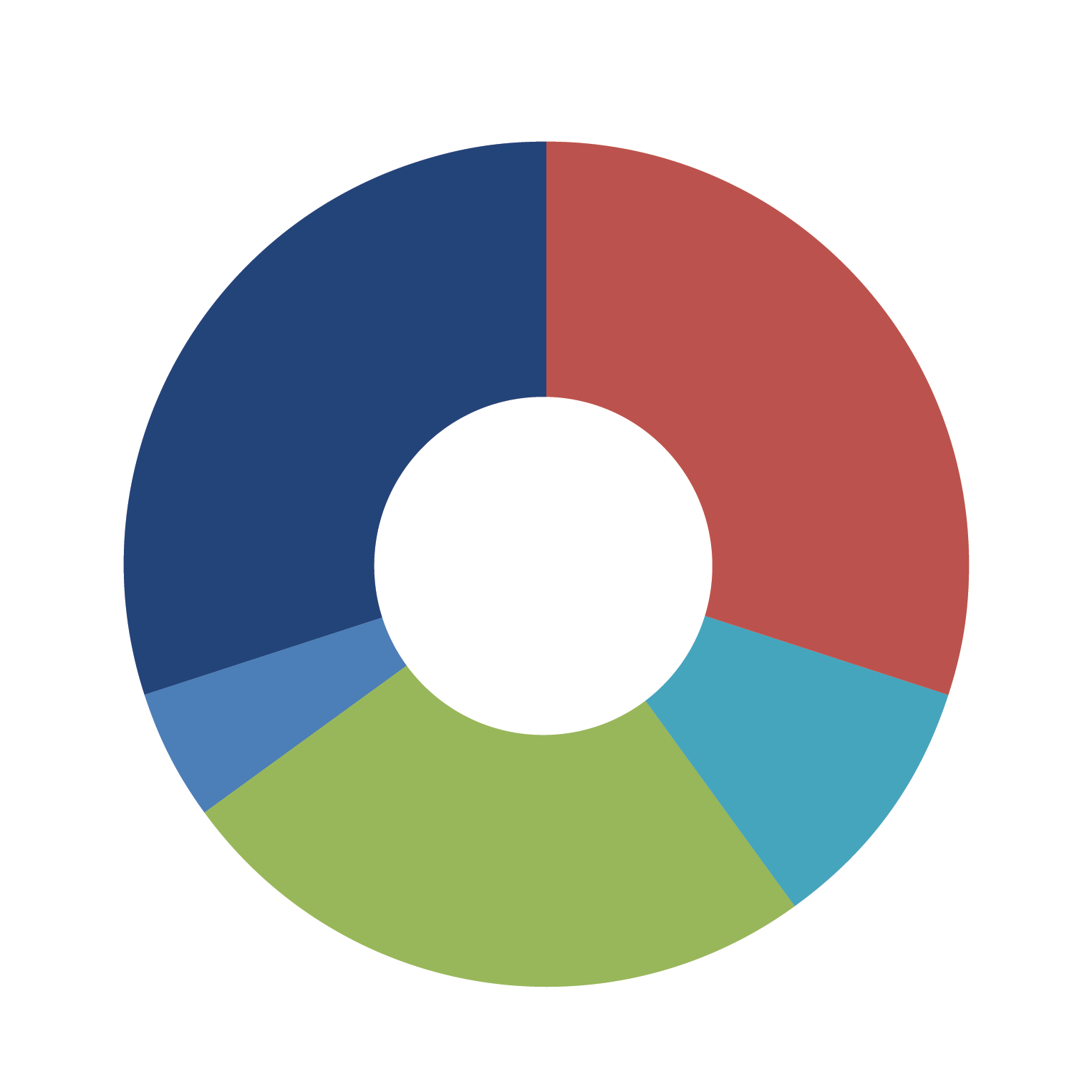

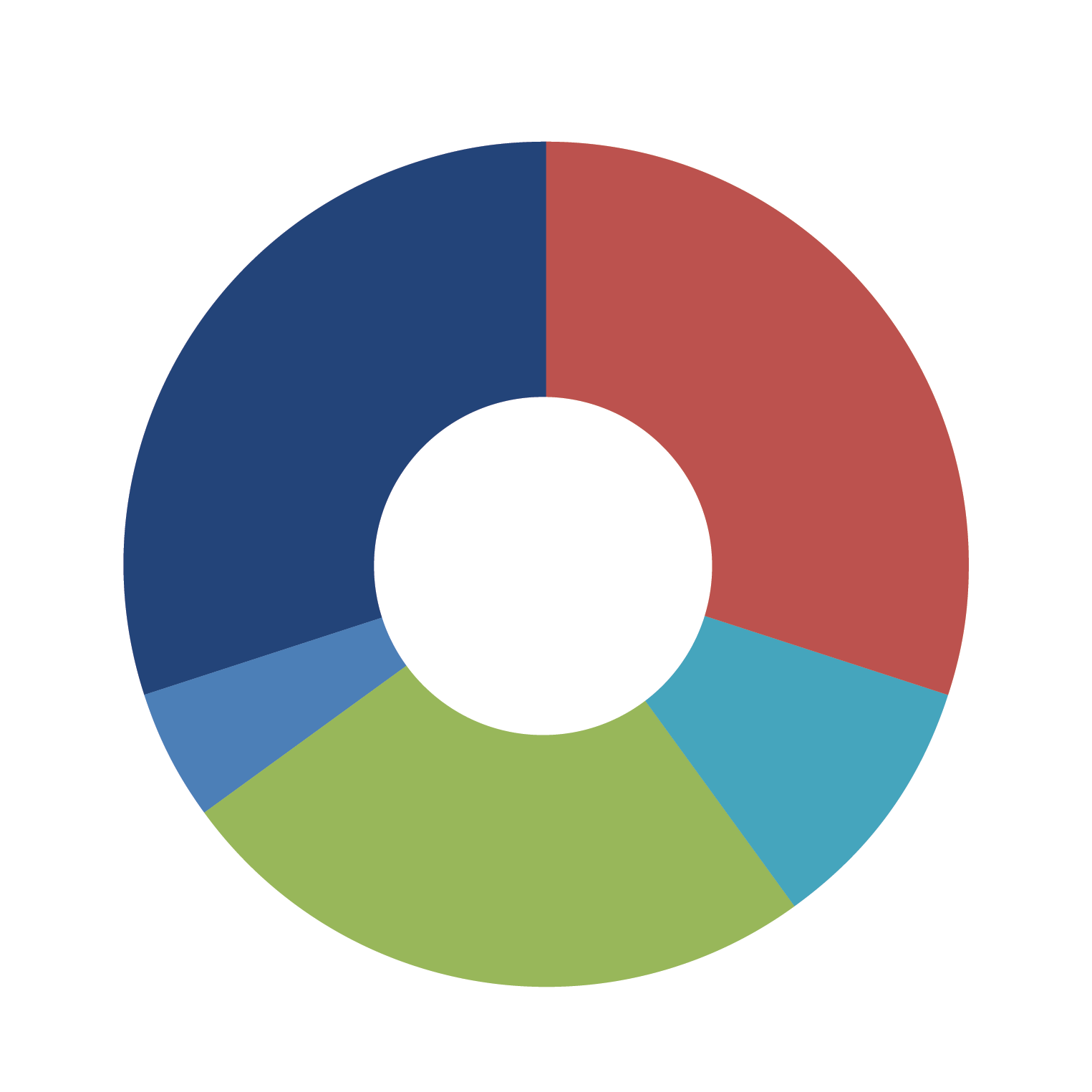

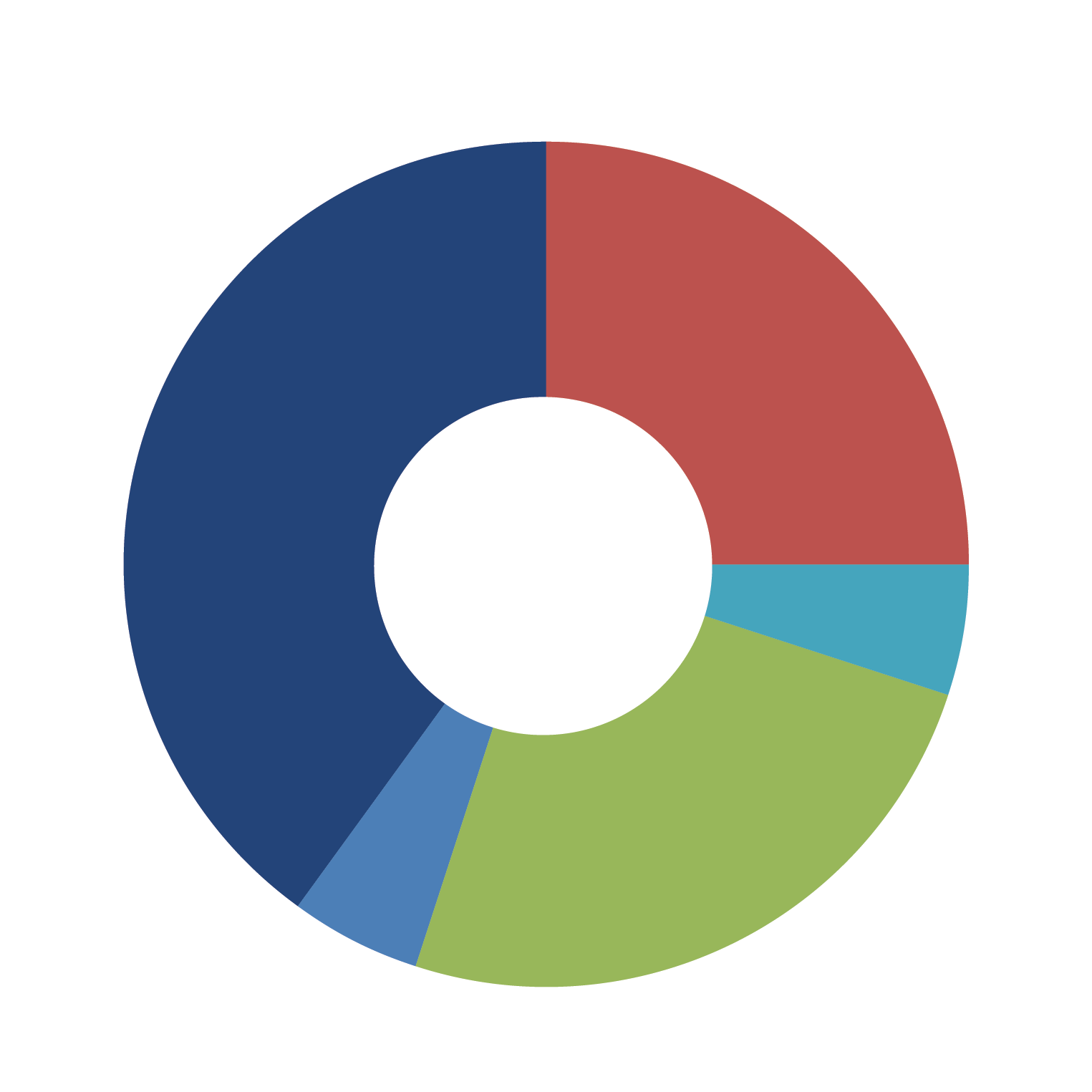

Zacks+ Model Portfolios offer solutions along the risk spectrum. The portfolios are designed to function as a full account solution for a client looking for more than just an ETF-only model. Unlike a traditional Unified Managed Account solution, Zacks+ gives the client a chance to own single stock securities while maintaining a concentrated portfolio. Each model maintains an average of 30-75 holdings and can be funded for $200K.

*Asset allocation subject to change

Please complete the form below to access.

Please complete the form below for more information.