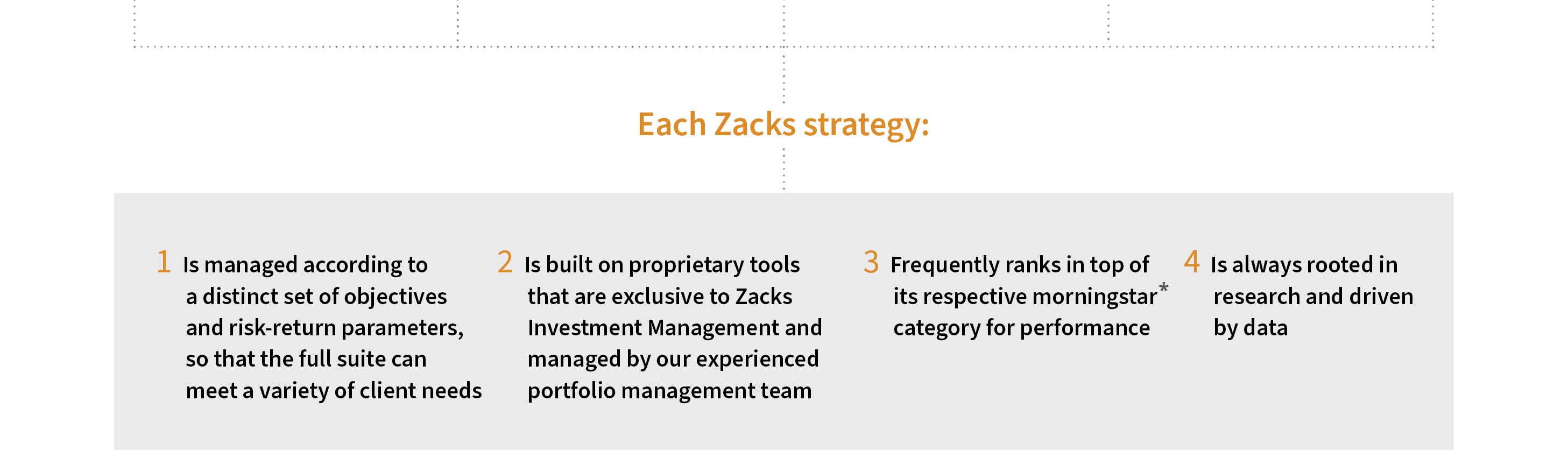

The Zacks Investment Process

Our investment process is a highly disciplined set of steps that encompass our most reliable alpha models and analytical tools, with a daily influx of independent research and manager insight.

“There are two main reasons our investment process has not changed over the years: first, we have a focus on long-term growth, so by definition our strategies require time to fulfill their objectives. And second, it works. We continue to use this methodology because it has proven itself time and again.”