In today’s Steady Investor, we look at key factors that we believe are currently impacting the market, such as:

- 2020’s economic growth roundup

- Economic evolution from industrial to service-based economy

- The importance of foreign direct investment

Economic Growth Roundup, 2020 Edition – There’s no need to restate all of the economic challenges 2020 presented. But the pain was not delivered equally across the world – some countries weathered the storm better than others, and in the case of China, actually grew for the year. One developed economy in particular that fared well on a relative basis was South Korea, which contracted only -1% in 2020. The Bank of Korea attributed the growth to rapid and strong pandemic-response measures, as well as South Korea’s large manufacturing base and strong e-commerce base. One developed economy that fared particularly poorly was the U.K., which is estimated to have contracted over -11% over the last year.1 The U.K. was already weak going into the pandemic – Brexit uncertainty was dragging sentiment and investment across the country, and the pandemic did not play into the U.K.’s economic strong suits, services, and spending. Here is a round-up of estimated GDP growth for other key developed countries, according to the OECD:

- United States: -3.8%

- Japan: -5.2%

- Germany: -5.8%

- Euro Area: -7.8%

- France: -9%

- Italy: -9%

________________________________________________________________________

Download Our Dean’s List of Investment Strategies!

The Coronavirus pandemic has impacted the economy in many ways, which can cause investors to question what’s coming next. While you may not be able to predict what comes next, you can prepare you investments with the right investment strategy! Using the right investment strategy can make a huge difference in preparing your long-term investments for success and can help you navigate these challenging and unprecedented times.

To help you learn more about strategies that cater to different investment objectives, we have created our Dean’s List of Investment Strategies. Our Dean’s List describes five of our investment strategies that are ranked in the top of their respective classes by Morningstar (as of 12/31/20).2

If you have $500,000 or more to invest and want to learn about five of our top strategies, click on the link below.

Learn More About Our Top-Ranked Strategies!3

________________________________________________________________________

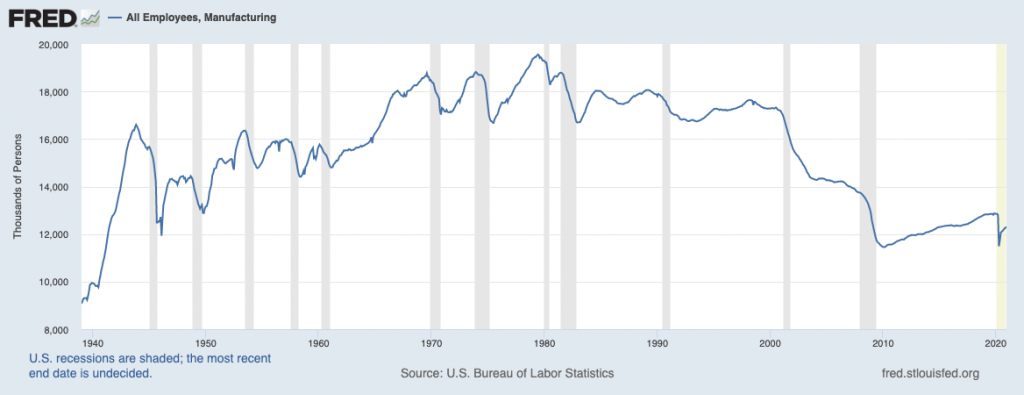

Is a Manufacturing Renaissance Coming to the U.S.? As you can see from the chart below, manufacturing jobs in the U.S. have been in steady decline since the early 1980’s. There are many factors for the decline, but perhaps the most significant has been the economy’s evolution from an industrial economy to a service-based economy. And, of course, technological innovation has played a big role too. Many attempts have been made to save manufacturing jobs, but the policy is arguably not powerful enough to counteract technological and fundamental shifts in the economy. There may be an upshot in the offing, however: the auto industry’s rapid-fire shift to investment in electric vehicles (EVs) is driving strong demand for a new type of manufacturing – lithium-ion batteries. China is currently the top market for the production of lithium-ion EV batteries, but auto-makers in the U.S. are pivoting investment domestically, with sights on developing supply chains for batteries and related materials. Over the next decade and beyond, as the market for EVs grows quickly, the U.S.’s battery-making capacity is expected to increase sharply.4

Source: Federal Reserve Bank of St. Louis5

The Importance of Foreign Direct Investment – A key part of sustainable, long-term economic growth is investment – private fixed investment (at the corporate level), government investment, and lastly, foreign direct investment. The latter category involves countries and corporations investing in other countries, whether it’s to develop supply chains, establish end markets, or to drive sales. As a general rule, more investment is good for economic growth, so every country should have the incentive to invest more, always, in our view. In 2020, China overtook the United States as the world’s top country for foreign direct investment, a title the U.S. should make every effort to reclaim. It should not be difficult, in our view – foreign direct investment by overseas businesses into the U.S. fell 49% in 2020, an anomaly tied to the pandemic. Over the same period, China saw direct investment increase by 4%. Once the risk of the pandemic fades, the U.S. should be able to reclaim the top spot and should make every effort to stay there, in our view.6

The current pandemic will continue to impact markets and economies around the world, but don’t let it stop you from making the right investments that can help you in the long run! Finding the right investment strategy can make a huge difference when managing the highs and lows of the market. To help you learn more about strategies that cater to different investment objectives, we have created our Dean’s List of Investment Strategies.7

Our Dean’s List describes five of our investment strategies that are ranked in the top of their respective classes, according to Morningstar (as of 12/31/20).8 If you have $500,000 or more to invest and want to learn more about these strategies, click on the link below to see how they could potentially benefit you.

Disclosure

2 These rankings may not be representative of any one client’s experience. In addition, they are not indicative of future performance

3 ZIM may amend or rescind the “Dean’s List of Investment Strategies” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. January 26, 2021. https://www.wsj.com/articles/u-s-mounts-a-charge-to-take-on-china-the-king-of-electric-vehicle-batteries-11611658235

5 Fred Economic Data. January 8, 2021. https://fred.stlouisfed.org/series/MANEMP

6 Forbes. January 24, 2021. https://www.forbes.com/sites/sarahhansen/2021/01/24/china-passes-us-as-no-1-destination-for-foreign-investment-as-coronavirus-upends-global-economy/?sh=1189d18d1252

7 ZIM may amend or rescind the “Dean’s List of Investment Strategies” guide for any reason and at ZIM’s discretion.

8 These rankings may not be representative of any one client’s experience. In addition, they are not indicative of future performance

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Returns for each strategy and the corresponding Morningstar Universe reflect the annualized returns for the periods indicated. The Morningstar Universes used for comparative analysis are constructed by Morningstar (median performance) and data is provided to Zacks by Zephyr Style Advisor. The percentile ranking for each Zacks Strategy is based on the gross comparison for Zacks Strategies vs. the indicated universe rounded up to the nearest whole percentile. Other managers included in universe by Morningstar may exhibit style drift when compared to Zacks Investment Management portfolio. Neither Zacks Investment Management nor Zacks Investment Research has any affiliation with Morningstar. Neither Zacks Investment Management nor Zacks Investment Research had any influence of the process Morningstar used to determine this ranking.