In many ways, the first half of 2021 has played out as largely expected. Here’s a quick list of forecasts made at the beginning of the year that I think are largely running their course:

- Rising vaccination rates were expected to give way to loosened and eventually removed economic restrictions;

- The economy was expected to surge on the heels of returning demand and a spending boom;

- The “reopening trade” was expected to favor companies that suffered most during lockdowns but could benefit most from re-engaged consumers;

- Surging demand would generate strong growth rates along with inflationary pressures.

The first six months have gone fairly close to script, in my view, which tees up a few key factors to watch in the second half. Here are three factors that investors should keep an eye on.

____________________________________________________________________________

Make the Most of the Remainder of 2021 – Invest Towards Your Long-Term Financial Goals!

With the first half of 2021 already behind us, we recommend that you stay focused on your long-term financial situation. Do not let worries and concerns drive short-term decision-making, instead focus on key economic indicators that can make a positive impact on your financial success.

To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- An update on the outlook for Covid-19

- Top stocks in top industries

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released August 2021 Stock Market Outlook1

____________________________________________________________________________

Factor #1: Will Inflation be “Transitory”?

The consumer price index jumped 5.4% in June – its quickest increase in 13 years – and has been trending firmly higher. Globally, inflation measures in 49 countries have also been tracking higher.2

The inflation debate continues to center around whether these price pressures will be transitory or more nefarious and long-term. In Q2 earnings calls and reports – both of which we monitor closely here at Zacks Investment Management – we noticed a majority of CEOs referencing inflation. Here are a couple of examples that stood out:

From the massive consumer packaged goods company, Conagra: “We expect the negative impact of the cost inflation to hit our financials before the beneficial impact of our responsive actions, including our pricing.”

From PepsiCo: “We’re seeing inflation in our business across many of our raw ingredients and some of our inputs in labor and freight and everything else.”

Early on, it appeared price pressures were largely being driven by energy, reopening categories like restaurants and travel/hospitality, and big-ticket categories like used cars and housing. But we’re seeing inflationary pressures in much broader categories this summer, and many producers are indicating continued firmness in commodities and other input costs. Continued supply chain bottlenecks aren’t helping.

If inflation does indeed prove sticky, we’d generally want to favor companies with strong pricing power, i.e., firms that can pass along rising costs to consumers without losing market share.

Factor #2: Will Leadership Continue to Shift Between Cyclicals (Value) and Growth?

We have seen quite a bit of style rotation year-to-date so far, namely as capital moved between cyclical (value) stocks and secular growth stocks. From the beginning of the year through the middle of May, value outperformed—the Russell 1000 Value index rose +15% compared to just +2% for the Russell 1000 Growth index. From mid-May to the end of the second quarter, however, U.S. Treasury bonds have rallied alongside growth stocks (+12%), while value stocks have lagged (+2%).

There are some logical explanations for the rotation year-to-date. When vaccines were announced to be effective in November, economically sensitive cyclical stocks started to outperform as investors anticipated the economic reopening. Some of the most beat-down stocks during the pandemic started to rally strongly.

But the rapid surge in demand gave way to what is largely considered peak growth in Q2, which has caused investors – in my view – to rotate into growth names expected to perform better as the U.S.’s pace of growth moderates. Concerns over rising inflation have also nudged capital back to secular growth names.

The key question from here is whether this rotation continues or if the value will start to lead again. In my view, economic growth has likely peaked, but I think will it continue at a faster pace than many expect. In other words, cyclicals likely have some room to run, but quality growth names should also do well in an expanding economy. I expect leadership to shift quite a bit, which favors a broadly diversified approach to equity investing.

Factor #3: Are Interest Rates Poised to Move Higher?

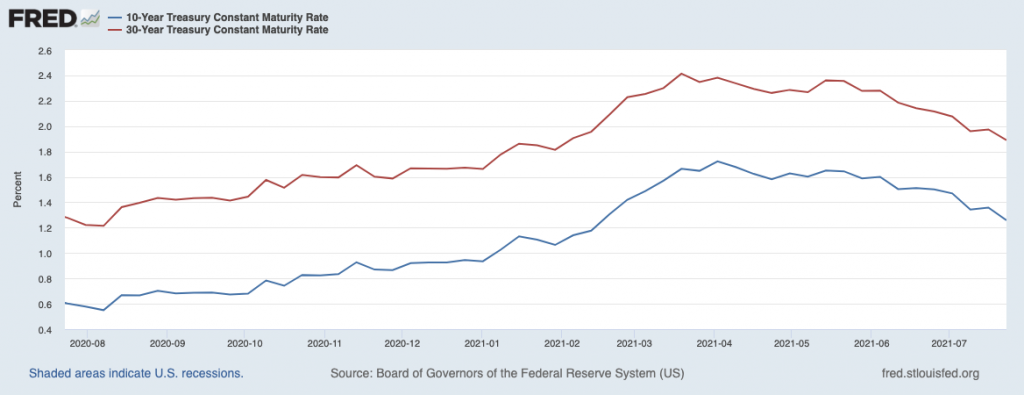

Interest rates in the U.S. – as measured by the 10-year and 30-year U.S. Treasury bond yield – moved higher in the second half of 2020 and throughout Q1 2021. However, as you can see in the chart, yields have slipped back over the last quarter:

There could be a few reasons for this fluctuation in rates. Yields may have pushed higher in anticipation of higher inflation and economic growth, and we may have seen some retracing as investors started to shift expectations to moderating economic growth and inflation that may indeed be transitory.

Going forward, I’d expect better-than-expected economic growth and an eventual reduction in the Fed’s bond purchases to put upward pressure on rates, both of which I could see playing out by the end of the year.

Bottom Line for Investors

I think worries over sticky inflation, peaking economic growth, and rising interest rates are together contributing to a wall of worry over the durability of the economic expansion – and by extension, the bull market. But in my view, the worries may inspire investors to start moderating expectations for sustained economic growth and profitability, and falling expectations could give way to positive surprises. And stocks tend to love positive surprises.

This leads to the main point – stay financially prepared! To positively impact your long-term investments, we recommend concentrating on the facts and hard data.

To help you do this, I am offering all readers our just-released August Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- An update on the outlook for Covid-19Top stocks in top industries

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Black Rock. July 15, 2021. https://www.blackrock.com/us/individual/insights/insights-for-equity-investors

3 Fred Economic Data. July 23, 2021. https://fred.stlouisfed.org/series/DGS10#0

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The MSCI ACWI captures large and mid-cap representation across 23 Developed Markets (DM) and 27 Emerging Markets (EM) countries. With 2,986 constituents, the index covers approximately 85% of the global investable equity opportunity set. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI UK All Cap Index captures large, mid, small and micro-cap representation of the UK market. With 819 constituents, the index is comprehensive, covering approximately 99% of the UK equity universe. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 1000 Value Index is a well-known, unmanaged index of the prices of 1000 large-company value common stocks selected by Russell. The Russell 1000 Value Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.