The S&P 500 has officially crossed over into correction territory1, which is generally defined as a decline of -10% to -20% over a reasonably short period of time (few weeks to a few months). As I wrote last week, little has changed fundamentally over the past two weeks with regard to interest rate expectations, earnings expectations and the potential length of a trade war with China – yet the market is acting like all three of those factors turned sharply negative overnight. They didn’t, in my view.

In this week’s column, I take a look at some of the most commonly cited equity market concerns, debunking them one at a time.

_____________________________________________________________________________

Focus on Key Economic Indicators

I suggest avoiding the urge to get caught up in day-to-day movements, and instead focus on economic data releases, earnings reports, and other economic factors!

To help you do this, we are offering all readers a look into our just-released Stock Market Outlook report.

This report will provide you with our forecasts along with additional factors to consider:

- Should you stay bullish?

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- What produces U.S. optimism in the coming year?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released Stock Market Outlook2

______________________________________________________________________________

1. Yield Curve Inversion Sparks Fears of Imminent Recession – the brass tacks on this investor concern is that it stems from a valid historical fact: the yield curve has inverted prior to each U.S. recession over the past 50 years.

The thinking follows that an inversion today can only mean one thing: a recession (and bear market) is next. But I believe there are problems with jumping to such a conclusion so quickly. The first is that the period of time between a yield curve inversion and a subsequent recession has typically been fairly significant – 14 to 34 months. But perhaps more importantly, stocks have historically gone up +15-16% on average in the 18 months following a yield curve inversion, underscoring the fallacy of using a yield curve inversion alone as a rationale for going defensive.

Second, it is critical to note that past recessions saw inverted yield curves accompanied by a variety of other negative economic signals, from layoffs to contracting PMIs to credit deterioration. History shows that recessions have not occurred without such negative accompaniments.3

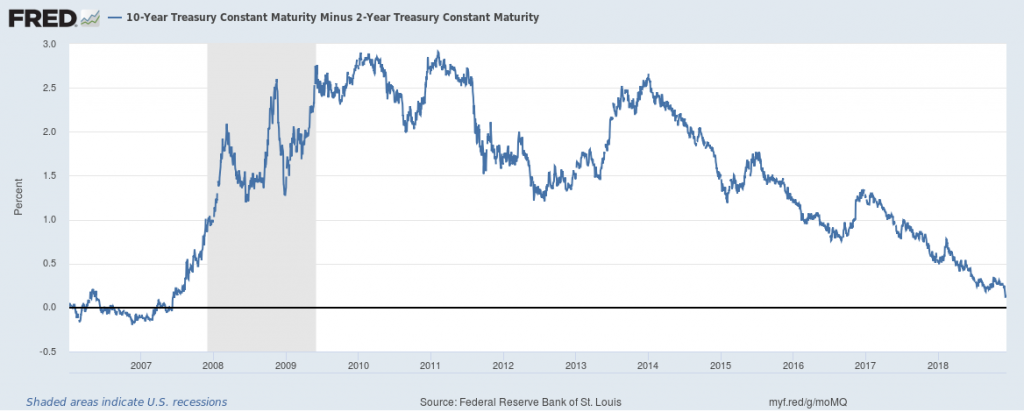

Lastly, and perhaps most importantly, the yield curve has not even inverted yet! For all the talk of yield curve inversion, I believe it is premature – the 10-year U.S. Treasury is still higher than the 2-year, as you can see from the chart below.

10-Year U.S. Treasury Minus the 2-Year U.S. Treasury

Source: Federal Reserve Bank of St. Louis

2. Economic Peak Concerns — the U.S. economy added 155,000 jobs in November, which fell below expectations, and the unemployment rate remained at 3.7%.4 Softer jobs reports, coupled with the growing sense that the impact of tax cuts on corporate earnings has almost fully run its course, has many investors convinced that U.S. economic activity may have peaked. I actually agree with this sentiment, but with one clear difference: peaking does not necessarily mean turning negative. Earnings expectations are almost certain to continue moving lower in the coming quarters, which I believe could limit return expectations in the coming year. But investors should not throw the towel in on the economic expansion just because it may be peaking – in my view, it’s actually a clear signal that there is more runway left, and more time to make those types of decisions.

3. China, Trade, the Fed, etc. – these are what I like to refer to as “recycled fears,” or the ones you’ll most commonly hear about in the day-to-day financial news cycle. The more you see these stories dominate the headlines, the less pricing power they actually have, in my view. Fears over trade and the Federal Reserve raising interest rates too quickly have been around all year, and we believe that they are likely fully priced into stock prices already. If anything, I believe the dominance of these stories in the headlines actually leaves room for positive surprises in the coming months and quarters, when the fears fade and do not have as bad an economic impact as originally feared.

Bottom Line for Investors

As I wrote last week, I believe it is imperative for investors to remember that you should make investment decisions based on changing fundamentals – not on changing prices. For now, we believe the economic fundamentals remain intact, and we’d urge patience.

But if the volatility is truly bothering you, and you’re considering making changes as a result, here are a couple of things you might want to do:

- Revisit Your Investment Plan and Your Goals – doing so might make it clear that you actually do not need the amount of equity exposure that you currently have, or that your plan could use some adjusting in an effort to reduce volatility while still addressing your growth needs.

- Rethink Your Risk Tolerance – so far, we’ve just experienced a shallow correction. But if the downside and volatility is making you lose sleep at night, perhaps your allocation is not in sync with your actual tolerance for risk.

If you feel like any of these adjustments or re-examinations could benefit you today, please do not hesitate to reach out to us here at Zacks Investment Management for help.

In the meantime, to help you focus on the fundamentals instead of the daily price movements, I am offering all readers our Just-Released Stock Market Outlook Report

This Special Report is packed with newly revised predictions to consider for 2019 that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Should you stay bullish?

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- What produces U.S. optimism in the coming year?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Credit Suisse, U.S. Equity Strategy. December 6, 2018.

4 Charles Schwab, December 7, 2018. https://www.schwab.com/resource-center/insights/content/stocks-drop-on-economic-and-trade-concerns

5 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.