When 2020 started, two of my biggest event-driven, macro concerns were rising geopolitical tensions with Iran and the potential for a messy run-up to the presidential election.

Then the pandemic happened.

The ground underneath the global economy shifted astronomically, quickly, and in ways few could have anticipated. Within 30 days, the stock market had declined -30% and the economy was in a deep recession. But then, with the economic crisis seemingly just getting started, the stock market baffled many investors with its strong and “v-shaped” rebound – even as a thick blanket of uncertainty still hangs over the economy.

Needless to say, it’s been one of the most interesting starts to a year in my career. Now that we’re halfway through it, I think it’s a good opportunity to zoom out and take stock of what happened and parse the experience for lessons and insights. Here are four of mine:

1. Risk Happens Fast, But Markets Move Faster

When the stock market peaked on February 19th, the economy wasn’t yet in a steep economic recession – but it was about to be. By the time the federal and state governments had started asking Americans to limit travel, socially distance, and stay home if possible (around mid-March), the S&P 500 was already down around -30% and close to hitting a bottom.1 Risk happens fast, but markets move faster.

The lesson for investors here, in my view, is a stark reminder that while most people assess and understand risk in real-time – based on watching the news or reading the newspaper – the stock market anticipates risks before they become widely known. By the time most investors realize it’s a recession and an economic crisis, it’s too late.

______________________________________________________________________________

Trying to Time the Market Could Be Costly, Focus on Hard Data Instead

Instead of letting news articles or fearful headlines impact your investing decisions, I recommend making decisions based on data and fundamentals. To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- The economic effects of the COVID-19 pandemic

- U.S. returns expectations for 2020

- Background on the U.S. fiscal stimulus program

- Why you should be careful in determining what S&P 500 data to use

- Zacks Rank S&P 500 Sector Picks

- Status of global energy markets

- What produces 2020 optimism?

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released July 2020 Stock Market Outlook2

______________________________________________________________________________

2. Event-Driven Bears are Scary but Lack Stamina

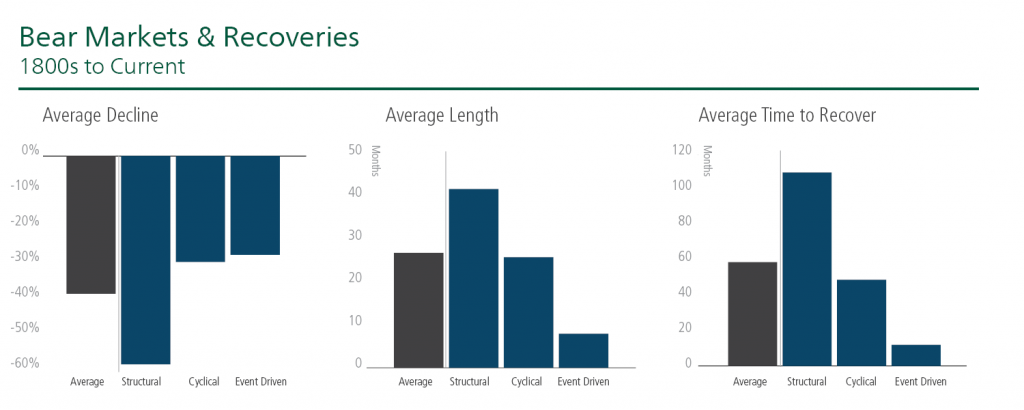

Bear markets generally fall into one of three categories:

- Structural bear markets are triggered by structural imbalances and financial bubbles, often resulting in price shocks and deflation.

- Cyclical bear markets are part of a normal business cycle and typically commence during periods of high inflation and rising interest rates.

- Event-driven bear markets can be triggered by policy mistakes or any sudden shock. They typically lead to a sharp market decline but not a long recession.

So far, this episode has followed the patterns of an ‘event-driven’ bear market—steep, but shorter and less severe than structural and cyclical bear markets. I do believe it’s possible that this event-driven bear could evolve into a structural bear if the outbreak materially worsens and stimulus ends, but the jury is still out on both.

Source: Goldman Sachs3

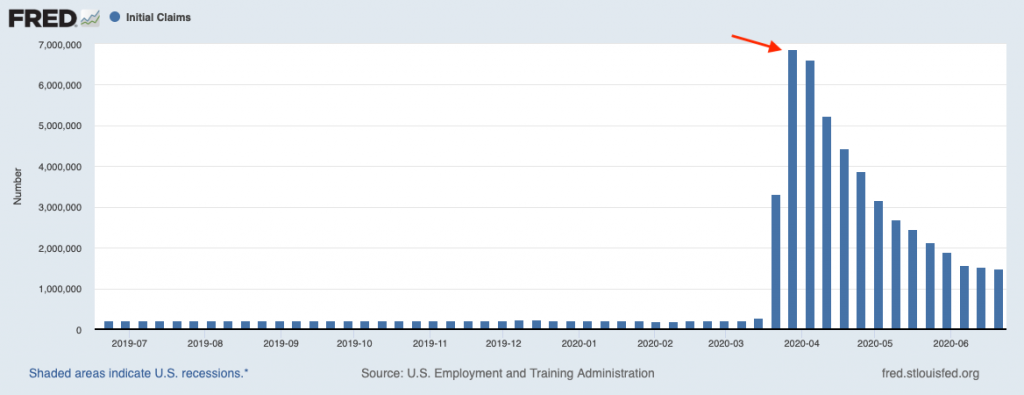

3. Initial Jobless Claims are a Key Indicator for Recessions and Bears

The two charts below look at initial jobless claims, which is defined as a claim filed by an unemployed individual after leaving an employer. The top chart shows the last year, and the bottom chart looks at a period during and after the Great Recession: January 1, 2008 to December 21, 2009. The fascinating takeaway from both data sets is that the stock market bottoms at almost exactly the time when initial jobless claims reach a peak. This, in my view, is no coincidence – the stock market is picking up the signal that the worst of the economic crisis is over, even though it will take the job market years to fully recover.

Investors often have a hard time with this reality. How can the stock market go up when hundreds of thousands – or even millions – of Americans are still losing their jobs? The answer is that the stock market is already looking ahead by six, twelve, even two years into the future. Just like the stock market plummeted well before anyone grasped the full damage to the job market, so too does the stock market soar well in advance of the job market recovering.

Initial Jobless Claims, June 2019 – June 2020

Initial Jobless Claims, January 2008 – December 2009

4. Technology is King, but so is Diversification

The pandemic made even more apparent a trend that was already well underway: rapid expansion of the digital economy. Businesses and sectors that had been slow to adopt technological upgrades, enterprise software, cloud-based systems, and remote work are all scrambling to catch up. Technology helped soften the damage to the economy and the stock market, and are helping lead the recovery.

I’ve noticed many investors looking to tilt more heavily to technology as a result – I’d urge caution. Exposure to the Technology sector is a crucial component of any diversified equity strategy, there is no doubt about that. But now is a time to remember the merits of diversification as part of a long-term strategy. In my view, pivoting heavily to technology right now puts investors at risk of making two classic investment errors at once: chasing heat, and shifting asset allocation when your long-term goals haven’t changed.

Bottom Line for Investors

Above all, perhaps the most important lesson we can take away from the first six months of 2020 is a lesson we’ve known all along: don’t try to time the stock market. Risk happens fast, but the markets move faster. When investors try to react in a time of heightened emotion, volatility, uncertainty, and a stream of negative news, it leaves the door wide open to making critical mistakes. Diversification and a long-term focus are still king, but so is patience.

To help you remain patient and stick to the fundamentals, I am offering all readers our Just-Released July 2020 Stock Market Outlook Report.

This Special Report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- The economic effects of the COVID-19 pandemic

- U.S. returns expectations for 2020

- Background on the U.S. fiscal stimulus program

- Why you should be careful in determining what S&P 500 data to use

- Zacks Rank S&P 500 Sector Picks

- Status of global energy markets

- What produces 2020 optimism?

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!6

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion

3 Goldman Sachs, Bear Essentials: a guide to navigating a bear market. March 9, 2020.

4 U.S. Employment and Training Administration, Initial Claims [ICSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ICSA, June 26, 2020.

5 U.S. Employment and Training Administration, Initial Claims [ICSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ICSA, June 26, 2020.

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.