When it comes to assessing risk in the economy and equity markets, I have a good guiding principle: if people are ignoring a risk and talking about it infrequently, that’s a signal we should be paying close attention to it and talking about it more.

To be sure, history suggests that real risks are rarely ones that come out of nowhere and shock the world. They are usually hiding in plain sight, but they get overlooked because investors are chasing profits or riding gains in the stock market. The 2000 tech bubble and 2008 financial crisis offer clear examples of these exuberance-driven blind spots.

I don’t think we are currently in an environment where investors are overconfident – the wall of worry is still plenty strong, in my view. But I do think there are a handful of risks that are not being adequately acknowledged, which ultimately gives them more pricing power. Here are four I think you should watch in 2020:

_____________________________________________________________________________

Stay Steady & Focus on Fundamentals!

Before I dive deeper into these potential risks, I want to point out how important it is to keep an eye on economic indicators as opposed to making emotional, knee-jerk reactions. This can be difficult to do, especially in the midst of so many negative news stories. To help you do this, we are offering all readers a look into our just-released February 2020 Stock Market Outlook report.

This report will provide you with our forecasts along with additional factors to consider:

- U.S. returns expectations for 2020

- What Produces 2020 Optimism?

- What of U.S. GDP Growth?

- Is it time to buy U.S. stocks in January?

- Will the “U.S. China Trade War” remain a stumbling block in 2020?

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released February 2020 Stock Market Outlook1

_____________________________________________________________________________

1 – The Return of Inflation

The latest inflation reading from December 2019 confirmed what has been the case for the better part of the entire decade: inflation remains in check. The consumer price index showed a year-over-year increase of +2.3% in December for all goods, largely in line with the Federal Reserve’s 2% target.2

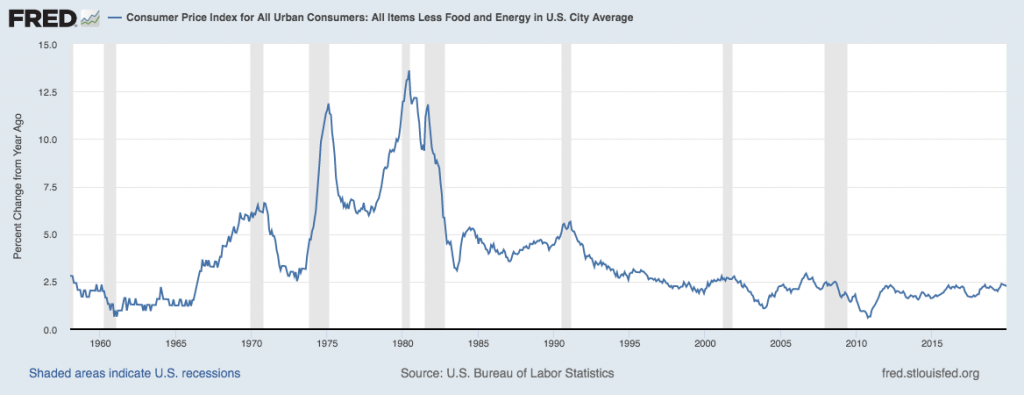

For the decade, prices climbed at their slowest pace since the Great Depression, which I would argue was driven partly by technological advances (which put downward pressure on input costs, production, and cost of goods sold) and largely by the massive amount of spare capacity created as a result of the 2008 financial crisis and recession. While the costs of many consumer goods continue to decline or remain steady, other sub-sectors have experienced rapid inflation, such as medical care and the cost of education. As you can see in the chart below, inflation growth has not been this slow since the 1960’s, but that period was also followed by a significant inflation spike that few expected. In my view, one of 2020’s surprises could be that inflation rises at a faster clip than many expect (though nowhere near what we saw in the late 1960’s). The risk might be framed as: what will the Fed potentially do to respond?

History of Inflation 1960 – Present

Source: Federal Reserve Bank of St. Louis3

2 – Rising Costs Hamper Earnings

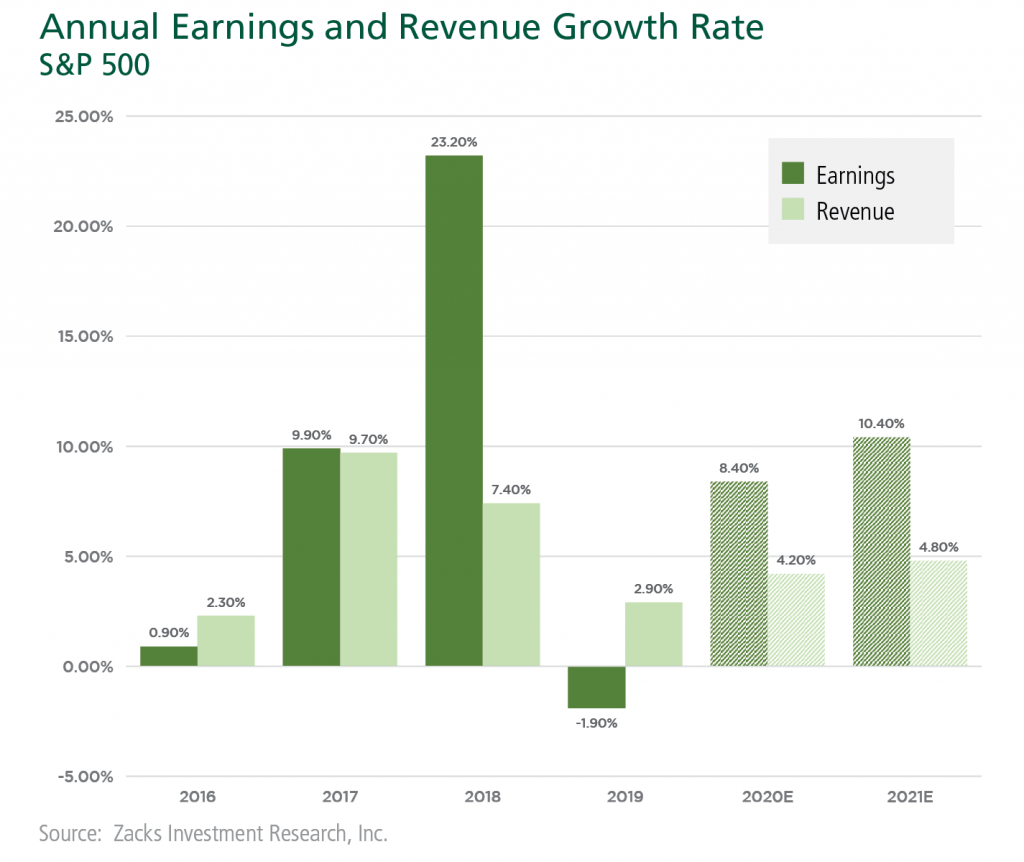

Consensus here at Zacks Investment Management is that we should see a ~8% rebound in S&P 500 earnings this year, following a slightly negative year of earnings growth in 2019.4

Source: Zacks.com5

The risk to the earnings story, in my view, is a confluence of two factors.

The first is tariffs, which in spite of “Phase 1” of the trade deal with China are still largely in place. The Trump Administration has also threatened tariffs on our largest trading partner, the European Union. I’m not convinced that the negative impact of existing tariffs have been fully absorbed in the US economy, and multinationals could start seeing cost pressures soon.

The second factor is wage pressure. Low unemployment combined with a skilled labor shortage (and weak productivity), could put upward pressure on wages. Since labor is the biggest expense for most companies, the end result could be a squeeze on profit margins and lower-than-expected earnings results. Downward earnings revisions and lower-than-expected results are not great for stocks, in my view.

3 – US Presidential Election Unrest

The run-up to the 2020 US presidential election is almost certain to be noisy, messy, and exhausting. In my view, the risk is not about whether President Trump is re-elected or whether a Democrat wins – i.e., the risk is not political whatsoever. In my view, the risk is in the election itself.

All signs point to continued pressure from foreign actors to nefariously interfere in the election, and the divisiveness and tightness of the race could create a great deal of unrest about whether the results are authentic. The uncertainty surrounding how the election will unfold could weigh on markets, particularly if the nation is divided on who the winner actually is.

4 – The U.S. and China Accelerate Their Decoupling

The world’s two largest economies are clearly at odds. But recent escalations have led both nations into more isolationist approaches as it relates to technology, talent (labor), and investment. We now have a situation where China is aiming to completely cut off US technology suppliers, instead shifting focus to a “Long March” towards building their own technology infrastructure. As the Eurasia Research Group put it, China is building a “digital Berlin Wall.”6

As the US and China compete for market share in selling semiconductors, cloud services, and 5G to the rest of the world, countries will likely have to decide which side of the “wall” they want to be on. To the extent that technological innovation (5G, A.I.) will drive the global economy forward in the next decade or even century, the next year or two could be critical in establishing the playing field.

Bottom Line for Investors

Perhaps the biggest risk not mentioned above is the risk that investors get too euphoric about rising stock prices. Euphoria leads to the ‘blind spots’ I mentioned above, where investors start paying less attention to risk and instead start believing the economy will expand and the market will go up indefinitely. That’s when investors start overpaying for risk assets, and valuations drift too high, in my view. Keeping an eye on the aforementioned risks this year will be important, but I think our main focus should be watching investor sentiment.

To help you get a deeper insight into these potential risks and other key economic indicators, check out our Just-Released February 2020 Stock Market Outlook Report.

This Special Report is packed with newly revised predictions to consider for 2020 that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- U.S. returns expectations for 2020

- What Produces 2020 Optimism?

- What of U.S. GDP Growth?

- Is it time to buy U.S. stocks in January?

- Will the “U.S. China Trade War” remain a stumbling block in 2020?

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report on fundamentals, earnings, growth, and innovation today!7

Disclosure

2 The Wall Street Journal, January 15, 2020. https://blogs.wsj.com/economics/2020/01/15/newsletter-everyday-low-prices/?guid=BL-REB-39697&mod=searchresults&page=1&pos=12&dsk=y

3 U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average [CPILFESL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPILFESL, January 25, 2020.

4 Charles Schwab. January 6, 2020. https://www.schwab.com/resource-center/insights/content/top-ten-global-risks-investors-2020

5 Zacks.com, January 23, 2020. https://www.zacks.com/commentary/730905/q4-results-show-improving-earnings-picture

6 Eurasia Group, January 6, 2020. https://www.eurasiagroup.net/live-post/risk-2-great-decoupling

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.