In today’s Steady Investor, we take a look at key factors that we believe are currently impacting the market and will affect the new year, such as:

- Tight U.S. labor market

- Federal Reserve pivots

- Omicron’s effect on southeast Asia manufacturing

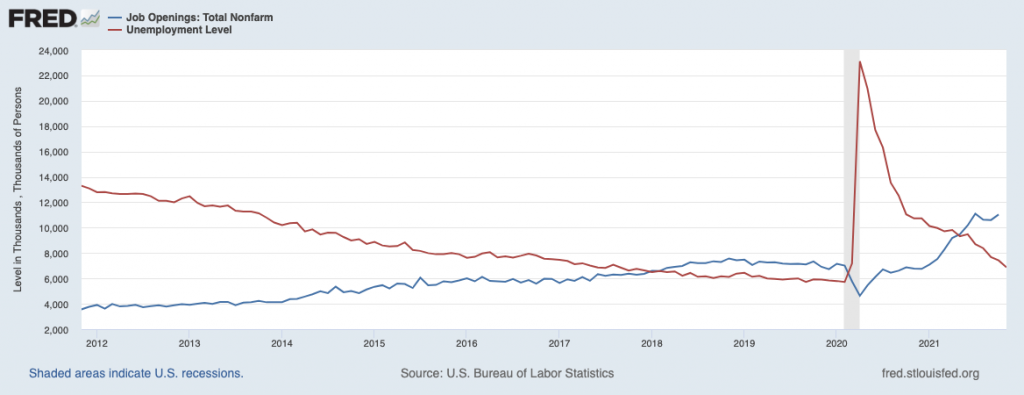

A Very Tight U.S. Labor Market – Inflation pressures and the pandemic have many Americans feeling as though the economy is not headed in the right direction. But economic fundamentals paint a different picture, which is why there seems to be a ‘disconnect’ between stock market performance and people’s general views on the economy. One case-in-point of an underappreciated, strong economic fundamental: the jobs market. In the U.S., the number of job openings far exceeds the number of unemployed people. According to ZipRecruiter, there are approximately 11 million available jobs in the U.S. versus 6.9 million unemployed people actively looking for work (see chart below). Such a strong labor market largely gives workers leverage – the ability to quit a job and seek a better-paying one, the ability to negotiate higher wages and sign-on bonuses, and the possibility of securing better benefits. Indeed, a recent survey by the Conference Board found that U.S. companies are setting aside an average of 3.9% of total payroll for wage increases in 2022, which is the highest percentage recorded since 2008. The survey also reported that companies are planning to lift salary ranges, both of which should put U.S. households on a path to increase saving and spending in the new year – particularly if inflationary pressures ease. Below, a chart showing the number of job openings (blue line) compared to unemployed workers (red line).1

______________________________________________________________________________________________

Why Should You Avoid Market Timing in a Volatile Market?

Investors often fall into the trap of trying to buy “at just the right time,” or selling stocks in a volatile market when emotions are running high.

Studies show that the average investor is a poor market timer. In many cases, investors allow emotions and media noise to get the best of them, selling in and out of the market at the wrong times.

Our guide, “How Market Timing Can Affect Your Retirement Plan3” seeks to explain these behavioral traps and offers potential solutions. If you have $500,000 or more to invest and want to learn how you may be able to avoid these mistakes today, click on the link below to get your free copy:

Download Zacks Guide, “How Market Timing Can Affect Your Retirement Plan.”

______________________________________________________________________________________________

The Federal Reserve Pivots – About a month ago, the Federal Reserve communicated plans to very gradually wind down the monthly bond and mortgage security purchases by $15 billion per month, effectively ending the QE program by June 2022. By the end of November, however, those plans had been scrapped – the Federal Reserve, responding to longer and higher-than-expected inflationary pressures, decided to pivot. We will know more details about the change of plans after the mid-December meeting, but all signs point to unwinding QE on a faster timetable, ending the program by March 2022 instead of June. Also, the Fed could potentially move forward the timeline of raising interest rates, which some investors fear could be an ominous sign for the economic expansion and bull market. In a Mitch on the Markets column this week, Mitch Zacks weighs in: “In my view, the Federal Reserve’s shifting message and policy is in response to a good problem. In the words of New York Fed President John Williams, the U.S. economy is ’roaring back,’ and supply/demand imbalances are putting pressure on prices. Demand is above pre-pandemic levels, and supply can’t keep up. I don’t see this as a permanent problem.” He added that: “corporate earnings and economic growth matter more than the Fed, and I do not think a slight shift in the Fed’s messaging and policy will affect either in the coming year.”4

Will Omicron Wreak Havoc on Southeast Asia Manufacturing? The surge of the Delta variant created problems for Southeast Asia manufacturing hubs, like Vietnam, Malaysia, and Thailand. We covered some of these factory shutdowns in this space and added that these closures were a key part in creating bottlenecks in the supply chain that still exist today. Fortunately, some of the key players in the region – Thailand and Vietnam specifically – have shifted away from aggressive pandemic measures like full shutdowns, instead opting for less restrictive measures that allow the economy to continue producing. These moves have been helped along by rising vaccination rates, which are likely to continue trending higher as more vaccine supply becomes available.5

Should You Time to Market? It can be easy to get swept into the negative headlines that saturate the news. When emotions are running high, many investors fall into the trap of trying to buy “at just the right time,” or selling stocks out of fear. Instead, we recommend focusing on the long-term view and sticking to your course.

But before making any big decisions, check out our guide, “How Market Timing Can Affect Your Retirement Plan.”6

This guide seeks to explain emotional and behavioral traps that investors can fall prey to and offers potential solutions to common mistakes that many self-managed investors make.

If you have $500,000 or more to invest and want to learn how you may be able to avoid these mistakes today, get your free copy by clicking on the link below:

Disclosure

2 Fred Economic Data. December 9, 2021. https://fred.stlouisfed.org/series/JTSJOL#0

3 ZIM may amend or rescind the “How Market Timing Can Affect Your Retirement Plan” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. December 6, 2021. https://www.wsj.com/articles/high-inflation-falling-unemployment-prompted-powells-fed-pivot-11638786601

5 Wall Street Journal. December 6, 2021. https://www.wsj.com/articles/supply-chains-in-southeast-asia-are-less-vulnerable-after-delta-driven-disruptions-11638794416?mod=djemRTE_h

6 ZIM may amend or rescind the “How Market Timing Can Affect Your Retirement Plan” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.