A glance at the title of this week’s column may ring some alarm bells. If earnings are expected to moderate while interest rates (and inflation) rise, wouldn’t this pose some pretty stiff headwinds for stocks?

I’ll expand on this question more below, but I think the short answer is: “yes and no.” Let’s first take a look at where Q4 2021 earnings stand as of early February.1

According to researchers at Zacks Investment Management, the picture emerging from the Q4 earnings season is one of continued strength and momentum. The proportion of companies beating consensus revenue estimates is tracking above what we saw from this group in the preceding earnings season, with earnings beats nearly the same.

What Does Rising Interest Rates & Volatility Mean for Your Investments?

Rising interest rates could mean more volatility. And with it comes many more unknowns, but do you know there are still ways you can protect your investments?

I want you to make the most out of your long-term returns. This requires thinking long-term and focusing on key data that can help guide your financial decision-making. To help you do this, I am offering all readers a look into our just-released February 2022 Stock Market Outlook report. This report will provide you with our forecasts along with additional factors to consider:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces optimism in 2022?

- Zacks forecasts for 2022

- Zacks ranks industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released February 2022 Stock Market Outlook2

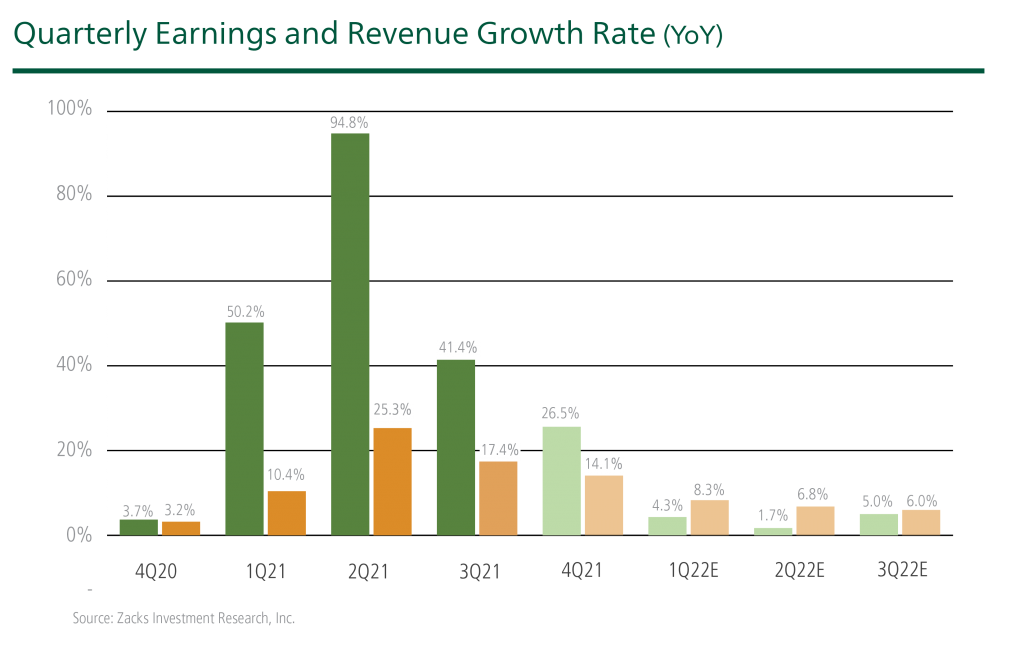

Through early February, we had Q4 2021 results from 278 S&P 500 members, and total earnings were up +30.2% from the same period last year on +16% higher revenues. 78.4% of the companies reporting beat earnings-per-share and revenue estimates, pretty much in-line with longer-term averages.

Projecting out over the next few weeks, total S&P 500 earnings for Q4 are expected to be up +25.6% from the same period last year on +14.1% higher revenues. These are solid prints, and are largely better-than-expected given the well-known headwinds of cost pressures, logistical bottlenecks, and the labor impact from the Omicron variant. If anything, the real struggle companies are facing is being able to keep up with a historically high-demand environment.

Of course, these are all backward-looking figures, and what matters to stock prices in 2022 is where earnings are headed – not where they’ve been. And it’s plain to see in the chart below that the pace of earnings growth is set to decelerate in the coming quarters:

Now I can revisit the question of rising interest rates and moderating earnings, and what it means for stocks. The basic premise investors need to understand is this: rising interest rates make future earnings less valuable. When risk-free bond yields (which I will refer to as the discount rate) are close to zero, investors will pay more for a company with high earnings and strong projected future earnings, i.e., growth stocks. This helps explain why many high-flying tech names trade at such high multiples.

However, when the discount rate starts to rise, those future earnings are worthless to an investor. In the past few weeks, bond yields have risen to their highest level since 2019, which helps explain the concurrent sharp selloff in many high valuation stocks, particularly in the tech sector. If the discount rate is rising, and an overvalued company even hints at weaker-than-expected earnings, it probably spells trouble.

Not all stocks necessarily feel the headwinds of a rising discount rate, however. Value stocks – which on a relative basis are cheap based on measures like book value and price-to-sales ratios, often look more attractive in a challenging rate and earnings environment. That’s why I think the task-at-hand for investors in 2022 is to review your portfolio for quality – to ensure you are not overcommitted to high growth, high valuation companies that may not be able to maintain the same earnings growth pace of previous years. After all, we know stocks have historically done very well early in rising rate environments – it’s just about knowing where the quality is.

Bottom Line for Investors

We remain positive in our earnings outlook for 2022, and we see the overall growth picture steadily improving particularly as labor issues associated with Omicron start to ease. Looking ahead, many reporting companies so far have offered reassuring, if not altogether positive guidance for the year.

Interest rates are also on the rise, however, which means the future earnings of high valuation stocks will be looked at more critically. This environment could pose challenges for ‘growthy,’ high multiple corners of the market while making value companies look more attractive by comparison.

In times like this, I recommend that investors focus on factors that can protect their investments for the long term. To help, I am offering all readers our Just-Released February 2022 Stock Market Outlook Report3.

You’ll discover Zacks’ view on:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces optimism in 2022?

- Zacks forecasts for 2022

- Zacks ranks industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.