In the latest edition of Steady Investor, we explore market updates and essential points for investors to keep in mind, such as:

- The U.K.’s inflation problem

- Busy U.S. housing market

- Strength in the U.S. labor market

- The rise in retail spending

The U.K.’s Inflation Problem Isn’t Getting Better – Inflation is a global problem, but in the realm of developed market economies, it doesn’t get any worse than in Britain. According to the U.K. statistics office, consumer prices rose 8.7% year-over-year, with core prices (which exclude food and energy) climbing to 7.1% – an increase of April’s year-over-year increase of 6.8%. Looking under the hood, some of the price increases being experienced in Britain are staggering. Food inflation was up 18.7% in May, with the prices of milk, cheese, and eggs rising at a 27.4% annual clip. The price of air travel, recreational goods, and used cars are also pressuring consumer prices higher, as these categories added the most to the headline figure in May. All told, core inflation rose at its fastest pace since March 1992, and is moving in the wrong direction. These price pressures have forced the Bank of England to become an outlier among other global central banks. As the Federal Reserve pauses rate increases and other banks downshift to smaller rate increases, the Bank of England raised its key interest rate by 0.5% at its Thursday meeting, bringing the lending rate to 5% – roughly in line with the U.S. While the Federal Reserve is hoping to pursue only modest rate increases from here in hopes of perhaps avoiding recession, the Bank of England appears more resigned that a recession is what’s needed to get prices under control.1

Improve Your Long-Term Investment Goals with This Simple Step!

In today’s market, it’s impossible to predict exactly how the future will pan out or how the market could be affected in the future, but you can try to prepare for what’s to come.

Knowing your net worth is a great place to start as it is critical to your financial well-being and can help you prepare for what’s ahead in the future!

If you have $500,000 or more to invest and want to understand how to measure your net worth, download our guide Measuring Your Net Worth.2 Simply click on the link below to get your copy today!

Download Zacks Guide, Measuring Your Net Worth2

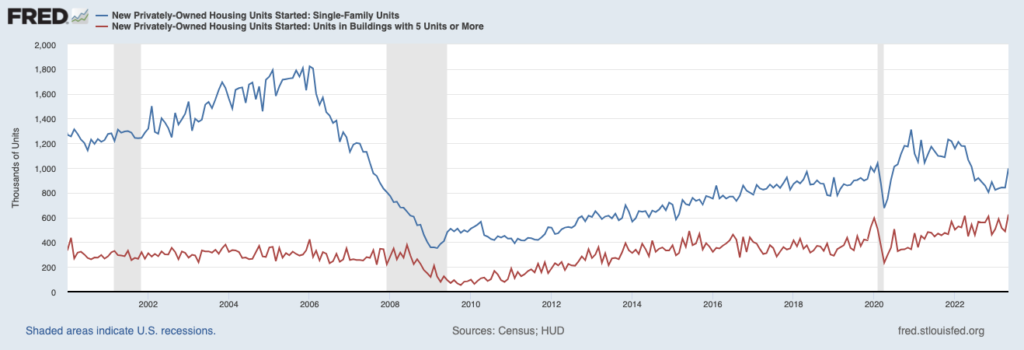

U.S. Home Builders are Staying Busy – With 30-year mortgage rates still hovering around 7%, many existing homeowners are very reluctant to put their houses on the market – a phenomenon some economists have referred to as “golden handcuffs.” Why sell a house with a very low mortgage rate only to buy a new one with a much higher rate? This dilemma has created an opening for home builders. Since the market for existing home sales is tight, but demand for housing is still strong, much of that demand can be directed to new single-family homes. It follows that U.S. home builders are breaking ground on more and more new projects. In May, housing starts rose to an annual rate of 1.6 million, the fastest pace in a year. There is also strong activity in the multi-family construction market since many would-be homeowners are choosing to rent given mortgage rates are high. Multifamily construction has been running at its fastest pace since 1986, with the total number of units under construction matching the highest-level dating back to 1970.3

Single Family (blue) and Multi-Family (red) Housing Starts

Source: Federal Reserve Bank of St. Louis4

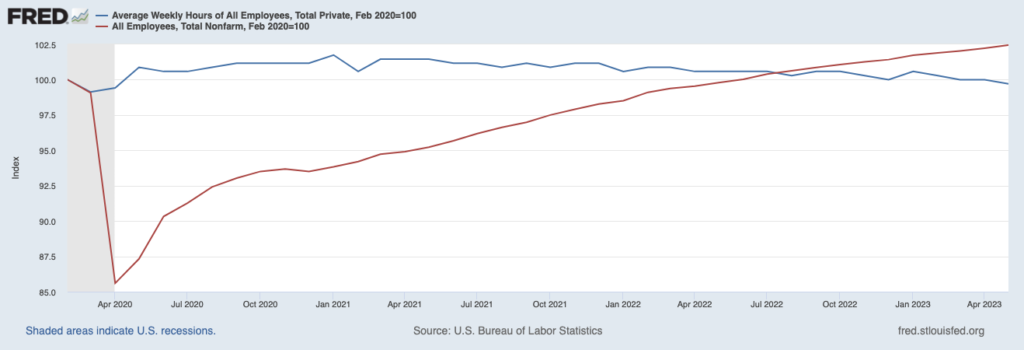

The Hiring Boom’s Hidden Data Point: Fewer Hours – Much has been made of the ongoing strength in the U.S. labor market, with payrolls growing at a strong clip throughout 2023. But there’s another data point in labor that is getting less attention, and may suggest more softness in the jobs market than meets the eye. There are more jobs, but employees are working less. According to the Labor Department, the average number of hours per week fell to 34.3 in May, down from a peak of 35 hours in January 2021. There may be two takeaways from this data. The first is that employers may be cutting back hours in anticipation of an economic slowdown looming. The other may have to do with worker disengagement.5

New Jobs (red) and Average Weekly Hours Worked (blue): February 2020 to present

Source: Federal Reserve Bank of St. Louis6

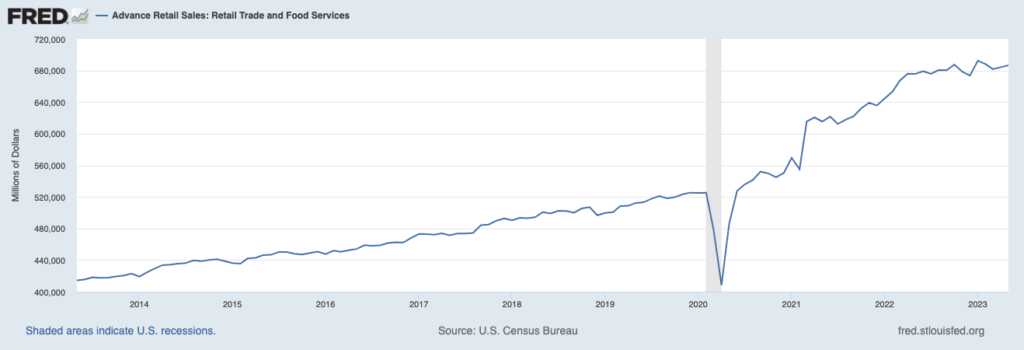

U.S. Consumers Log Another Strong Month – The U.S. consumer won’t quit. One of the downstream effects of abundant jobs in the U.S. economy is that consumers have more dollars to spend. And that was evident in May’s retail spending data. According to the Commerce Department, spending in May rose at a seasonally adjusted 0.3% rate, a fairly steady carry-through from April’s 0.4% solid advance. Spending appeared to be sturdy across many categories. Consumers spent more at grocery stores, on furniture and electronics, and even at auto dealerships and home improvement stores. For those who expected a post-pandemic stimulus pullback in spending, it just hasn’t happened yet.7

Retail Sales & Food Services Sales

Source: Federal Reserve Bank of St. Louis8

The Importance of Knowing Your Net Worth – We may not know how the market will be affected long-term, but knowing your net worth can be critical to your financial well-being and can help you prepare for what’s ahead!

Calculating your net worth may give you a better idea of where you stand in terms of your long-term investment goals. If you do not currently know your net worth, then now may be a great time to calculate it.

If you have $500,000 or more to invest and want to understand how to measure your net worth, download our guide Measuring Your Net Worth.9 Simply click on the link below to get your copy today!

Disclosure

1 Wall Street Journal. June 21, 2023. https://www.wsj.com/articles/uk-inflation-unexpectedly-held-steady-in-may-as-core-rate-rose-665c7d60

2 ZIM may amend or rescind the “Measuring Your Net Worth” guide for any reason and at ZIM’s discretion.

3 Wall Street Journal. June 20, 2023. https://www.wsj.com/livecoverage/stock-market-today-dow-jones-06-20-2023/card/strong-housing-starts-add-fuel-to-homebuilder-stock-rally-ZbZoLpoF1OySApnmEm7S?mod=djemRTE_h

4 Fred Economic Data. June 20, 2023. https://fred.stlouisfed.org/series/HOUST1F#

5 Wall Street Journal. June 18, 2023. https://www.wsj.com/articles/lots-of-hiring-but-not-so-much-working-d4f01646?mod=economy_more_pos3

6 Fred Economic Data. June 2, 2023. https://fred.stlouisfed.org/series/AWHAETP#

7 Wall Street Journal. June 16, 2023. https://www.wsj.com/articles/us-economy-retail-sales-may-2023-c9ddefcb?mod=economy_more_pos5

8 Fred Economic Data. June 15, 2023. https://fred.stlouisfed.org/series/RSAFS#

9 ZIM may amend or rescind the “Measuring Your Net Worth” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.