In the latest edition of Steady Investor, we explore market updates and essential points for investors to keep in mind, such as:

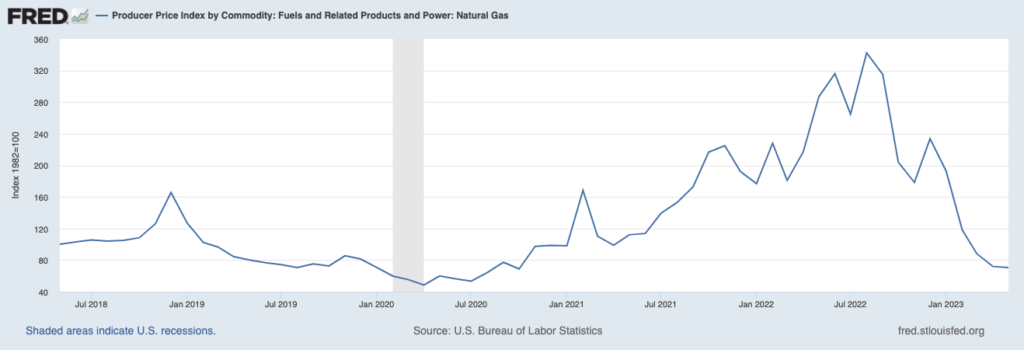

Summer Shopping Bargain in the U.S. – Any time a consumer encounters a 50% discount deal on a desired item, excitement usually ensues. And that’s what’s happening with natural gas right now. Last summer, natural gas prices jumped to their highest level in over 10 years, as Europe moved to replace Russian gas supplies with liquified natural gas from the U.S.—spurring intense new demand that put upward pressure on prices. This summer, natural-gas futures for July delivery ended this week at $2.603 per million BTUs, a 60% discount from last year’s prices. August futures weren’t much higher, at $2.668.1

Producer Price Index for Natural Gas

Source: Federal Reserve Bank of St. Louis2

Bull or Bear Market?

There have been questions about whether we’re in a new bull market. During times of uncertainty, it is important for investors to understand the fundamentals of both bull and bear markets and how to stay on top of their investments.

So, to better understand market trends and steps you can take to protect your assets, you’re invited to get our free guide — Everything You Need to Know About Bear Markets.3

If you have $500,000 or more to invest, get this helpful guide today. It walks through the history and types of bear markets, how investors typically react to extreme volatility, and what we can learn from the history of bear markets.

Download – Everything You Need to Know About Bear Markets3

Readers may wonder, how does cheaper natural gas factor as a summer shopping bargain? The reason is that lower natural gas prices should lower electricity bills for millions of American households, especially as hotter temperatures are likely to keep air conditioners on for long periods of time. Analysts forecast that natural gas prices are likely to move higher as higher electricity demand accompanies higher temperatures, but not by much. The amount of gas storage is over 15% higher than the 5-year average for this time of year, which should be a supply cushion as demand ticks higher. Another beneficiary of lower prices is many companies that rely on natural gas for production, like makers of chemicals, fertilizer, paper, steel, and even cat litter. Many companies have reported an easing of cost pressures as a result of lower natural gas prices, which should boost profit margins this summer.

Strong Travel Demand Bolstering the Aviation Industry – The post-pandemic travel surge is real, and it’s bolstering demand for planes. According to the Transportation Security Administration, about 2.3 million passengers have passed through U.S. airports every day in 2023 (on average). That’s about where things were in 2019, and recent deals at the Paris Air Show indicate that plane makers and airlines think strong demand will continue. For one, Indian budget carrier IndiGo made a record 500-jet deal with Airbus, which isn’t scheduled for delivery until 2030 – at the earliest. This long-term outlook is a clear signal that executives and industry watchers think travel demand is here to stay, and will likely only increase in the coming years as developing economies usher more people into the middle class. On the other side of the supply–demand equation is Airbus and Boeing, the two titans of the aviation industry. The problem is that these two companies have limited ability to quickly ramp up production, given supply constraints of engines, chips, and workers. This poses a ‘good problem’ for the industry, given the 1,429 year-to-date orders of Airbus and Boeing jets, which is more than the 1,377 posted for the entire year in 2019.4

An Unexpected Way to Spend Your Twilight Years – Many people dream of spending their 70s and 80s near a beach, lake, grandchildren, a golf course, or all of the above. Some would rather keep working. According to the Census Bureau, about 650,000 Americans over 80 were working last year, which is nearly 20% higher than levels 10 years ago. Of course, part of the reason for the jump is that there is simply more 80+ year-olds, i.e., members of the baby boomer generation. But others have re-entered or stayed in the workforce for other reasons, namely inflation, stock market volatility, and perhaps above all, a simple desire to work and contribute. In some cases, jobs taken by 80+ year-olds are simple ones, like being a greeter at a store or running a help desk at a nursery. But federal data show that 80-somethings are more commonly found in professional, managerial, and financial jobs than they are in the service sector.5

Prepare for Any Market Outcome – We’ve all witnessed how quickly the stock market can change. And as talks of a bull market rise, investors should understand how bull and bear markets work.

To give insight into steps on how you can take to protect your assets during the next bear market, you’re invited to get our free guide — Everything You Need to Know About Bear Markets.6

If you have $500,000 or more to invest, get this helpful guide today. It walks through the history and types of bear markets, how investors typically react to extreme volatility, and what we can learn from the history of bear markets.

Disclosure

2 Fred Economic Data. June 24, 2023. https://fred.stlouisfed.org/series/WPU0531#

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Everything You Need to Know About Bear Markets offer at any time and for any reason at its discretion.

4 Wall Street Journal. June 24, 2023. https://www.wsj.com/articles/demand-for-airliners-soars-we-cannot-make-planes-fast-enough-5758d02e?mod=djemRTE_h

5 Wall Street Journal. June 25, 2023. https://www.wsj.com/articles/the-reasons-more-people-are-working-in-their-80s-34f11699?mod=djemRTE_h

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Everything You Need to Know About Bear Markets offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.