Chelsea C. from Lexington, KY asks: Hi Mitch, my question is about a recession in the U.S. I’ve been hearing calls for a recession for over a year now, and it still hasn’t arrived. What’s the deal? Has everyone just been dead wrong, or is it just a matter of time now? Thank you for your time.

Mitch’s Response:

Thanks for writing! In my columns to date, I’ve also hinted at the probability of recession, which the U.S. economy has continued to defy. There is still not a sure answer to your question, but I do think from an investment and equity markets standpoint, stocks have already priced in weakness at least from the standpoint of falling corporate earnings – which we think is close to running its course.

In short, the U.S. economy may, or may not, enter a recession later this year or early next. But it also may not matter to the stock market. As long as any economic downturn is in line with or better than expectations – and not worse – then I do not see a big negative surprise in the cards for stocks.1

How to Prepare for a Recession

What will happen to your investments if a recession occurs? A recession can impact investors in many ways, but with foresight and planning, you may be able to avoid some of the damage a recession can cause.

To help you plan for what’s ahead, we are offering our recession guide, to help you understand the following –

- Recession signals and indicators

- How recessions work

- How long recessions last

- How to potentially protect yourself and your family from long-term damage

If you have $500,000 or more to invest, get our free guide. You’ll learn the scope and impact of recessions, and get our viewpoint on the most important moves you can make to weather a potential one. Don’t wait—get this guide today!

Download Your Copy Today: A Recession is Coming: 6 Insights to Know You’re Prepared2

You mention hearing calls for a recession for over a year now, which is another reason I doubt we’ll see much stock market impact. This ‘looming downturn’ has arguably been one of the most anticipated recessions in modern history. Indeed, at the end of last year, 43.5% of surveyed economists (as per Federal Reserve Bank of Philadelphia) expected a recession sometime in 2023, the highest percentage on record dating back more than 50 years.

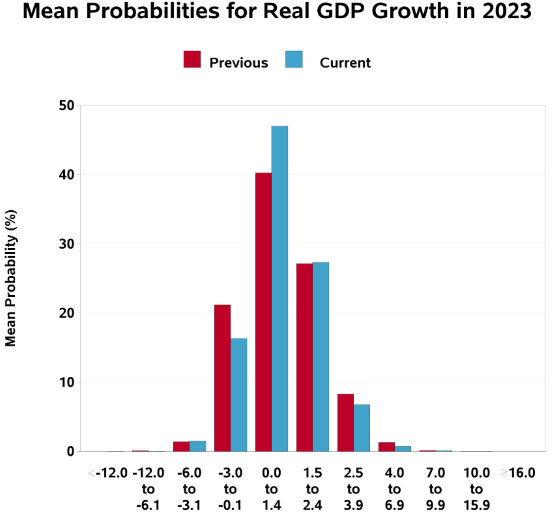

Economists have been changing their minds of late. As of June 30, the percentage of those expecting a recession in the next 12 months dropped to 31.75%. As you can see in the chart below, an increasing number of forecasts have shifted to flat or very modest growth in 2023:

Source: Federal Reserve Bank of Philadelphia3

There have been a few reasons the U.S. economy continues to chug along. The first is the labor market, which has been less sensitive to interest rate increases than just about everyone thought. While there have been waves of layoffs in the technology sector and among a few select white-collar jobs in the ‘knowledge economy,’ the overall jobs market remains one where job openings far outstrip the number of Americans looking for work. The unemployment rate remains below 4%.

Another key driver keeping the U.S. economy, and specifically the U.S. consumer, afloat has been falling energy prices. The war in Ukraine led to a spike globally in oil and natural gas prices, which placed pressure on producers and consumers alike. Had those high prices been sustained, eventually the effects of inflation would have substantially dented production and spending. But those high prices turned out to be fleeting.

Looking out from here, there is still a strong recession signal being sent by one of the most reliable leading indicators available: the yield curve. As seen on the chart below, a yield curve inversion (circled in red) has preceded each of the last few recessions. In fact, since 1966, an inverted yield curve has preceded all eight recessions that have taken place.

Source: Federal Reserve Bank of St. Louis4

It seems improbable, in my view, that the U.S. would be able to elude a modest downturn with these lending conditions in place. But then again, the jobs market and consumer spending strength may continue to surprise us.

There is no way to know exactly when or if a recession will occur, but you can prepare for one.

It’s important to understand how recessions work, how long they last, and how to potentially protect yourself and your family from long-term damage to your assets and security. We can help you with our free guide, A Recession is Coming: 6 Insights to Know Now So You’re Prepared.5

If you have $500,000 or more to invest, get our free guide today. You’ll learn the scope and impact of recessions, and get our viewpoint on the most important moves you can make to weather this one. Don’t wait—get this guide today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free: A Recession is Coming: 6 Insights to Know Now So You’re Prepared offer at any time and for any reason at its discretion.

3 Federal Reserve Bank of Philadelphia. 2023. https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q2-2023

4 Federal Reserve Bank of St. Louis. 2023. https://fred.stlouisfed.org/series/T10Y3M#

5 Zacks Investment Management reserves the right to amend the terms or rescind the free: A Recession is Coming: 6 Insights to Know Now So You’re Prepared offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.