In this week’s edition of Steady Investor, we dive into recent market dynamics influenced by significant events, including:

- Inflation dips below 4%

- U.S. manufacturing enters a weak patch

- Retirees investing more these days

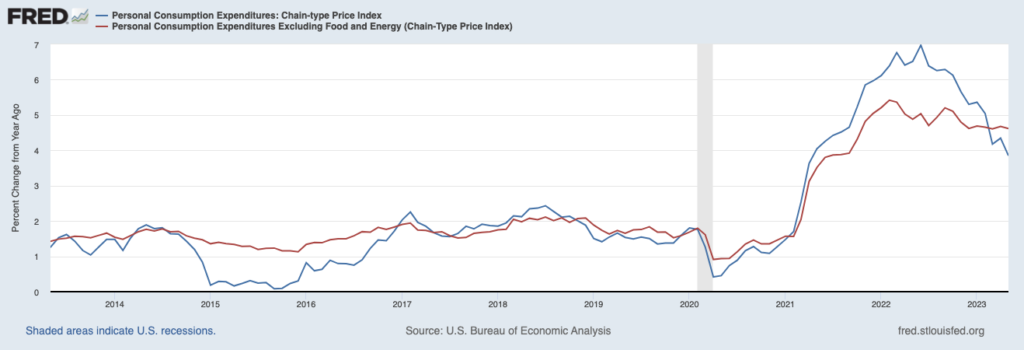

The Fed’s Preferred Inflation Measure Dips Below 4% – Buried in the 4th of July weekend news cycle was some nicely positive news: the Fed’s preferred measure of inflation quietly dipped below 4% for the first time since 2021. Consumer prices, as measured by the Fed’s preferred personal-consumption expenditures (PCE) price index, rose at a seasonally adjusted 3.8% annual rate in May, a meaningful improvement from the 7% peak rate reached in July 2022. Core prices, which exclude food and energy, registered at 4.6% in May, a slight improvement from April’s 4.7% print. The still elevated reading continues to be pressured by service sector inflation, namely in housing where the impact of rising and falling rents work on a lag.1

7 Secrets to Building the Ultimate Retirement Portfolio Before the Year Ends

Regardless of the current economic conditions, we believe it is possible to avoid the damage of downturns to achieve your retirement goals this year.

However, achieving these goals involves some work: Defining your investing objectives, determining your asset allocation, and managing investments over time.

To help you do this, we are offering readers our free guide that offers a step-by-step blueprint of our customized investing process to potentially help you build a sound retirement portfolio of your own.

If you have $500,000 or more to invest, get this guide to learn our ideas on building and maintaining a retirement portfolio to potentially achieve your long-term goals.

Get our FREE guide: 7 Secrets to Building the Ultimate DIY Retirement Portfolio2

PCE Price Index (Blue) and Core PCE Price Index (Red)

Source: Federal Reserve Bank of St. Louis3

As inflation has continued in a downtrend, household spending has leveled off. Spending was up a modest 0.1% in May, but was flat when adjusted for inflation. This convergence of data – weaker inflation and modest consumer spending – bodes well for the Federal Reserve, which wants to see economic activity moderate while inflation falls. The signal here is that the U.S. consumer is pulling back slightly, but spending is not falling off a cliff. More downward pressure on consumer spending is likely to appear in the fall when federal student-loan borrowers will need to resume making monthly debt repayments in October, which interest begins to accrue on September 1. The impact should not be significant, however – student-loan payments amount to about $6 billion to $9 billion a month, compared to the $1.5 trillion that consumers in the U.S. spend every month.

U.S. Manufacturing Enters a Weak Patch – The U.S. remains in a manufacturing slump. In June, factory activity contracted for the eighth straight month, the longest stretch of contractionary activity since weakness during the 2008 – 2009 Global Financial Crisis. The gauge of manufacturing activity, in this case, the Institute for Supply Management’s index, fell to 46.0 from 46.9 a month ago. New orders are slowing and manufacturers are working through backlogs, while inventories are also falling. There is a bright spot in the report, however, related to inflation – prices paid for materials, which is key for producer profit margins, have fallen to their lowest level this year, 41.8. Declining commodity prices are largely the reason, which of course can be viewed as a positive. Investors should also not worry too much about weak manufacturing numbers – they tend to be volatile, and manufacturing also only makes up a little over 10% of the U.S. economy.4

A “Risk-On” Investment Mindset…for 80-Year-Olds – Retirees and older Americans are investing in stocks at a higher rate than in years past. According to data from Vanguard, almost half of 401(k) investors over the age of 55 had more than 70% of their investment portfolios in stocks – up from 38% just 12 years ago. Boomers are seemingly more comfortable with stock ownership, but even older Americans are showing an embrace for equities, too. About 20% of investors over 85 had all of their money in stocks in taxable brokerage accounts, up from 16% a decade ago. For some investors, higher equity allocations are part of an effort to ‘catch up,’ i.e., to make up for past years of under-saving and underwhelming returns. But for others, it’s simply an acknowledgment that the investment horizon isn’t just the time between today and the day you retire. It’s about the time the money needs to work for you and your family, which can in some cases span generations.5

Protecting Your Retirement Portfolio Through Economic Downturns – The influential events above can affect the economy in different ways. As we wait to see how the market will be impacted, there are things you can do to protect your investments and create a retirement portfolio that meets your financial goals. To help you do this, I recommend reading our guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio.6 It provides a step-by-step blueprint of our customized investing process to potentially help you build a sound retirement portfolio of your own and pursue long-term investing success.

If you have $500,000 or more to invest, get this guide to learn our ideas on the step-by-step process to building and maintaining a retirement portfolio that will potentially help you reach your goals and enjoy a secure retirement.

Disclosure

2 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

3 Fred Economic Data. June 30, 2023. https://fred.stlouisfed.org/series/PCEPI#

4 Yahoo Finance. July 3, 2023. https://finance.yahoo.com/news/us-manufacturing-activity-shrinks-most-142737300.html

5 Wall Street Journal. July 4, 2023. https://www.wsj.com/articles/it-isnt-just-boomers-lots-of-older-americans-are-stock-obsessed-ca069e1a?mod=hp_lead_pos3

6 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.