In this week’s edition of Steady Investor, we dive into recent market dynamics influenced by significant events, including:

- A boom in the brand-new homes market

- U.S. consumers remain resilient

- U.S. recession expectations

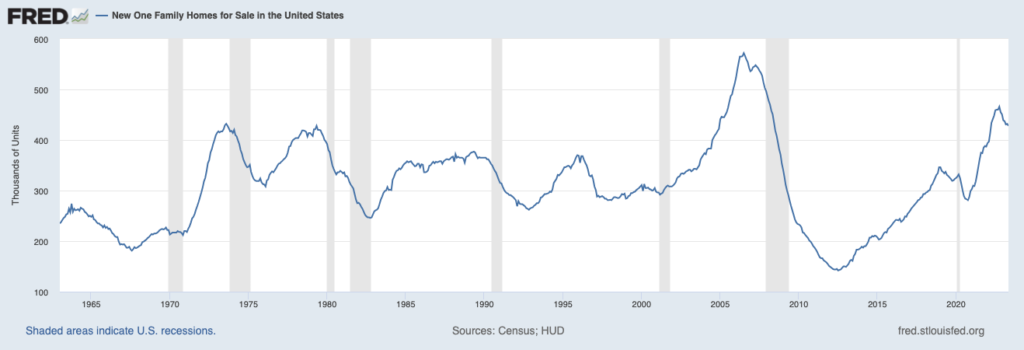

How “Golden Handcuffs” are Driving New Home Sales – Many existing homeowners in America are stuck. As mortgage rates have moved from historic lows (~3%) to nearly 7%, moving homes often means swapping a low mortgage rate for a high one. Home prices in some parts of the country have come down, but not by enough to make up for the new interest costs that are likely to accrue over time. Hence the term “golden handcuffs,” which describes homeowners who are essentially beholden to their low mortgage rate. According to the National Association of Realtors, only 1.08 million existing homes were for sale or under contract in May, which is the lowest level for that month going back to 1999. Dwindling supply for existing homes has left an opening for new homes, the development and purchases of which are booming. In May, newly built homes accounted for about 30% of single-family homes for sale in the U.S., which is well above the historical norm of 10% to 20%. In the same month, sales of existing homes dropped by 20% while sales of new homes rose by 20%. As seen in the chart below, new one-family homes for sale in the U.S. has risen solidly since the pandemic, especially as interest rates started moving higher.1

Market Volatility Can Be a Good Thing – Use it to Your Advantage!

The ups and downs in the market can be hard to manage. Even through the feeling of discomfort, do you know that volatility may have useful, positive benefits to better navigate your investing decisions?

We encourage investors to learn how to handle volatility instead of avoiding it. To help, we are offering our exclusive guide, Using Market Volatility to Your Advantage2.

If you have $500,000 or more to invest, download and learn about our insights, based on decades of experience, about how a volatile market may be able to help investors refine their strategies and potentially generate solid returns over time.

Download Our Guide, “Using Market Volatility to Your Advantage”2

Source: Federal Reserve Bank of St. Louis3

U.S. Consumers Remain Resilient – June marked yet another month when U.S. consumers increased their retail spending. The Commerce Department reported that retail sales rose by a seasonally adjusted 0.2% in June from May, the third straight month of increases. A tight labor market should be credited for consumers’ willingness to keep spending, specifically given the fact that paychecks are also growing. According to the Labor Department, inflation-adjusted hourly wages rose 1.2% year-over-year in June, signaling that wages are now rising faster than inflation. Anytime this happens, consumers gain spending power and have tended historically to spend that extra money versus saving it. In June, consumers spent more on furniture, electronics, and online shopping, while cutting spending slightly at grocery stores, sporting goods stores, and gas stations. Spending at bars and restaurants remained steady.4

Fewer Economists Expect a U.S. Recession – There is an old quote from the early 1900s by George Bernard Shaw which says, “If all the economists were laid end to end, they’d never reach a conclusion.” Recent forecasting regarding the potential for a U.S. recession brings this quote to mind. At the end of last year, nearly all economists surveyed said they believed the U.S. was due to enter a recession sometime in 2023. As months wore on with the economy still growing, the number of economists expecting recession keeps shrinking. In the most recent survey of business and academic economists conducted by The Wall Street Journal, the probability of recession in the next 12 months has now fallen to 54%. Most economists said the reason for renewed optimism was tied to falling inflation expectations, which conveniently came after June’s 3.0% CPI print. Economists also largely expected the Federal Reserve to begin cutting rates sometime in 2023, in response to said recession. These forecasts have changed, too. Now a majority of economists (79%) expect rate cuts in the first half of 2024 as unemployment goes up. The bottom line, in our view: the U.S. economy has delivered better-than-expected outcomes throughout 2023, and we expect that trend to continue.5

The market may be experiencing a lot of volatility, but there are ways to use it to your advantage. Here at Zacks, we recommend finding ways to manage volatility instead of overlooking it.

I am offering all readers our guide Using Market Volatility to Your Advantage6,which provides our insights, based on decades of experience, about how a volatile market may be able to help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

3 Fred Economic Data. June 27, 2023. https://fred.stlouisfed.org/series/HNFSEPUSSA

4 Wall Street Journal. July 18, 2023. https://www.wsj.com/articles/us-economy-retail-sales-june-2023-ac582986?mod=djemRTE_h

5 Wall Street Journal. July 15, 2023. https://www.wsj.com/articles/economists-are-cutting-back-their-recession-expectations-74118938?mod=djemRTE_h

6 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.