Gary B. from Las Vegas, NV asks: Hello Mitch, my question is about rising prices for oil and gas over the last few weeks. I’m curious to know what’s causing the price spike, and also if you expect prices to stay high for the rest of the summer and beyond?

Mitch’s Response:

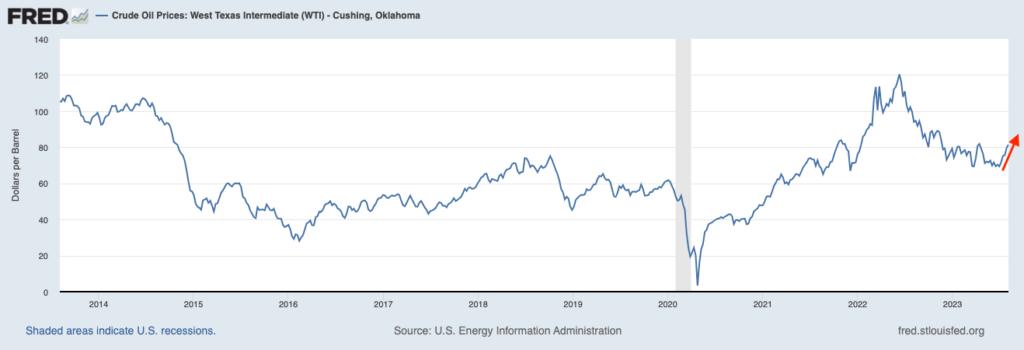

Great questions, Gary. Let’s start with increasing oil prices, as I note below in the chart of West Texas Intermediate (WTI) crude oil prices. As seen on the far right of the chart, prices have jumped over the last few weeks – increasing over 15% in the month of July alone.1

Rising Prices– What Can Investors Do Next?

Changes in the market, such as rising oil and gas prices, are never fun to deal with. But, could this type of volatility be an opportunity for your investments?

The real question investors should ask is – What is the next step?

The key to dealing with volatility is developing a mental approach to managing it. Our guide, “Helping You Manage Market Volatility,” will provide you with insights and tips to do just that. Get answers to questions like:

• Market downturns can and will occur, but what should you do?

• How can diversification help you manage volatility without compromising your returns?

• When volatility is too much for you to handle, how can a money manager help?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”3

The reason I pulled up the 10-year chart, however, was to remind investors of how volatile oil prices can be over time. There was a stretch in the mid-2010s when oil traded over $100 a barrel, which arguably provided incentives for the fracking boom that saw a new flood of supply and plummeting prices. The oil markets are fungible, and respond relatively quickly to discrepancies between supply and demand.

In the current environment, there’s a good argument that rising oil prices are tied to Saudi production cuts, an improving outlook for the U.S. economy that may not involve a recession, and ongoing supply snags being caused by Russia’s invasion of Ukraine. Gas prices tend to follow oil prices, which helps explain why we’re now seeing higher prices at the pump.

But there are other factors that can impact gasoline prices but are unrelated to oil prices. Two of them are heat waves and futures traders.

On the first point, hot temperatures can increase costs for refineries. In order to refine crude into different products like gasoline, part of the process involves cooling. When the air used to cool products is hotter, it can make the fuel-making process more difficult and less efficient, which raises costs. That’s why refineries tend to pare back summer fuel runs, which in the case of 2023, has been even more significant.

As for futures traders, many are taking the hotter temperatures as a sign that hurricane season could be particularly challenging, which could mean refineries could be shut down for weeks or months and supply reserves could dwindle quickly, putting even more upward pressure on prices.

This brings me to the second part of your question regarding whether prices might remain high for the rest of summer or beyond. In my view, the answer is all about the supply side of the equation, and whether refineries do indeed suffer production setbacks in the late summer and fall due to hurricane season.

Rising oil and gas prices may have you worried about how this could impact inflation or volatility down the line. To help you deal with this uncertainty I’m offering our exclusive guide, Helping You Manage Market Volatility4. You will get answers to questions like:

• Market downturns can and will occur, but what should you do?

• How can diversification help you manage volatility without compromising your returns?

• When volatility is too much for you to handle, how can a money manager help?

• Can volatility be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 Fred Economic Data. August 9, 2023. https://fred.stlouisfed.org/series/DCOILWTICO#

3 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

4 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets countries and 27 Emerging Markets (EM) countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. An investor cannot invest directly in an Index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.