In this week’s Steady Investor, we look at the biggest news stories and key factors that we believe are currently impacting the market such as:

• The slump in U.S. home sales

• Interest rate risk looms

• U.S. job numbers are strong, but low

U.S. Home Sales are in a Slump – A majority of U.S. home sales are existing homes. But with 30-year fixed mortgage rates pushing past 7%, existing homeowners are staying put – resulting in anemic inventories and also weak home sales. July marked the fourth time in five months that existing home sales have declined, falling 2.2% from June to a seasonally-adjusted rate of 4.07 million. And it marked the weakest July for sales in over 10 years. Year-over-year, sales were down -16.6%. Bad news for existing home sales has been good news for homebuilders, however, as the market has shifted towards demand for new homes. According to the U.S. Commerce Department, 714,000 new homes were sold in July, which is up from 543,000 last July and also marked a step up from June’s 684,000 annual rate. The market is responding to supply and demand forces, but how long the demand-side of the equation keeps up is an open question. Home prices are still near record highs, and with 30-year fixed mortgages shooting past 7% with no indication of coming down anytime soon, some would-be homebuyers are dropping out of the market.1

Perhaps you’ve envisioned an early retirement to enjoy extra moments with loved ones, or to spend some time traveling.

It may seem impossible to retire early, but if you plan carefully and maintain self-discipline, it can be done! Many investors may ask, though, ‘What steps do I take?’

In our exclusive guide, Early Retirement: You Can Achieve It Soon Than You Think, we cover investment strategies, such as reducing expenses and increasing income, as investors work toward early retirement. Investors will also get insight on how to make your money last longer in retirement.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Download Our Guide, Early Retirement: You Can Achieve It Soon Than You Think2

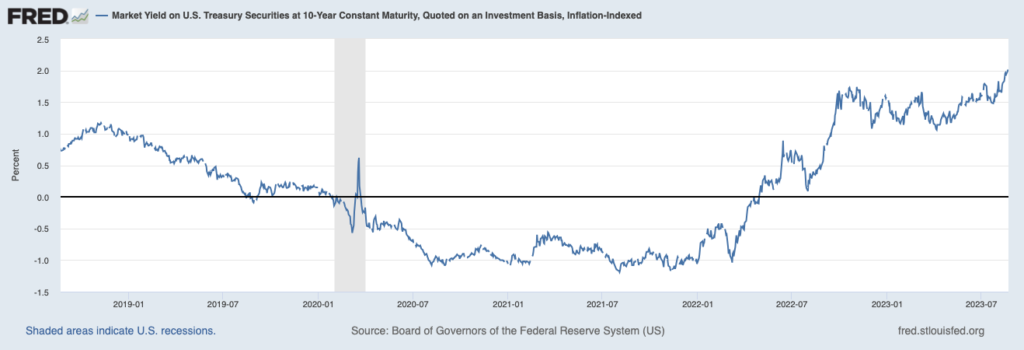

Real Yields are Up, But Interest Rate Risk Looms – When an investor earns a risk-free return on U.S. Treasuries, it’s important to consider the purchasing power of those earned dollars. In other words, when deciding whether to purchase a bond, investors should consider the yield on the bond minus the inflation rate. That’s known as the ‘real yield.’ For several years following the 2008 Global Financial Crisis, real yields were paltry as both interest rates and inflation hovered near record lows. For a period following the pandemic, real yields turned negative – meaning investors lost purchasing power in bonds. The setup looks different today. With the Federal Reserve ending quantitative easing and hiking interest rates quickly last year – and with inflation falling markedly from highs – real yields have turned positive in the last year. As seen in the chart below real yields have climbed to 2%, which is good news for savers.3

Higher and rising real yields aren’t great across the board, however. Higher real yields can indicate borrowing is becoming more expensive in the economy, which can choke off activity and thusly affect growth. Corporations may be less willing to finance new growth and investment. Second, for equity investors, higher real yields mean that a higher discount rate gets applied to future cash flows, which can make some stocks look less attractive from a valuation perspective.

U.S. Jobs Numbers Revised Lower, But Still Strong – The Labor Department has revised job growth figures from the first quarter, and it turns out that hiring was a bit softer than previously reported. The revised figures showed that the U.S. economy added 306,000 more than previously thought, which may sound like a high figure but represents 0.2% of all jobs for the twelve months through March 2023. This revision brings the average number of jobs created per month to 312,000, which is only slightly lower than the 337,000 previously reported and still marks a robust pace of hiring, above pre-pandemic levels. In a related story, Gallup recently conducted a survey about the labor market focused on engagement, and the findings support a rethinking of the value of remote work. According to the survey, the percentage of fully remote workers who feel a sense of connection to the purpose of the organization fell from 32% to 28%, which contrasts to the 33% of fully-time office workers who report a sense of connection. Hybrid workers reported the strongest connection of all, with 35% saying their company’s mission made them feel a sense of purpose in their jobs.5

Looking to Retire Early? Some people may question how others can retire before the age of 65, but it can be done if planned carefully and with the right discipline!

In our exclusive guide, Early Retirement: You Can Achieve It Soon Than You Think, we cover investment strategies as investors work toward early retirement, and also how to make your money last longer in retirement. Topics also include:

• Understanding the power of interest compounding

• Avoiding the trap of needing to buy the “latest greatest”

• How to generate a second income

• Plus, many more ideas to help you pursue the goal of early retirement

If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 ZIM may amend or rescind the free guide “Early Retirement: You Can Achieve It Soon Than You Think” for any reason and at ZIM’s discretion

3 Wall Street Journal. August 22, 2023. https://www.wsj.com/finance/investing/what-are-real-yields-stocks-treasury-bonds-13a419c2?mod=djemRTE_h

4 Fred Economic Data. August 23, 2023. https://fred.stlouisfed.org/series/DFII10#

5 Wall Street Journal. August 24, 2023. https://www.wsj.com/lifestyle/careers/the-growing-disconnect-between-remote-workers-and-their-companies-f7519676?mod=hp_lead_pos9

6 ZIM may amend or rescind the free guide “Early Retirement: You Can Achieve It Soon Than You Think” for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.