Greg I. from Denver, CO asks: Hello Mitch, There’s quite a bit of anticipation that the economy could shift into a higher gear with lower taxes and deregulation in the new year. My question is actually about inflation. Do you think there’s a risk of the economy running too hot, which could drive prices higher and then ultimately lead to higher interest rates? Thank you.

Mitch’s Response:

Thanks for writing, Greg. Theoretically speaking, the answer to your question is a simple ‘yes.’ Cutting taxes, slashing regulation in various parts of the economy, and implementing wide-ranging tariffs could all be inflationary. The right question to ask here, however, is what these policies will look like if or when they’re enacted. Tax cuts require congressional approval and will involve negotiation, deregulation efforts will be challenged in the courts, and tariffs have historically been used by the Trump administration as negotiating tactics.

Whether or not these policies lead to an acceleration of growth in the U.S. economy remains to be seen. But the general spirit of the agenda I think could lead to more expansion, especially given that the economy is already on a strong footing.1

Looking at your question in a different way, we could ask if there is a way the U.S. economy could accelerate without spurring an uptick in inflation. To which, I think the answer is yes, via gains in productivity.

Start the New Year with Confidence: Secure Your Retirement Strategy

Retirement is your time to embrace freedom, pursue passions, and create cherished memories. But to make the most of this chapter, a strong financial plan is key to ensuring your savings last as long as you need them.

That’s why we’ve crafted a free guide just for you: 4 Strategies for Spending Money in Retirement. Inside, you’ll find actionable advice tailored to help you maximize your nest egg and enjoy peace of mind. Highlights include:

- Smart Spending Made Simple: Navigate tax-efficient withdrawals with clarity.

- The 4% Rule Demystified: A timeless approach to maintaining a steady income.

- Dynamic Spending Strategies: Learn how the 5% rule adapts to your lifestyle.

- And much more…

If you’ve saved $500,000 or more for retirement, don’t miss this opportunity to protect your hard-earned wealth. Download your guide today and take the first step toward a more secure, confident retirement.

Download Zacks Guide, 4 Strategies for Spending Money in Retirement2

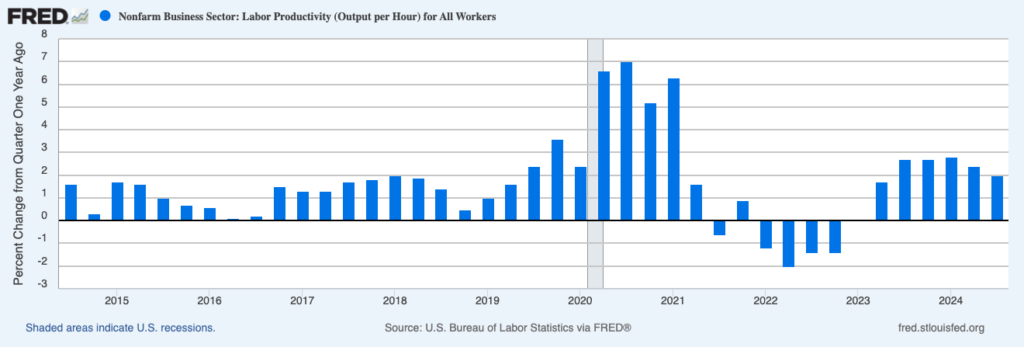

In 2024, quarterly productivity in the U.S. has grown by at least 2% year-over-year, with productivity gains notched over the past five quarters. As seen in the chart below, the steady gains in productivity are consistently higher than what’s been experienced in the previous decade, excluding the immediate post-pandemic rebound—when low productivity jobs like food service were slow to come back online.

Source: Federal Reserve Bank of St. Louis3

The productivity gains in the U.S. are notable for their contrast to other developed economies like Europe and Canada, where productivity has grown by less than 1% on average over the last decade. The pandemic may have played a key role in this divergence. In America, workers were greatly reshuffled following the pandemic, with many switching jobs or taking up opportunities to work remotely, in higher responsibility roles where they could be more productive.

Another key difference between the U.S. and the rest of the world: entrepreneurship. In the post-pandemic period, there was a significant surge in new business formation in the U.S., especially in technology-driven fields—where business often happens more efficiently. Small businesses tend to make decisions more quickly and embrace fast growth, which drives productivity on a larger scale.

So, getting back to your question about whether the economy can heat up with causing a resurgence in inflation, I think the answer is yes, if we see significant productivity gains alongside the new growth. If we can increase the productive capacity of the economy without too much overheating in the labor market, I think we can avoid an inflation event.

As you consider what could happen in the new year with inflation and regulatory policy, you may also want to take a closer look at your retirement plan and how it could be impacted. Smart planning today can help you navigate these changes confidently and ensure your savings remain secure.

That’s why we’re offering our exclusive guide, 4 Strategies for Spending Money in Retirement. This resource is designed to help you make informed decisions so you can focus on enjoying your retirement without worrying about running out of money.

Inside, you’ll discover:

- How to Optimize Your Withdrawals: Master the art of tax-efficient spending.

- Proven Income Rules: The 4% rule and 5% rule explained in detail.

- Strategies to Protect Your Nest Egg: Ensure your savings work for you over time.

- And more…

If you have $500,000 or more to invest and are ready to learn more, click the link below to get your copy today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

3 U.S. Bureau of Labor Statistics, Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Workers [PRS85006091], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PRS85006091, December 10, 2024.

4 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The ICE U.S. Dollar Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States, as measured in 1973: the Euro zone, Japan, the United Kingdom, Canada, Sweden, and Switzerland. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.