Jasmine K. from San Diego, CA asks: Hi Mitch, I read some articles over the weekend about consumers falling behind on car payments and credit card bills, even those with high incomes. Student loan payments are also about to restart. Do you think this could be a bad sign for the economy and markets?

Mitch’s Response:

Thanks for writing, Jasmine. It’s true that delinquencies among high-income borrowers have ticked higher in recent quarters. According to data from the St. Louis Fed and credit scoring firms, credit card and auto loan delinquencies have risen nearly 20% over the past two years among Americans earning $150,000 or more. These aren’t isolated to subprime borrowers, either. Many are considered “prime” or “super prime.”

There are a few possible explanations. Some higher earners may have overextended themselves during the low-rate, high-spending period after the pandemic. Others may be affected by sector-specific job weakness, particularly in white-collar fields like tech or media, where hiring has cooled or layoffs have materialized. And a surprising number of households that look well-off on paper are still living paycheck to paycheck in high-cost cities.1

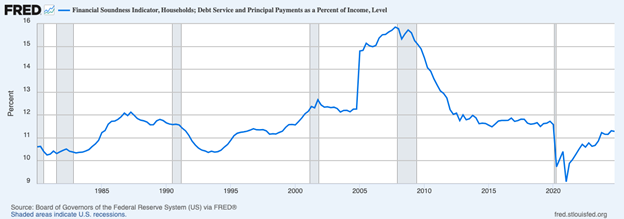

That said, I would not extrapolate these anecdotes into a macro-level warning sign. First, overall household debt remains in a healthy place. In Q1 2025, household debt stood at about 68% of U.S. GDP, down significantly from its 2008 peak of 98%. And as seen in the chart below, debt service (interest payments) and principal payments as a percent of income are also still at historically low levels. This is important, as it tells us how capable households are broadly of managing debt.

Source: Federal Reserve Bank of St. Louis2

Second, consumer spending has remained steady. In fact, some retailers are reporting stronger sales among higher-income shoppers who are choosing value over luxury. To me, this is not so much a story of consumers collapsing as it is a behavioral reset. After a few years of outsized spending and government support, households are recalibrating. People are more selective, more deal-oriented, and less impulsive. That’s not a red flag, in my view. It’s a natural consumer adjustment.

Some top earners are clearly feeling the pinch. But from an investment standpoint, I see this more as a behavioral cooling than a sign of imminent economic trouble. If anything, it reinforces how strong the broader consumer foundation is, even as sentiment turns cautious.

Disclosure

2 Fred Economic Data. June 12, 2025. https://fred.stlouisfed.org/series/BOGZ1FL010000346Q#

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.