With markets constantly shifting, now is the time to reassess your investments and uncover new opportunities. In this edition of Steady Investor, we highlight three key themes to help you stay ahead, including:

- Wages rising with a hidden catch

- Inflation steady, markets reassured

- Small businesses face rising tariffs

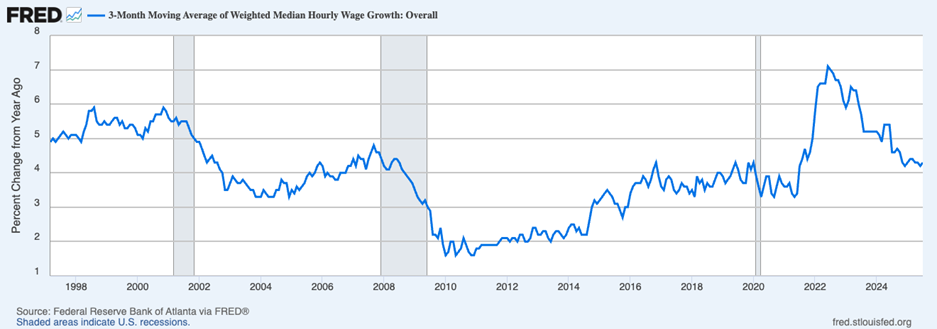

Wages are Going Up, but There’s a Catch – Wages for American workers have been going up steadily since the pandemic, such that real wages (wages adjusted for inflation) remain in solidly positive territory1:

3-Month Moving Average of Hourly Wage Growth

Keep Your Portfolio on Track in Today’s Market

Market uncertainty challenges investors, and staying on track for retirement takes more than hope—it requires clear goals, smart investment choices, and disciplined portfolio management.

To help you take control of your retirement plan, we’re offering a free Ultimate Retirement Portfolio Guide3, which includes actionable steps to build a portfolio designed for your needs, including:

- Accurately forecasting your retirement income needs

- The two phases of determining your asset allocation

- Developing an investment discipline that allows you to get good results over time

- Avoiding self-sabotage—what you need to know

- Plus—our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000 or more to invest, get this guide and explore strategies to potentially secure your long-term financial future.

Get our FREE guide: 7 Secrets to Building the Ultimate DIY Retirement Portfolio3

In the immediate aftermath of the pandemic, wage growth had a rare feature: wages for lower-income workers rose faster than those of high-income workers. And therein lies the catch with wage growth today: the trend appears to be reversing. Recent data suggest wage growth has cooled meaningfully for low-wage workers, while holding up better for those earning more. In July, average hourly earnings for leisure and hospitality workers rose 3.5% from a year prior. For higher-earning information sector workers, wages rose 5.4%. The contrast is even more striking compared to late 2021, when lower-wage sectors were seeing 14% annual increases, far outpacing higher-wage job categories. Data from the Federal Reserve Bank of Atlanta confirm the shift: annual wage growth for the bottom quarter of earners has slowed to 3.7%, while the top quarter now sees 4.7% growth. Why does this matter for investors? Lower-income households typically spend a higher share of each additional dollar they earn, meaning slower wage growth at the bottom can weigh more heavily on consumer demand. If wage stagnation at the lower end persists, and coincides with elevated borrowing costs and tighter labor markets, it may gradually cool the engine of spending that’s critical to powering U.S. economic growth.

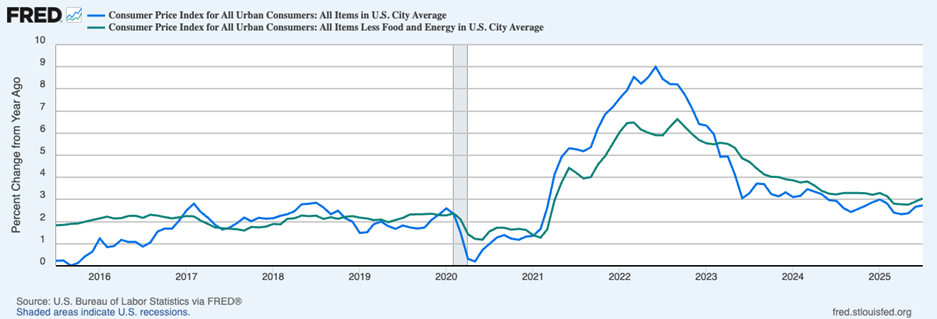

Inflation Holds Steady, Reassuring Markets – July’s consumer price index (CPI) inflation report delivered a mix of signals. According to the data, tariff-related price increases are starting to show in certain goods categories, but overall inflation remained steady, keeping the Federal Reserve on track for a possible rate cut in September. The consumer price index rose 2.7% in July from a year earlier, matching June’s reading and coming in slightly below economists’ expectations. Core inflation, which excludes food and energy, rose 3.1%, just above forecasts, with most of the increase driven by services (see chart).4

CPI (blue line) and Core CPI (green line) have Leveled Off

Despite rising prices in certain goods, overall inflation is still largely behaving. Gasoline prices fell, grocery costs were flat, and rent increases continued to slow. The shelter index, a major driver of inflation, has slowed, rising 3.7% year over year versus 5% last summer.

With the largely benign inflation print combined with recent downward revisions to job growth in May and June, Fed officials are now arguably in a strong position to cut rates at their September meeting. If businesses continue absorbing tariff-related costs or spreading them out over time, inflation could stay on its current trajectory, making future rate cuts possible. But if inventories run down and companies feel more pricing power, those cost pressures could start to bite more broadly, especially if services inflation doesn’t cool. As ever, investors will need to keep watching the data.

How are Small Businesses Dealing with the Impact of Tariffs? Small businesses appear optimistic. July’s Small Business Optimism Index from the National Federation of Independent Business (NFIB) ticked up to 100.3, suggesting a sunnier mood among small firms. But beneath that upbeat headline lies a growing disconnect: While survey respondents say they feel more confident, many small businesses are quietly buckling under the weight of rising tariff-related costs. According to the U.S. Chamber of Commerce, America’s roughly 236,000 small-business importers face a projected $202 billion annual tariff cost under the latest wave of Trump administration duties. That translates to an average of $856,000 per firm per year, a potentially devastating sum for smaller operations that lack the compliance teams, legal expertise, or cash buffers of larger enterprises. Additional red tape is compounding the problem. Customs and Border Protection has introduced new documentation and bond requirements, creating operational hurdles that disproportionately impact leaner organizations. While large multinationals can absorb and adapt, many small firms are left navigating an increasingly opaque regulatory landscape without adequate support. Business owners may say that they feel optimistic, but hard-dollar costs and the uncertainty of future tariff policy may ultimately constrain hiring, capital investment, and growth.6

Looking to Build Your Ultimate Retirement Portfolio? Market fluctuations are a constant, but the actions you take today can help safeguard your investments and set you on the path to a secure retirement.

Download our updated guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio7, for a step-by-step framework designed to help you create a personalized portfolio aligned with your long-term financial goals.

This guide offers actionable insights on:

- Accurately forecasting your retirement income needs

- The two phases of determining your asset allocation

- Developing an investment discipline that allows you to get good results over time

- Avoiding self-sabotage—what you need to know

- Plus—our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000 or more to invest, get this guide to learn our ideas on the step-by-step process of building and maintaining a retirement portfolio that will potentially help you reach your goals and enjoy a secure retirement.

Disclosure

2 Fred Economic Data. August 7, 2025. https://fred.stlouisfed.org/series/FRBATLWGT3MMAWMHWGO#

3 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. August 12, 2025. https://www.wsj.com/economy/cpi-inflation-july-2025-interest-rate-c9d31b19?mod=economy_lead_pos5

5 Fred Economic Data. August 12, 2025. https://fred.stlouisfed.org/series/CPIAUCSL#

6 MSN. 2025. https://www.msn.com/en-us/money/economy/small-us-firms-paying-trump-tariffs-face-a-202-billion-hit/ar-AA1Kixti?ocid=BingNewsSerp

7 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.