Mark P. from Fort Worth, TX asks: Hi Mitch, I saw that wholesale inflation jumped in July, supposedly the biggest increase in three years. I feel like the news is all over the place on this issue. Some say there’s little inflationary impact; others say that companies are starting to pass those costs on. What’s your take, and do you think this changes what the Fed may do?

Mitch’s Response:

You’re right. The July Producer Price Index (PPI) did show a sharp acceleration, up 0.9% from the prior month and 3.3% year-over-year. This marked the biggest monthly gain in three years, led by a 2% jump in margins at wholesalers and retailers. Some observers have linked these price increases to tariffs, noting that businesses may be raising prices rather than fully absorbing higher import costs.

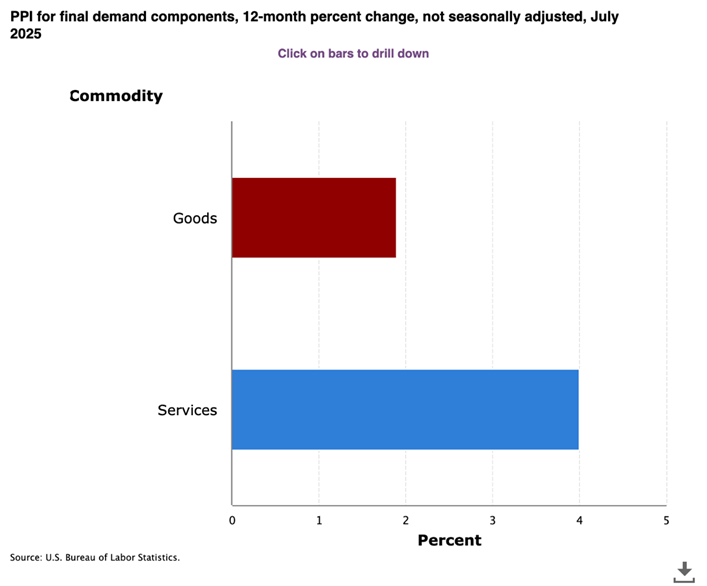

I think we’re still in wait-and-see mode when it comes to gauging the pass-through effects of tariffs to consumer prices. As seen on the chart below, a significant portion of the price pressure came from services, which to date are not affected by import tariffs. Services inflation is a concern on its own, to be sure, but the link to tariffs may not be as straightforward.

Don’t Let Rising Prices Shrink Your Retirement Savings

Inflation is steadily eroding the money you’ve worked a lifetime to build. July’s spike is a clear reminder of how quickly rising costs can undermine your plan.

That’s why I’ve created our free guide, 4 Ways to Protect Your Retirement from Rising Inflation1. This free guide provides simple, proven strategies to help keep your retirement on track, no matter what happens with the Fed or the economy. Inside, you’ll discover:

- Asset allocations that outperform inflation

- Spending categories where prices are rising the most

- Getting the most from Social Security benefits

- Plus, many more ideas to protect yourself and your assets against inflation

If you have $500,000 or more to invest, get your free guide today! Download 4 Ways to Protect Your Retirement from Rising Inflation1.

From what I’m seeing today, companies appear, so far, to be absorbing at least part of the tariff burden themselves. Margins have compressed in certain areas, which is neither surprising nor alarming. Businesses often balance between price increases and profit pressures in response to higher costs. In July, for example, a big portion of the services price increase came from portfolio management fees, which are tied to stock market movements, not tariffs.

There is some debate on whether producer prices are leading indicators for consumer prices. I tend to think they are, which means August and September data will be very telling for how the tariff/inflation story is playing out. I would expect to see some upward pressure on consumer prices in the fall, which, as you mention in your question, could impact the Fed’s thinking.

Fed officials do acknowledge tariffs can put upward pressure on inflation, and they’re likely to see any upward pressure on CPI as directly related to import duties. But they’re also balancing that against a cooling labor market and slower demand in the first half of the year. When you put all the economic data together, I think the Fed has a window to lower borrowing costs at its next meeting, but just by 25 basis points. Suggestions that the cuts may be bigger are overly optimistic, in my view.

From here, businesses will likely continue to juggle whether to pass along tariff costs or absorb them. We need more data to know for sure. In terms of the July PPI print, some of the volatility had little to do with tariffs at all. It doesn’t strike me as the start of a new, sustained inflation surge, but it does give the Fed some cover not to be overly aggressive with rate cuts.

For long-term investors, moments like this are a chance to step back and make thoughtful adjustments, not to panic.

To help you navigate rising prices and protect your retirement, we’ve created a free guide, 4 Ways to Protect Your Retirement from Rising Inflation3. It provides practical strategies to manage inflation pressures, safeguard your income, and keep your plan on track in today’s market.

Inside, you’ll learn about key inflation-related topics, including:

- Asset allocations that outperform inflation

- Spending categories where prices are rising the most

- Getting the most from Social Security benefits

- Plus, many more ideas to protect yourself and your assets against inflation

If you have $500,000 or more to invest, get your free guide today! Download 4 Ways to Protect Your Retirement from Rising Inflation3.

Disclosure

2 BLS. 2025. https://www.bls.gov/charts/producer-price-index/final-demand-goods-and-services-12-month-percent-change.htm

3 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Ways to Protect Your Retirement from Rising Inflation offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.