In today’s Steady Investor, we take a closer look at the forces shaping markets this week and what they could mean for investors. Key themes include:

- Fed signals cautious rate cuts

- Supreme Court takes up tariffs

- Wholesale prices ease inflation pressure

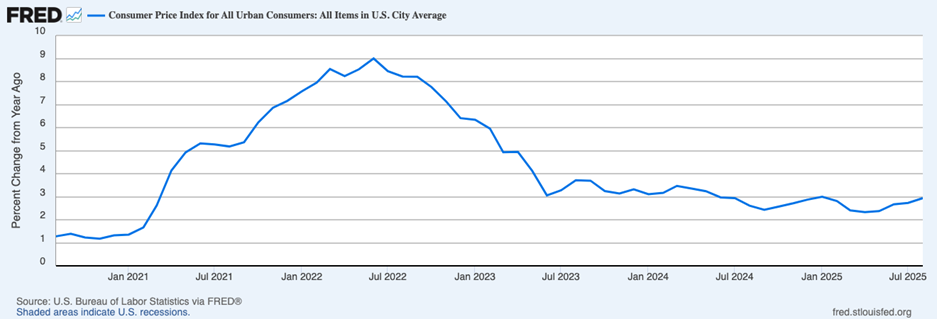

Inflation and Jobs Data Pull the Fed in Opposite Directions – The Fed is hyper-focused on jobs and inflation, and two new data points arrived this week that could influence their decision-making. First, inflation. Consumer prices rose more than expected in August, with headline inflation measured by the Consumer Price Index (CPI) rising 0.4%, the largest monthly increase since January. The year-over-year CPI print came in at 2.9%, which is the highest reading since January and +0.2% higher than July. Core CPI, which strips out food and energy, rose 3.1% year-over-year.1

A New Era for Taxes: What OBBBA Means for Your Finances

The One Big Beautiful Bill Act (OBBBA) has officially rewritten the U.S. tax code. While debate continues over its benefits and drawbacks, one fact is clear: these sweeping changes will directly affect how individuals plan, invest, and manage their wealth.

Our free, easy-to-reference guide, Tax Guide for 2025 and Beyond3 summarizes the law’s most relevant tax provisions, including:

- Individuals & Families—Changes to deductions, credits, and income thresholds

- Small Business Owners—Tax incentives related to pass-through income, equipment depreciation, and more

- High-Income Households—Where deduction phaseouts begin and how to plan around those income cliffs

- Seniors & Retirees—Opportunities to reduce taxable income and optimize retirement distributions

- Quick Reference Table—Our high-level overview of key provisions, with phaseout thresholds and planning notes

If you have $500,000 or more to invest, download your free copy today!

Download Our Free Guide, “Tax Guide for 2025 and Beyond”3

The read here is that inflation is still at a level that should give the Fed pause, but then you have to factor in jobs market data. In the first week of September, initial jobless claims climbed to 263,000, significantly above expectations and the highest reading since October 2021. What’s more, revised employment data from the Bureau of Labor Statistics (BLS) suggests that job growth over the past year was significantly overstated. The agency reported that the U.S. added 911,000 fewer jobs in the 12 months ending March 2025 than originally reported, a downward revision of more than 50%. If confirmed, that would slash the average monthly pace of job creation from 147,000 to just over 70,000 jobs per month. Enter the Fed, which faces a trade-off: inflation remains slightly elevated, but not out of control, while the labor market may be weakening more quickly than anticipated. In our view, this fully clears the path for a 25-basis point rate cut, and opens the door for additional cuts in October and December. Talks of a “jumbo cut” are overstated, in our view. The Fed is likely to continue to move cautiously.

Tariff Policy Heads to the Supreme Court – In a major legal development with economic implications, the Supreme Court announced Tuesday that it will hear arguments in November over the legality of the Trump Administration’s sweeping global tariff regime. The decision to fast-track the case could mean a ruling before year-end, bringing long-awaited clarity to a hotly debated economic policy. At issue is whether the administration exceeded its authority under the 1977 International Emergency Economic Powers Act (IEEPA), which was used to justify a 10% baseline tariff on most imports and steeper levies on countries seen as trade offenders. Lower courts—including the U.S. Court of International Trade and a federal appeals court—have ruled against the administration, finding that the IEEPA does not authorize the president to unilaterally impose such broad duties.The justices will hear not one but two consolidated cases: one brought by a small wine importer and other businesses alleging economic harm, and another by an educational toy company. Both suits argue that the tariffs have caused severe financial strain through supply chain disruptions and higher import costs.Administration officials argue that legal uncertainty is already disrupting trade talks with key partners, and they’ve urged the court to act swiftly to resolve the matter.From a market perspective, however, the likely impact may be more muted. Investors have had months to digest the legal risks, and courts have been signaling their skepticism of the tariffs’ legal footing since early summer. The administration has also indicated it is exploring alternative legal routes to maintain its trade posture if the current tariff framework is overturned. That includes potential use of Section 338 of the 1930 Smoot-Hawley Tariff Act, which allows temporary tariffs against nations that discriminate against U.S. commerce.4

Another Piece in the Inflation Puzzle: Wholesale Prices Tick Lower – While the August CPI print came in a bit hotter than expected, inflation watchers saw relief this week when wholesale prices in the U.S. unexpectedly declined. The Producer Price Index (PPI) fell -0.1% month-over-month, its first decline in four months. While the drop was small, it was enough to grab attention, particularly given concerns about tariffs lifting prices.On an annual basis, PPI rose 2.6%, roughly in line with its recent trend and well within a normal range of variability. Meanwhile, core goods prices, excluding food and energy, rose 0.3%, while services costs declined -0.2%. That drop in services was driven largely by a sharp decline in margins for wholesalers and retailers, many of whom appear to be absorbing tariff-related costs rather than passing them along to consumers.Fed officials are likely to take note. The PPI report is one of the last inflation readings before the central bank’s policy meeting next week, and several components feed into the Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) index.5

OBBBA and Your Money—How Should Investors Respond? The new tax law represents one of the biggest overhauls in years. While its full impact will unfold over time, investors who understand the changes now will be better positioned to adjust their strategies with confidence.

Our free Tax Guide for 2025 and Beyond6 breaks down the law’s most important provisions and what they could mean for you. Inside, you’ll find insights on:

- Individuals & Families—Changes to deductions, credits, and income thresholds

- Small Business Owners—Tax incentives related to pass-through income, equipment depreciation, and more

- High-Income Households—Where deduction phaseouts begin and how to plan around those income cliffs

- Seniors & Retirees—Opportunities to reduce taxable income and optimize retirement distributions

- Quick Reference Table—Our high-level overview of key provisions, with phaseout thresholds and planning notes

If you have $500,000 or more to invest, download your free copy today!

Disclosure

2 Fred Economic Data. September 11, 2025. https://fred.stlouisfed.org/series/CPIAUCSL#

3 ZIM may amend or rescind the free guide offer, Tax Guide for 2025 and Beyond, for any reason and at ZIM’s discretion.

4 Wall Street Journal. September 9, 2025. https://www.wsj.com/us-news/law/supreme-court-agrees-to-hear-trumps-tariff-appeal-330b62ca?gaa_at=eafs&gaa_n=ASWzDAhPUcljUu6gpfpZbmWFZtUvxi0OuYXks1Ey39IDXP1vFvPWi7ZoyXCeEYhJce4%3D&gaa_ts=68c32821&gaa_sig=SxGceKqTyBNZ0hBnW0JjEFf7U0drSp6RY50wdgFfnoo46dgzoWq3scyNrfOsmgbQj-lhAeGRdqB-MChaX8lL4g%3D%3D

5 MSN. 2025. https://www.msn.com/en-ca/money/markets/us-producer-prices-unexpectedly-drop-first-decline-since-april/ar-AA1MgTSQ

6 ZIM may amend or rescind the free guide offer, Tax Guide for 2025 and Beyond, for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.