Markets are shifting, making now a smart time to review your portfolio and spot new opportunities. In this issue of Steady Investor, we cover three key themes to help guide your next moves:

- Mortgage rates not Fed-driven

- 401(k) catch-up rules shifting

- Global business activity still growing

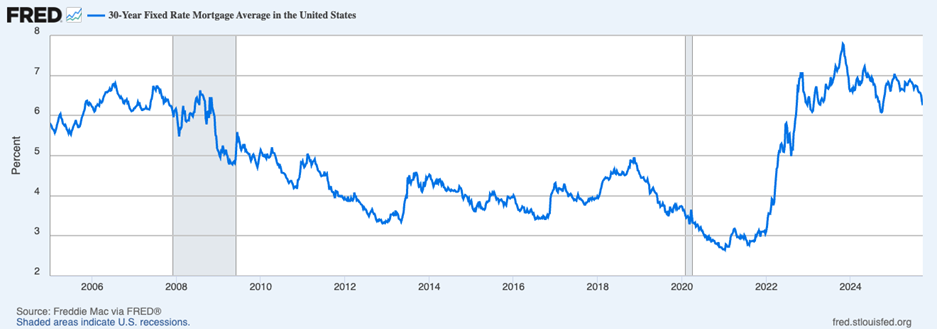

The Fed is Cutting Rates, But Does That Mean Mortgage Rates Will Fall Too? With the Federal Reserve poised to continue cutting rates at future meetings, many assume mortgage rates will follow. But for would-be homebuyers (and sellers) anticipating a more affordable financing market, the connection isn’t nearly as tight as headlines suggest.That’s because the Fed controls overnight rates, which are very short-term borrowing costs. Mortgage rates are set by long-term interest rates, which tend to follow the 10-year U.S. Treasury bond yield. To understand what affects the 10-year, one must look at market forces, not central bank decisions. Why the 10-year and not the 30-year Treasury bond yield? Because most mortgages don’t last 30 years in practice. Homeowners often move or refinance after about a decade, making the 10-year yield a more natural benchmark for pricing mortgage-backed securities. Inflation expectations, supply and demand for bonds, and global investor sentiment all play a role in moving 10-year yields. If investors worry that rate cuts today will reignite inflation tomorrow, they may demand higher long-term yields now. Case-in-point: just last year, the Fed cut rates by half a percentage point, and 10-year yields rose in the following weeks, pushing mortgage rates higher. To be sure, borrowing rates may drift lower from here as the Fed engages in further monetary easing. But if they do, it will likely be because inflation expectations fall and bond demand rises, not because of 25 basis point cuts.1

Is Your Retirement Portfolio on Track in Today’s Market?

Market uncertainty challenges investors, and staying on track for retirement takes more than hope—it requires clear goals, smart investment choices, and disciplined portfolio management.

To help you take control of your retirement plan, we’re offering a free Ultimate Retirement Portfolio Guide3, which includes actionable steps to build a portfolio designed for your needs, including:

- Accurately forecasting your retirement income needs

- The two phases of determining your asset allocation

- Developing an investment discipline that allows you to get good results over time

- Avoiding self-sabotage—what you need to know

- Plus, our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000 or more to invest, get this guide and explore strategies to potentially secure your long-term financial future.

Get our FREE guide: 7 Secrets to Building the Ultimate DIY Retirement Portfolio3

30-Year Fixed Mortgage Rates

“Catch-Up” Contributions to 401(k)s are About to Change – For some time, working Americans over the age of 50 have been able to contribute extra dollars into retirement plans, known as “catch-up” contributions. The nature of these contributions is about to change for high income workers. Starting in 2026, some high-income workers will no longer be able to make pretax catch-up contributions to their 401(k) plans and will instead need to put those savings into Roth accounts, i.e., after-tax contributions that grow tax-free. The change comes from the IRS’s finalized rules on a 2022 law and applies to workers who earned more than $145,000 in the previous year. While the basic contribution limit in 2025 will be $23,500, workers age 50 and older can put in an extra $7,500, and those aged 60 to 63 will qualify for an additional “super catch-up” of $11,250. But for high earners, all of that catch-up money must now go into a Roth.

In the worst-case scenario, if a high-income worker’s 401(k) plan does not offer a Roth option, they won’t be able to make catch-up contributions at all. While the new rule may sting for those accustomed to the pretax benefit, it could be a blessing in disguise for long-term planning. Many high earners are already top-heavy with pretax savings and may welcome the chance to build up more tax-free income in retirement. In fact, some advisors are encouraging clients to view this moment as a broader opportunity to consider making all their 401(k) contributions, regular and catch-up, in Roth format. In our view, with rules shifting and thresholds tightening, this is a smart time for retirement savers to re-evaluate how and where they’re saving.4

U.S. and European Business Activity Continues Expanding – U.S. business activity expanded in September, though the pace of growth slowed slightly for a second straight month. That’s the takeaway from S&P Global’s flash purchasing managers’ index (PMI), a widely watched measure of private-sector activity. The Composite PMI dipped to 53.6 from 54.6 in August, still well above the 50 mark that separates growth from contraction.The latest reading showed a modest cooling in both manufacturing and services. But critically, despite higher input costs, largely due to tariffs, businesses didn’t pass those costs along to customers in the form of higher prices. The input price index ticked up to 62.6, while the output price index fell to 56.0, suggesting firms are absorbing more of their rising costs rather than risking customer pushback.

It’s also true that most U.S. imports are not currently subject to sweeping tariffs, which likely helps explain why consumer inflation hasn’t surged. Across the Atlantic, the eurozone’s PMI edged slightly higher to 51.2 in September, marking its ninth straight month of growth. That modest uptick was driven largely by Germany, while France saw continued contraction, with a composite PMI of 48.4, its 13th consecutive month below 50. For investors, we think the big picture here is that global economic data continue to support a “muddle-through” environment, where moderate growth and above-average inflation coexist. For stocks, that can be a very workable mix, especially when expectations are low.5

Building a Resilient Retirement Portfolio in Today’s Market – Markets continue to shift with interest rate cuts, inflation pressures, and evolving economic signals. The steps you take now can help protect your savings and keep your retirement plan on track.

Download our updated guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio6, for a clear, step-by-step framework to design a portfolio built for long-term goals, even in an uncertain market.

This guide offers actionable insights on:

- Accurately forecasting your retirement income needs

- The two phases of determining your asset allocation

- Developing an investment discipline that allows you to get good results over time

- Avoiding self-sabotage—what you need to know

- Plus, our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000 or more to invest, get this guide to learn our ideas on the step-by-step process of building and maintaining a retirement portfolio that will potentially help you reach your goals and enjoy a secure retirement.

Disclosure

2 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

3 Fred Economic Data. September 25, 2025. https://fred.stlouisfed.org/series/MORTGAGE30US#

4 Wall Street Journal. September 24, 2025. https://www.wsj.com/personal-finance/retirement/high-earners-age-50-and-older-are-about-to-lose-a-major-401-k-tax-break-75572091?mod=djemMoneyBeat_us

5 Reuters. September 23, 2025. https://www.reuters.com/world/us/us-business-activity-moderates-further-september-2025-09-23/

6 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.