Will a Steepening Yield Curve Boost Financials and the Broader Economy?

Conditions for a steepening yield curve are forming.

The Federal Reserve cut its benchmark fed funds rate by 25 basis points at its September meeting, and there are indications that more rate cuts are on the horizon. If the next few meetings go as many market participants anticipate, yields on the short end of the curve are poised to keep falling.

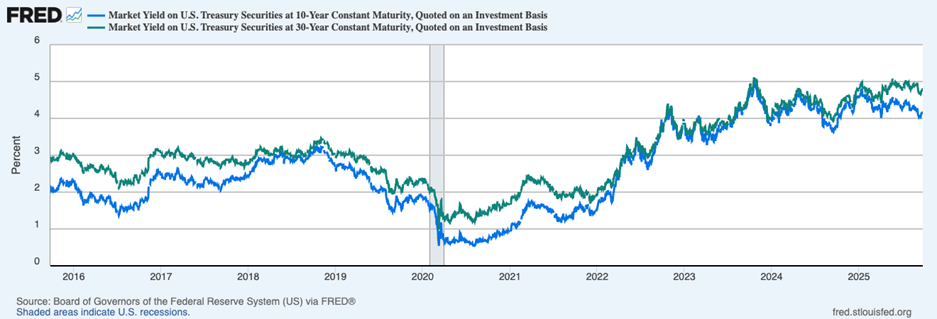

Meanwhile, yields on the longer end of the curve (10-year and 30-year U.S. Treasurys) have been steadily climbing. As seen on the chart below, 30-year U.S. Treasury bond yields recently brushed 5%, and the 10-year has remained above 4% all year.

Yields on 10-Year U.S Treasurys (blue line) and 30-Year U.S. Treasurys (green line)

Will Rising Long-Term Rates Put the Market Rally at Risk?

The Federal Reserve is cutting short-term rates, but long-term Treasury yields are rising, a pattern that’s flipped the yield curve and now appears to be steepening again.

Historically, this setup has signaled turning points in the market. It can push stock prices down, change which sectors lead, and unsettle investors when growth or inflation surprises.

Our latest Stock Market Outlook Report shows what this shift could mean and how to help protect and position your portfolio before Q4 volatility hits. Inside, you’ll discover:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your free copy of the report and see how today’s policy shifts could shape tomorrow’s opportunities.

IT’S FREE. Download our latest Stock Market Outlook Report2

As I wrote in a recent column, there are a few reasons to believe we could see sustained pressure on long duration bond yields. Debt issuance has picked up after the summer lull, increasing supply. Sentiment could also play a role—after years of near-zero interest rates and heavy central bank buying, investors have grown more sensitive to small shifts in expectations about growth, inflation, and policy. Expectations of lower growth and higher inflation can push yields up.

In that same column, I framed this dynamic as a potential positive. I argued that with central banks cutting short-term rates and long yields drifting higher, yield curves could be set to steepen, which is a classic marker of healthier credit conditions since it improves incentives for banks to lend. Remember, the basic business model of banking relies on borrowing money at short-term rates and putting it to work through longer-term loans. When the yield curve slopes upward, long rates exceeding short, banks have higher incentive to extend credit widely because the margin is in their favor.

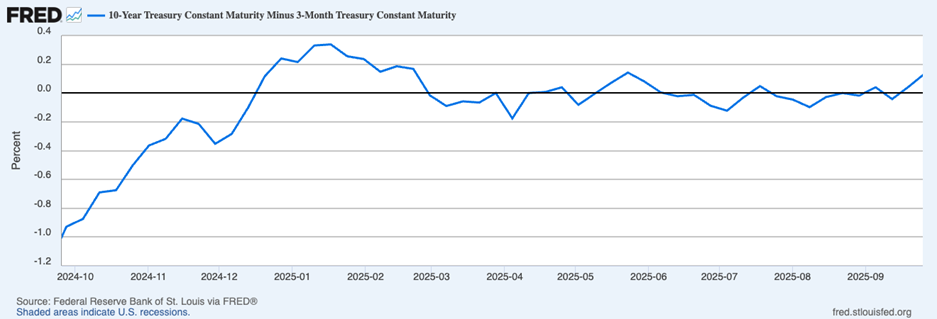

The chart below shows the yield curve as the difference between yields on 3-month U.S. Treasurys and 10-year U.S. Treasurys. It’s clear that the yield curve has been flat for some time, but as outlined above, there’s a reasonably good thesis that we could see more steepening ahead.

3-Month / 10-Year U.S. Treasury Bond Yield Curve (below zero is inverted, above zero is steep)

A steeper yield curve is generally good news, but I want to be careful not to portray it as a definitive game-changer.

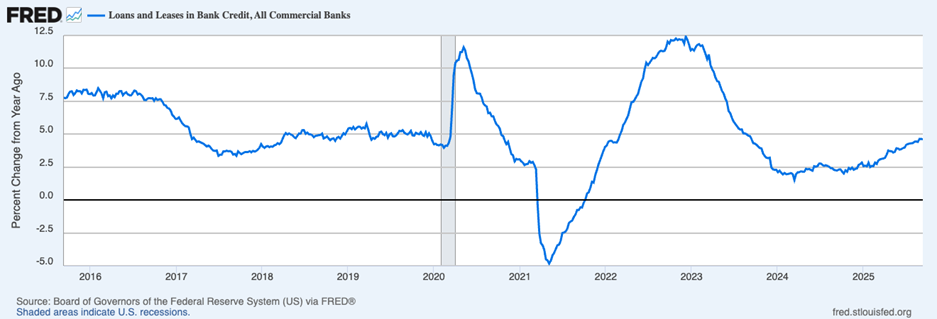

Although the correlation is relatively tight, banks’ lending margins don’t map directly to government bond spreads. Banks’ funding costs are shaped more by the abundance of deposits, swollen in recent years by pandemic-era fiscal transfers, than by short-term Treasury yields. Loan pricing, meanwhile, generally runs above long-term government yields, reflecting higher credit risk. This helps explain why loan growth (see chart below) has remained steady even during the curve’s inversion. In other words, banks did not suddenly stop lending when the curve flipped upside down, so it’s unlikely that merely un-inverting will spark a dramatic new lending boom.

To be sure, a modestly positive slope can provide a tailwind for Financials stocks, and it may offer some incremental support to credit creation. But as a barometer for the U.S. economy overall, the curve’s current steepening is more symbolic than fundamental. The bigger picture is that lending activity never really faltered, and the economy has kept grinding ahead despite widespread worries.

Bottom Line for Investors

A steepening yield curve is positive, and it can add some support for Financials. But I do not think we’re in a place in this cycle where a steeper curve will fundamentally alter the economic outlook. The U.S. economy remains sturdier than many appreciate, with strong employment and steady loan growth underscoring that resilience. For investors, a steeper yield curve is something to celebrate, but it’s not a panacea for weakness that could emerge elsewhere in the economy.

That’s why it’s important to watch what’s happening beyond the curve. The bond market is shifting fast. The Fed is cutting short-term rates while long-term yields climb, creating new risks for stocks. Inflation pressures, policy changes, and stretched valuations could test portfolios in the months ahead.

Get our latest Stock Market Outlook Report5 for a clear look at what’s driving markets now and how to stay positioned before Q4 volatility hits. Inside, you’ll discover:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your free copy of the report and see how today’s policy shifts could shape tomorrow’s opportunities.

IT’S FREE. Download our latest Stock Market Outlook Report5

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

3 Fred Economic Data. September 30, 2025. https://fred.stlouisfed.org/series/T10Y3M#

4 Fred Economic Data. September 26, 2025. https://fred.stlouisfed.org/series/TOTLL

5 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.