In this week’s Steady Investor, we look at the market forces shaping today’s headlines and the key indicators that could guide your next financial decision, including:

- Mixed labor market signals

- Shutdown fears, muted economic effects

- Tariffs are slowing global exporters

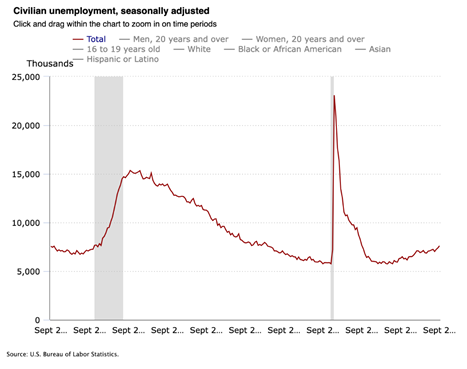

After a Long Pause, Investors Finally Get Data on the U.S. Labor Market – After long delays due to the U.S. government shutdown, market participants finally got some vital data on the health of the U.S. economy. The verdict is mixed. According to the Labor Department, employers added 119,000 jobs in September, the strongest monthly gain in five months and well above expectations. On a sector basis, payrolls most notably rose in healthcare, education, leisure and hospitality, retail, construction, and state/local government. While the headline number was solid, the ‘mixed’ piece comes into focus in other areas of the report. The unemployment rate rose to 4.4%, a four-year high, as nearly 500,000 people entered the labor force. Revisions to the July and August jobs report showed that payrolls were a net 33,000 lower than first reported, underscoring a summer slowdown. Continuing jobless claims climbed to 1.97 million, the highest since late 2021, hinting at tougher re-employment for those already out of work. And finally, and perhaps most importantly, transportation/warehousing and temporary help jobs fell in September, which are areas that often soften early in slowdowns.1

Avoid Costly Mistakes to Your Portfolio: Ask These 10 Questions First

In a market defined by sharp swings, policy shifts, and fast-moving risks, working with a money manager who truly understands your needs isn’t optional, it’s crucial. But deciding whether they’re the right fit can be tough.

Our free guide, What to Look for in a Money Manager2, lays out the 10 questions every investor should be asking right now, along with clear explanations of why each one matters for protecting your wealth and positioning it for long-term growth.

Inside, you’ll get straightforward answers to questions like:

- How have your investment strategies performed vs. their benchmark?

- Are there fees or penalties if I decide to leave your firm?

- How do you measure risk?

- How are you compensated?

- And 6 more pointed questions

If you have $500,000 or more, click the link below to download your free guide today!

Download Our Free Guide, What to Look for in a Money Manager today!2

BLS3

For investors, it all goes back to what this means for the Fed meeting in December. ‘Mixed’ is also the prevailing takeaway here, as September’s job report likely argues for the doves (likely rate cutters) and the hawks (those who want to hold rates steady. Hawks can point to better-than-expected hiring and resilient demand, while doves can cite the higher jobless rate, slower three-month hiring trend (averaging 47,000 through September), and a pattern of downward revisions as reasons to insure against further cooling. Rate-cut odds for December nudged to ~40% after the release.

Assessing the Damage from the U.S. Government Shutdown – The U.S. government shutdown lasted a record 43 days. Markets didn’t seem to mind all that much. The S&P 500 rose about 2.5% during the lapse, and 10-year Treasury yields barely budged. As we’ve written before, U.S. government shutdowns are big on the fear headlines but light on the economic damage. No government shutdown to date has caused a recession or bear market, and this one was no exception. To be fair, however, the episode was not painless—going six weeks without pay is a real strain for affected workers and nearby small businesses. But for markets, day-to-day commerce elsewhere kept moving along, and corporate earnings broadly did not feel any headwinds. Government data is the main lingering issue. With October collection disrupted, some reports will be skipped or reconstructed. The BLS is likely to forego October’s inflation report (CPI/PPI) and portions of the jobs report, with September’s delayed Employment Situation arriving on November 20. GDP, trade, retail sales, durable goods, and industrial production should resume on a lag as agencies catch up, but we do not think this retroactive data will have much effect on markets. The funding bill is short-term, which means we could be writing about the shutdown again come January 2026. For their part, markets are likely to keep reacting the same way—watching profits, rates, and demand, not Washington’s stop-start routine.4

Global Growth Starting to Feel the Effects of Tariffs – A survey of global economic growth data reveals a trend: major exporting countries facing tariffs are seeing a slowdown. Japan and Switzerland both reported Q3 contractions, citing weaker U.S.-bound orders as higher duties raised costs. Mexico and Ireland, which are major U.S. suppliers, also slipped. Germany and Italy stabilized, but a look back at the last quarter shows declines. Two forces are cushioning the blow. First is the AI build-out. U.S. and global firms are importing chips, servers and networking gear at a rapid clip, supporting manufacturing hubs tied to that supply chain. Second, most targeted countries have avoided broad retaliation, keeping alternative trade channels open. World Bank data indicates that countries are increasingly adapting to tariffs by re-routing goods. While developing-country exports to the U.S. have declined significantly year-to-date compared to 2024, sales to other advanced economies rose, and shipments to other developing markets climbed even more. That’s a key takeaway for investors that many are missing. Trade cooperation is deepening outside the U.S. orbit, which may add a neutralizing tailwind to global growth over time. Recent signs of warmer India–China commercial relations point to more cross-border deal flow, and China’s growing commerce with Southeast Asia is accelerating.5

Markets are constantly changing, bringing both risks and opportunities. To navigate this landscape successfully, it’s crucial to have a clear understanding of how your investments are managed.

That starts with asking the right questions—so you know your money manager is aligned with your goals and ready for today’s challenges. Our free guide, What to Look for in a Money Manager6, covers the essential questions every investor should ask before choosing or continuing with a manager, such as:

- How have your investment strategies performed vs. their benchmark?

- Are there fees or penalties if I decide to leave your firm?

- How do you measure risk?

- How are you compensated?

- And 6 more pointed questions

If you have $500,000 or more, we recommend clicking the link below to download your free guide today!

Disclosure

3 BLS. https://www.bls.gov/charts/employment-situation/civilian-unemployment.htm

4 ABC News. November 13, 2025. https://abcnews.go.com/Business/government-shutdown-impact-numbers/story?id=127484037

5 Wall Street Journal. November 18, 2025. https://www.wsj.com/economy/trade/higher-tariffs-take-toll-on-global-growth-and-impact-is-set-to-linger-52c992cb?mod=economy_feat1_global_pos1

6 Zacks Investment Management reserves the right to amend the terms or rescind the free: What to Look for in a Money Manager offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.