Markets are shifting again. This issue of Steady Investor highlights the three themes investors should watch now.

- Soft holiday spending ahead

- Tariff costs rising but contained

- Services driving global resilience

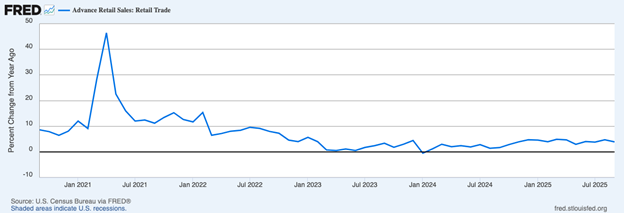

Signs are Pointing to a Weaker Holiday Shopping Season – It’s too early to get a read on retail sales data for the Thanksgiving shopping weekend, but a few signs point to spending softness we might expect to see in the final weeks of the year. Seasonal hiring looks thin while interest in seasonal work is up, an unusual pairing that points to tighter wallets and jobs market weakness. Several big holiday employers skipped their customary “we’re hiring X number of seasonal workers” announcements, and private trackers flag the weakest seasonal add since 2009. That backdrop squares with softer sentiment and a Beige Book that noted caution heading into year-end.1

Retail Sales Look Flat Heading into Holiday Shopping Season

Is Your Retirement Portfolio on Track in Today’s Market?

Market uncertainty challenges investors, and staying on track for retirement takes more than hope—it requires clear goals, smart investment choices, and disciplined portfolio management.

To help you take control of your retirement plan, we’re offering a free Ultimate Retirement Portfolio Guide3, which includes actionable steps to build a portfolio designed for your needs, including:

- Accurately forecasting your retirement income needs

- The two phases of determining your asset allocation

- Developing an investment discipline that allows you to get good results over time

- Avoiding self-sabotage—what you need to know

- Plus, our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000 or more to invest, get this guide and explore strategies to potentially secure your long-term financial future.

Get our FREE guide: 7 Secrets to Building the Ultimate DIY Retirement Portfolio3

Foot traffic and headlines can still look lively while the hard data underneath is more mixed. Freight and parcel anecdotes suggest restocking numbers could be lower after a front-loaded inventory build earlier in the year. And a notable industry forecast sees container volumes down sharply into Q4 after a strong first half. Add the lingering effects of the shutdown (delayed SNAP disbursements for some; pay timing issues for affected workers), and you get a holiday that may lean more promotional, more last-minute, and more bifurcated by income. For investors, the data to watch closely will come after the weekend rush. Look to see if retailers pull back on January orders, how deep December discounting runs, and if buy-now-pay-later usage, returns, and average ticket sizes confirm a cautious shopper or a steady one.

What 5,000 CEOs are Saying About Tariffs – The Wall Street Journal recently analyzed the earnings calls of 5,000 companies to see what CEOs were saying about tariffs at this point in the year. What the reporters found was that leaders are talking less about tariff “risk” and more about how they’re managing through it. Several forces are behind the shift. First, what firms actually pay has tended to undercut the sticker price. Oxford Economics estimates October’s average paid rate around 12% of import value—higher than January, but far shy of the most dramatic schedules. Second, selective rollbacks and carve-outs (e.g., recent food and agriculture items, cocoa, etc.) plus expanded offset programs in some categories have trimmed exposure. Third, companies have had time to adapt. They’ve renegotiated with suppliers, re-routed inputs, raised prices selectively, and absorbed a portion of costs with still-healthy margins. The tariff framing has turned from dour to “manageable.” But for investors, remember that “manageable” isn’t the same as painless. Many companies have absorbed higher prices and taken hits on margin, hoping to ride out the storm. But that sentiment will not last forever, and passing through those price increases will be something that may be inevitable in 2026. As we’ve written before, the biggest story to watch in the coming weeks will be the Supreme Court’s decision on tariffs, which could alter the legal footing for the tariff regime.4

For the Global Economy, Surveys Show Steady—But Uneven—Growth – Business surveys hit the tape globally during Thanksgiving week, with flash PMIs showing private-sector activity still grinding forward across several major economies.In the UK, weeks of budget chatter have weighed on confidence and nudged November’s composite PMI down to 50.5 (services 50.5; manufacturing 50.2). In France, November’s flash composite rose to a 15-month high (49.9), driven by services popping back into expansion (50.8) even as manufacturing stayed soft. Here in the U.S., as expected, the shutdown didn’t halt business. The US flash services PMI edged up to 55.0 while manufacturing eased to 51.9, both still expansionary. Firms reported adding staff and facing higher input costs from wages and tariffs, but competitive pressure kept selling-price increases in check. Taken together, these snapshots show a global private sector that’s more resilient than headlines imply. Stocks haven’t been climbing on AI-driven hype alone. Underlying activity, especially in services, continues to show signs of modest expansion.5

Building a Resilient Retirement Portfolio in Today’s Market – With markets rotating, rates stabilizing, and economic data sending mixed signals, now is a smart time to strengthen your retirement strategy and keep your long-term plan on course.

Download our updated guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio6, for a clear, step-by-step framework to design a portfolio built for long-term goals, even in an uncertain market.

This guide offers actionable insights on:

- Accurately forecasting your retirement income needs

- The two phases of determining your asset allocation

- Developing an investment discipline that allows you to get good results over time

- Avoiding self-sabotage—what you need to know

- Plus, our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000 or more to invest, get this guide to learn our ideas on the step-by-step process of building and maintaining a retirement portfolio that will potentially help you reach your goals and enjoy a secure retirement.

Disclosure

2 Fred Economic Data. November 25, 2025. https://fred.stlouisfed.org/series/RSXFS

3 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. November 22, 2025. https://www.wsj.com/economy/trade/ceo-tariffs-earnings-calls-optimism-6e7aa423?mod=economy_feat2_trade_pos1

5 Wall Street Journal. November 21, 2025. https://www.wsj.com/economy/eurozone-business-activity-continues-growth-despite-manufacturing-hit-66e3a43f?mod=economy_feat1_global_pos3

6 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.