The Story Isn’t the Rate Cut, It’s What Comes Next

The Federal Reserve delivered another 25-basis point rate cut at its December meeting, bringing the federal-funds range down to 3.50% to 3.75%. I would argue that the markets had priced in the outcome for weeks, and most investors already viewed it as a continuation of the Fed’s gradual effort to transition from “restrictive” toward something closer to neutral.1

The data heading into the meeting gave the Fed enough cover to ease, in my view. The latest inflation update, the September PCE report2, showed core prices rising 0.2% month-over-month and 2.8% year-over-year. Those aren’t perfect numbers, but they’re stable, and importantly, not accelerating meaningfully despite tariff pressure.

The labor market, meanwhile, has been showing signs of moderating but not collapsing. The most recent JOLTS report3 from the Bureau of Labor Statistics showed job openings easing to roughly 8.8 million, with quits rates drifting down—signs that both workers and employers are hanging tight. Employers are not on hiring or firing sprees, and workers are not switching jobs at a high rate. In short, there’s balance in the labor market, but it may be softer than what the Fed wants to see.

After the Rate Cut: What Actually Matters Now

The Federal Reserve’s latest rate cut may grab headlines, but history suggests small policy moves rarely drive lasting market outcomes. What matters more is how credit conditions, growth trends, and corporate fundamentals continue to evolve after the decision.

Our December 2025 Stock Market Outlook Report4 puts this moment in perspective, helping investors separate signals from noise as the Fed shifts toward a more data-dependent posture.

The report focuses on the indicators that have historically guided markets, including:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your complimentary copy of the report and see how shifting market trends could influence opportunities in the months ahead.

IT’S FREE. Download our latest December Stock Market Outlook Report4

At the end of the day, concerns about the labor market appeared to outweigh concerns over inflation making downward progress towards the 2% target. Fed officials were divided over these two factors, but the compromise was what appeared to be a “cut-and-cap” approach: deliver the rate cut now, but make it clear that the bar for further easing is higher from here. That was my read from Chairman Powell’s posturing after the meeting.

In terms of where we go from here, investors often overestimate the economic impact of a quarter-point adjustment in the fed funds rate. Few long-term business projects suddenly become viable because the policy rate moves 25 bps lower. And markets also tend to price in anticipated Fed actions ahead of time, with mortgage, auto, and business-loan rates rarely moving one-for-one with the Fed.

Still, saying the impact is limited doesn’t mean it’s zero.

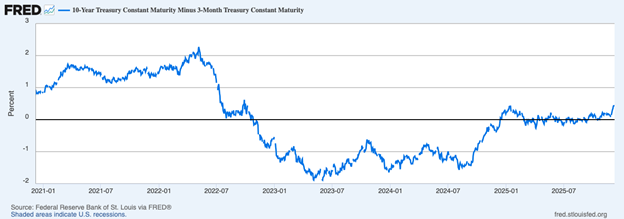

The first area where rate cuts can help is the yield curve, which has been flat for an unusually long stretch. While the curve has steepened slightly in recent months (see chart below), it remains close to flat. Lowering short-term rates generally encourages some natural steepening, which historically supports forward economic growth.

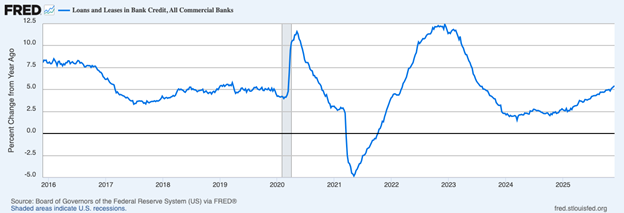

The second area is bank lending, where the backdrop is already healthier than headlines imply. Growth in loans and leases has improved meaningfully over the past year, as seen on the chart below. Part of this comes down to simple economics. The average savings deposit rate at banks today is roughly 0.4%, while long-term lending rates—mortgages, commercial loans, consumer credit—are several percentage points higher. That spread gives banks strong incentives to lend, and a modest rate cut only reinforces that dynamic.

Taken together, I think this modest rate cut will help at the margin, but I would not frame it as a catalyst that will all of a sudden drive a surge in economic activity. The economy is in relatively fine shape, and already being supported by steady lending, improving real wage trends, and corporate earnings that continue to exceed the more pessimistic forecasts from earlier this year. 25-basis points is not likely to move the needle dramatically, in my view.

Bottom Line for Investors

Investors often look to Fed decisions for clarity, but the more important takeaway from this meeting is what hasn’t changed, in my view. The expansion remains intact, even if it is slower and more uneven beneath the surface. A small rate cut is not going to change the economic narrative, but it may add a tailwind at a time when credit creation and corporate fundamentals still provide a reasonable foundation for continued growth. The Fed’s shift toward a “cut-and-cap” posture simply returns the focus to data rather than expectations, which is exactly where long-term investors should keep their focus as well.

Markets don’t turn on quarter-point moves. They turn on shifts in growth, credit, and fundamentals.

Our December 2025 Stock Market Outlook Report7 distills those forces, showing how the current policy backdrop fits into the broader cycle, where support remains, and where constraints are forming. Inside, you’ll find:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your complimentary copy of the report and see how shifting market trends could influence opportunities in the months ahead.

IT’S FREE. Download our latest December Stock Market Outlook Report7

Disclosure

2 CNBC. December 5, 2025. https://www.cnbc.com/2025/12/05/pce-inflation-report-september-2025.html

3 BLS. 2025. https://www.bls.gov/news.release/jolts.nr0.htm

4 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

5 Fred Economic Data. December 5, 2025. https://fred.stlouisfed.org/series/TOTLL

6 Fred Economic Data. December 5, 2025. https://fred.stlouisfed.org/series/TOTLL

7 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.