In today’s Steady Investor, we break down the market shifts and economic signals that matter most right now, including:

- Small caps gain policy tailwind

- Services strength anchors global outlook

- Year-end RMD pressure rising

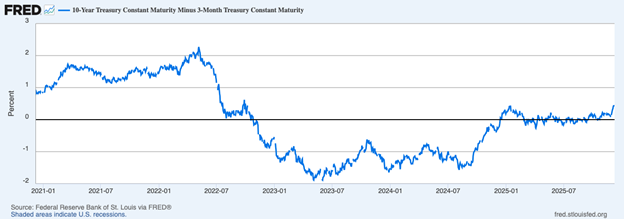

What to Take Away from the Fed’s “Hawkish Cut” – As expected, the Federal Reserve delivered another quarter-point rate cut, pulling the benchmark fed funds rate down to a range of 3.50% to 3.75%. Markets had this move penciled-in for weeks, so what matters from this meeting is rates’ future path. Inflation progress looks steady (not perfect, not re-accelerating), and the labor market has cooled without cracking, which gave officials an opening to cut but also made the case for being in no rush to cut more, a position that branded this latest move as a “hawkish cut.” In our view, a rate cut certainly does not hurt, particularly given the flat yield curve as seen in the chart below. A less-flat curve can support bank lending and drive economic activity in the process.1

3-month / 10-year U.S. Treasury Bond Yield Curve

Essential Strategies for Navigating Stock Market Volatility

Market fluctuations can make investors uneasy, but waiting for stability could lead to missed opportunities. Volatility can offer unexpected advantages; it’s just important to recognize how to leverage it.

To get more insights, all readers have access to our guide, “Using Market Volatility to Your Advantage”, which offers our expert viewpoint on navigating a volatile market, including:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000+ to invest and want deeper insights into how volatile markets can offer potential benefits for strong returns, download our free Using Market Volatility to Your Advantage3 guide today.

Taking Stock of Global Economic Health from Purchasing Managers’ Indexes (PMIs)– Purchasing managers’ indexes are useful indicators because they’re broad surveys of large firms in services and manufacturing, which can give market watchers a read on how CEOs and other executives are gauging activity and prices. In the US, November’s S&P Global services PMI stayed comfortably above 50, signaling most firms saw activity expand even as the reading eased a touch to 54.1. ISM’s older survey told a similar story, with services rising to 52.6, with new orders still in expansion. Employment remained sub-50 for a sixth straight month, but the contraction moderated, consistent with a labor market that has cooled without cracking. Manufacturing is the soft spot, as it has been for years. S&P’s US manufacturing gauge stayed in expansion while ISM dipped further into contraction, a familiar divergence given their different panels. Either way, the sector is a minority slice of modern economies (roughly one-sixth in the US), and the larger services side continues to carry the load. For investors, it’s important to remember that these surveys are backward-looking for stocks, but they help validate what markets have been pricing, which in our view, is a narrative of economic resilience vs. recession. With services expanding broadly and new orders still pointing to activity ahead, the macroeconomic outlook for growth in early 2026 looks viable.4

With Only Weeks Left in the Year, Many Retirees Haven’t Taken Their RMDs Yet – December 31 is fast approaching, and a new survey from Fidelity raises a caution flag. As of November 30, Fidelity reports 53% of its investors who owe a 2025 RMD hadn’t taken one yet, with nearly a third of the outstanding amounts tied to inherited IRAs. For most retirees, RMDs begin at age 73, but heirs who have inherited IRAs also face that same December 31 deadline. Since 2020, many non-spouse beneficiaries fall under the 10-year rule: the account must be emptied by the end of year 10. On top of that, if the original owner had already started RMDs before passing, certain beneficiaries must also take annual RMDs during those ten years. For those who miss the RMD deadline, and the IRS assesses a penalty of up to 25% of the shortfall (potentially reduced to 10% if you correct within two years and file Form 5329). Plenty of folks are cutting it close. If you still have a distribution to make, the practical advice is to take it now. Waiting now means risking fewer settlement days, less flexibility, and a higher chance you’re forced to sell something you’d rather hold just to raise cash.If you’re unsure which rules apply to you or an inherited account, we’d recommend calling your custodian or tax professional to gain clarity. We’re also happy to help answer questions if you want to reach out.5

Finding Silver Linings in a Volatile Market – Spotting hidden opportunities in a dynamic market can unlock valuable advantages for savvy investors.

For insights on how a volatile market can assist investors in refining their strategies and potentially achieving solid returns over time, we encourage you to explore our guide, Using Market Volatility to Your Advantage.6

If you have $500,000 or more to invest, download this free guide today by clicking the link below.

Disclosure

2 Fred Economic Data. 2025.

3 Zacks Investment Management reserves the right to amend the terms or rescind the Volatility can be a good thing guide offer at any time and for any reason at its discretion.

4 ISM World. 2025. https://www.ismworld.org/supply-management-news-and-reports/reports/ism-pmi-reports/services/november/

5 CNBC. December 9, 2025. https://www.cnbc.com/2025/12/09/deadline-for-required-minimum-distributions.html

6 Zacks Investment Management reserves the right to amend the terms or rescind the Volatility can be a good thing guide offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is at the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

“The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.”

The Russell 1000 Value Index is a well-known, unmanaged index of the prices of 1000 large-company value common stocks selected by Russell. The Russell 1000 Value Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.