3 Reasons Market Leadership Could Extend Beyond Large-Cap Growth Stocks in 2026

Large-cap U.S. growth stocks have been on a roll, outperforming most other categories over the past couple of years. As many readers know, and as I’ve written before, strong mega-cap tech earnings and AI capex are key reasons for this prolonged period of leadership.

But we also know that market leadership doesn’t last forever.

Consider this fact: cycles of small-cap underperformance relative to large caps have lasted about nine years on average. The current cycle is now in its twelfth year. Over that period, performance dispersion between large and small/mid-cap companies has widened meaningfully.

But extended cycles don’t end simply because they are long. History tells us that leadership can, and often does, change as financial conditions, earnings fundamentals, and policy environments evolve over time. And as I look ahead to 2026, I think several of the forces that have constrained performance outside of the large-cap growth category appear to be shifting in more constructive directions.

While small- and mid-cap stocks represent the clearest opportunity given current conditions, the themes below also suggest that narrow leadership concentrated in mega-cap growth may give way to broader market participation in 2026.

Here are three of those forces.

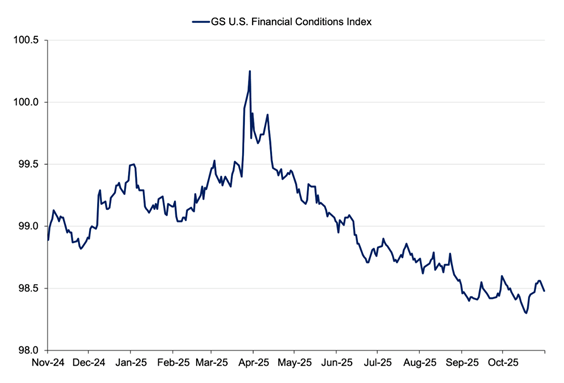

- Financial Conditions Are Easing, Reducing Pressure on Borrowing-Dependent Companies

One of the most important changes heading into 2026 is the broader easing in global financial conditions. Central banks across many economies have already begun lowering policy rates, credit spreads have tightened, and liquidity conditions have improved.

A Clear Outlook for the Stock Market in 2026

Markets are entering a period where leadership, earnings growth, and valuation matter more than headlines. For investors, the key question is not what policymakers do next, but which parts of the market are best positioned as conditions continue to evolve.

Our December 2025 Stock Market Outlook Report1 focuses on the data shaping the year ahead, with particular attention to small-cap stocks and their role in a changing market environment.

Inside the report, we examine:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your complimentary copy of the report and see how shifting market trends could influence opportunities in the months ahead.

IT’S FREE. Download our latest December Stock Market Outlook Report1

U.S. Financial Conditions Index

Importantly, this easing has occurred even as inflation in some countries remains modestly above target, reflecting a greater willingness by policymakers to focus on medium-term trends and real economic activity (primarily with employment).

For small-cap and mid-cap companies, for instance, the direction of financial conditions often matters more than the absolute level of interest rates. Smaller firms tend to rely more heavily on borrowing to fund operations and growth, and they typically refinance more frequently than large, well-capitalized multinationals. As a result, incremental easing of borrowing costs can impact cash flows and balance sheets more quickly. This favorable financial outlook for small- and mid-cap companies could spur some rotation in the new year, in my view.

For now, the Fed appears to be in “wait-and-see” mode, so I’m not anticipating a rate cut early in 2026. But as I look deeper into the year, a cooling labor market and the approaching end of Chair Powell’s term introduce a reasonable case for further policy easing. That possibility matters less as a forecast and more as a backdrop, since smaller companies stand to benefit when policy shifts from restraint toward support.

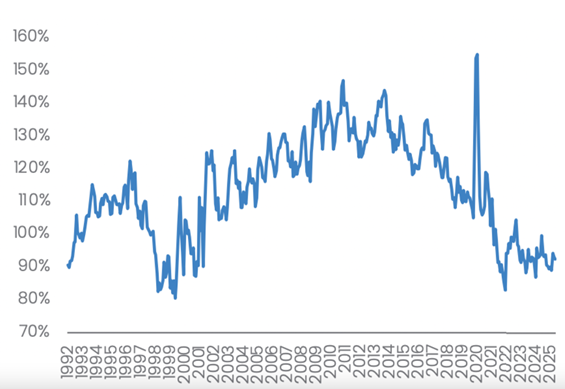

- Valuations and Earnings Are Beginning to Re-Align After an Extended Cycle

Beyond small and mid-caps specifically, valuation gaps have widened notably. Small- and mid-cap stocks trade at a meaningful discount to large caps, even though they have typically traded at a premium over long periods. In the case of small caps specifically, we have not seen relative pricing be this attractive in over 20 years, as seen on the chart below.

Relative Forward PE of Russell 2000 (small caps) / S&P 500 (large caps)

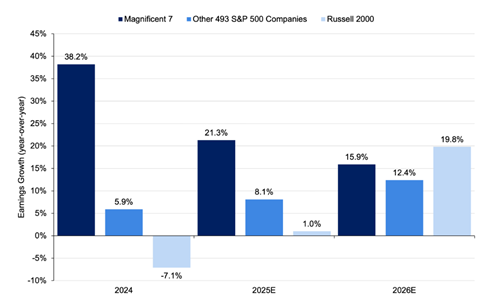

What makes this setup more compelling is that earnings fundamentals are beginning to improve outside of the large-cap growth category. As seen on the chart below, 2026 earnings growth for the Magnificent 7 (mega-cap tech companies) is poised to decelerate, while earnings growth for the rest of the S&P 500 index and the Russell 2000 index are both poised to accelerate. Mean reversion tends to work through fundamentals rather than sentiment and improving earnings growth could provide the mechanism for valuation gaps to narrow, and market leadership to broaden, over time.

Year-Over-Year Earnings Per Share Growth

- Tariffs Headwinds May Ease

Trade policy was an important variable in 2025, not just because of tariffs, but also the uncertainty surrounding their size, scope and duration. That uncertainty may now be coming into clearer focus.

In oral arguments in November, the Supreme Court appeared skeptical of the Trump administration’s authority to impose broad tariffs under emergency powers. We’ll know the decision in the coming weeks, but the case introduces the possibility that tariffs could be narrowed or adjusted. That could be majorly impactful for smaller companies, as it could influence input costs and planning decisions.

My view is that reduced policy uncertainty tends to favor companies whose results are driven more by operational execution and domestic demand, rather than long-duration growth assumptions (small caps). It creates another policy variable that could benefit areas of the market outside of large-cap growth.

Bottom Line for Investors

It’s worth emphasizing: the shift I’m describing doesn’t require mega-cap growth or AI trends to reverse. It simply suggests that returns may become more evenly distributed as other areas start participating alongside, rather than instead of, what’s been working.

Likewise, none of the above factors requires perfect conditions. Incremental changes can have outsized effects for borrowing-dependent, domestically-oriented companies.

From an investment perspective, I think that balance-sheet strength, earnings quality, and valuation discipline will continue to matter, which underscores the importance of selectivity and process. At Zacks, our long-standing focus on earnings trends and risk-adjusted returns across market capitalizations—including active strategies in the small- and mid-cap space—reflects the view that environments like this tend to reward careful analysis more than bold predictions.

When the focus shifts back to data, the question becomes how those conditions translate across the stock market.

Our December 2025 Stock Market Outlook Report5 examines that translation—looking at where growth is holding up, where constraints remain, and how fundamentals are evolving across market capitalizations, including small caps.

Inside the report, you’ll find:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your complimentary copy of the report and see how shifting market trends could influence opportunities in the months ahead.

IT’S FREE. Download our latest December Stock Market Outlook Report5

Disclosure

2 Goldman Sachs. December 12, 2025. https://www.lordabbett.com/en-us/individual-investor/insights/investment-objectives/2025/2026-investment-outlook-riding-the-tailwinds.html

3 Conestoga Capital. December 2, 2025. https://conestogacapital.com/extreme-large-cap-valuations-signal-opportunity-in-small-caps/

4 Lord Abbett. December 12, 2025. https://www.lordabbett.com/en-us/individual-investor/insights/investment-objectives/2025/2026-investment-outlook-riding-the-tailwinds.html

5 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.