4 Factors Investors Should Watch Closely in 2026

As we head into a new year, there is certainly no shortage of storylines to follow. What’s been lacking is reliable data to frame our understanding of events and stories. Much of the economic information released late in 2025 was distorted by the lingering effects of the government shutdown, making it difficult to separate signal from noise.1

That should begin to change in January, and I think the first quarter will bring a crop of key announcements and data that could set the stage for the year. Here are four factors I’ll be watching closely.

- A Fresh Set of Economic Data, With an Asterisk

Inflation appeared to cool late last year, with the year-over-year rate easing to 2.7% in November from 3.0% in September. But investors should treat that number cautiously. There was no October inflation report, and November’s data collection resumed just as retailers were cutting prices around Black Friday. Seasonal adjustments struggled to account for that timing, likely biasing the headline figure lower.

One more inflation report will arrive before the Federal Reserve’s next meeting, but January and February prints should be far more informative. Many companies reset prices at the start of the year, and with clean data collection back in place, those readings should offer a clearer inflation picture, which will, of course, feed into interest rate expectations.

What the Data Is Telling Investors About 2026

Markets are moving into a phase where data, not narratives, will determine outcomes. As 2026 begins, cleaner economic reports, shifting policy signals, and changing earnings dynamics are creating a more defined backdrop for investors willing to look past headlines.

Our latest Stock Market Outlook Report1 is grounded in the data shaping this transition. The report focuses on where growth is holding up, where expectations may be mispriced, and how market leadership could change as inflation, labor conditions, and earnings trends evolve.

Inside, we also examine:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your complimentary copy of the report and see how shifting market trends could influence opportunities in the months ahead.

IT’S FREE. Download our latest December Stock Market Outlook Report2

The labor market is sending similarly mixed signals. Payrolls rose by 64,000 in November, yet the unemployment rate increased to 4.6% from 4.4% in September. That combination raised concerns about a sharper slowdown, but timing played a role here as well. Shutdown-related delays blended October and November data together, and when federal layoffs are stripped out, private-sector job growth looks broadly consistent with this year’s slower, but still positive, trend.

The Fed appears to now be more focused on the jobs market versus inflation, but new data early in the year could reset the narrative.

- Monetary Policy Could Shift from Neutral to Accommodative

Monetary policy will follow the labor and inflation backdrop. Following the 25 basis point cut in December, the Federal Reserve has shifted into “wait-and-see” mode, but that stance may not last long. Chair Jerome Powell’s term ends in May, and political pressure for lower rates has become more pronounced.

What will matter, in my view, is whether softer labor market data and easing inflation give the Federal Reserve room to move from a neutral posture toward something more supportive. Even a modest shift in tone could influence financial conditions, valuations, and investor risk appetite. Historically, markets tend to price these changes well before they are formally announced.

- Turbulence in Trade Policy

A Supreme Court ruling on the administration’s use of emergency powers under the International Emergency Economic Powers Act (IEEPA) is expected later this month. If the Court strikes down or narrows the current tariff framework, the implications across Corporate America could be immediate.

But that doesn’t mean uncertainty would go away overnight.

The administration has made clear that they would pursue other avenues for implementing tariffs, such as Section 301 investigations, national security-related tariffs under Section 232, or temporary measures under Section 122 of the Trade Act. These alternatives are more targeted and often slower to implement, which I think could reduce near-term economic drag as businesses take advantage of the opening. But I also think it’s true that tariffs would ultimately remain part of the policy mix.

Overall, I think a drawn-out transition toward narrower, more deliberate trade actions could give businesses time to plan, adjust supply chains, and rebuild inventories—a meaningful difference from abrupt, sweeping tariff changes.

- Earnings Growth May Broaden Beyond a Narrow Group of Leaders

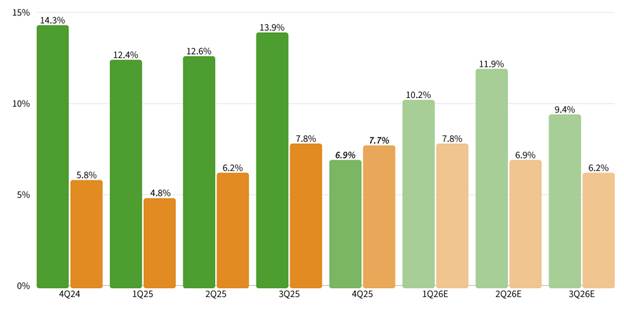

Finally, investors should watch how earnings leadership evolves. Technology has been driving overall earnings growth since Q3 2023, and according to our colleagues at Zacks Investment Research, the sector is still expected to be a major growth driver in Q4 2025 and full year 2026.

But we also think the earnings picture is poised to broaden.

Other sectors are projected to post stronger growth rates in 2026, contributing more meaningfully to overall profit expansion. As seen on the chart below, we’re expecting S&P 500 earnings to accelerate through the second quarter, even as Tech earnings decelerate (while remaining nominally strong).

This matters because durable market advances rarely depend on a single group of stocks. Broader earnings growth tends to support more resilient market leadership and reduces reliance on a narrow set of outcomes. Investors should keep an eye on sector-level earnings revisions and margins as the year progresses, looking broadly for opportunities.

Bottom Line for Investors

Early 2026 will be a critical period that could set the stage for the year, in my view. Investors will finally receive cleaner economic data, greater clarity on policy, and a better sense of where earnings growth is coming from. That doesn’t mean uncertainty disappears, as funding deadlines, policy transitions, and legal rulings still loom. But it does mean the inputs driving markets should become clearer.

The goal isn’t to predict every outcome. It’s to monitor the conditions that tend to drive them, i.e., watch the data, the policy landscape, and the breadth of earnings growth. These will matter more than any single headline as the year unfolds.

The more important question, then, is how these conditions translate across the market, and what they imply for positioning.

Our latest Stock Market Outlook Report4 evaluates how current economic and earnings trends are influencing market structure, highlighting where resilience is building and where concentration risks remain as 2026 approaches.

Inside the report, you’ll find:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your complimentary copy of the report and see how shifting market trends could influence opportunities in the months ahead.

IT’S FREE. Download our latest Stock Market Outlook Report4

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

3 Zacks. December 10, 2025. https://www.zacks.com/commentary/2802597/q4-earnings-tech-expected-to-remain-growth-driver

4 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.