While many are crying out to the markets, “bring out your dead”, this bull is letting us know “I’m not dead yet!” On March 9th, 2009, the current bull market was born – and it is still alive today. Indeed, March 9th 2016 marked this bulls 7th “birthday” making it one of the longest on record. During this time, the S&P 500 index rose by approximately 190% making this one of the biggest bulls on record.

The S&P 500 since March 9, 2009

Source: Federal Reserve Bank of St. Louis

This uptrend not only reflects America’s recovery from the Great Recession but also underscores the resilience of the most diverse economy in the world. It is often taken for granted, but during this expansion the economy has been dealt several set-backs that have been overcome: the U.S. fiscal cliff, fears of major bank failures, the Eurozone’s long sovereign debt crisis, fears that the Eurozone would cut Greece loose, China’s economic ‘crisis,’ a commodity price collapse and, most recently, fears of a British exit from the European Union.

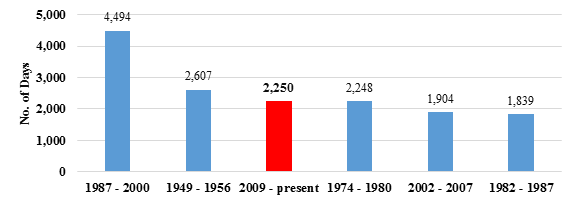

Despite some dark clouds hovering over the market for some time now, this has been the third longest market upswing in U.S. history and has replenished around $14 trillion back into the equities markets.

Bull Market by Length (current bull market is the 3rd longest in history)

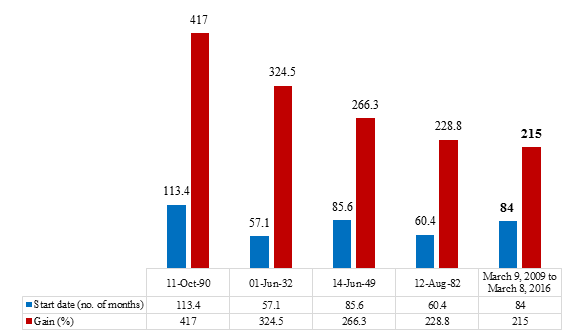

Bull Market by Percentage Gain (Red) and Length (Blue in # of Months)

Despite volatility in the market of late, the S&P 500’s 10 sectors have increased over the past 84 months. The NASDAQ stocks in IT companies, consumer, financial and industrial sectors grew by 284%, 400%, 250% and 250%, respectively. Medical and pharmaceutical companies have seen robust growth as well with values nearly tripling in aggregate.

Bottom Line for Investors

Given an eight year bull market, old by historic standards, it’s easy to understand why investors might be mentally preparing for this bull’s demise. But, bull markets don’t die of old age. They die when fundamentals collapse and growth ceases, two conditions we’re not seeing now. So, stay steady and keep an eye on the fundamentals as you consider your next investment moves.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.