It wasn’t even three months ago that the Fed seemed committed to “gradually raising rates” over time. But, when the Fed’s March minutes were released in April, Fed-watchers and investors almost unanimously concluded that the Fed would delay raising rates in their April 26-27 meetings. And, that’s precisely what happened—the Fed only managed a single rate hike before backing off. In a sign of the Fed turning dovish again, they decided to hold the federal funds rate unchanged at 0.25-0.50 percent range.

In the published minutes the Fed also quantified its projections of key economic variables—something that was missing in the January minutes. We took a closer look to get a better sense of the steering policy stances:

US and Global Situations

Even as other developed economies struggle with sluggishness, the Fed noted solid signs of strength from U.S. statistics during the inter-meeting period. Upward revisions to U.S. Q4 2015 GDP growth figures, and an increase in inflation rates in recent months, added to the optimism on domestic fundamentals. Additionally, the labor market was bolstered by solid gains in nonfarm payroll employment in January and February. This helped maintain the unemployment rate at an 8-year low of 4.9% along with average hourly wage hikes and an increase in the labor force participation rate.

However, a patchwork of weakness overseas continues to pose headwinds for U.S. exports, and contributed to a widening trade deficit through December and January. Additionally, business fixed investment was weak.

As for financial markets, although global woes did clobber U.S. equities in the beginning of the inter-meeting period, the volatility somewhat subsided around mid-February. Correspondingly, yields on 5- and 10-year Treasuries were initially compressed given investors’ aversion to risk, only to rise later.

Projections Warrant Caution Amid Hope

Overall, the Fed acknowledges strength in U.S. domestic fundamentals, but is also wary of global risks—something reflected in their median projections of key economic indicators:

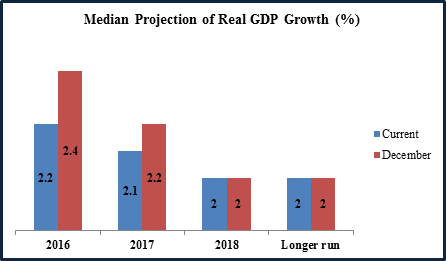

- Real GDP growth in the near term to exceed long-run estimate, but global factors pose risks

Bolstered by domestic factors, such as strengthening household spending, promising labor market conditions and lower energy costs, GDP is projected to grow at rates higher than the Treasury long-term rate of 2% over the next couple of years.

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

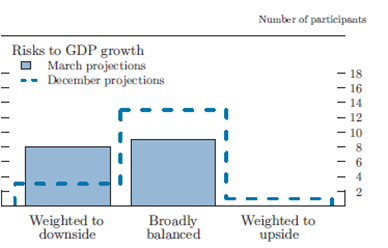

However, GDP has declined slightly from December’s projections, probably due to several participants’ apprehensions about global pressures in the near term. Even so, the majority still perceives risks as broadly balanced.

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

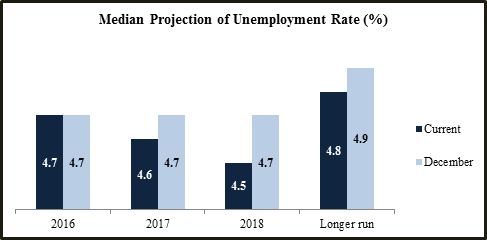

- Better-than-expected labor market, lower unemployment projections:

With job market conditions beating expectations, unemployment rate projections have been reduced slightly since the December meeting.

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

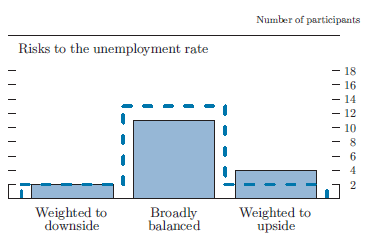

Most participants thought risks were broadly balanced. Only a slight upward shift in upside risk perception was noted this time compared to December, as global risks suppress their confidence a bit.

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

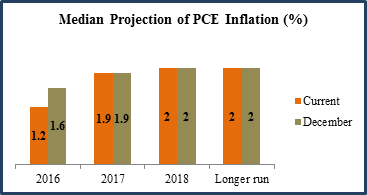

- Participants hold a cautious stance on inflation:

Despite increases in inflation rates over recent months, many participants were split about the trend’s sustainability in the near term since a substantial part of the increase resulted from previously volatile components. Also, lower energy prices, coupled with a strong greenback, could suppress prices this year. Hence, the median prediction for 2016 PCE (personal consumption expenditures) inflation is 1.2%, down from December’s projection of 1.6%. However, most participants expect inflation to converge toward the 2% target—albeit gradually—as they foresee global effects wearing-off slowly and the employment conditions firming along the way.

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

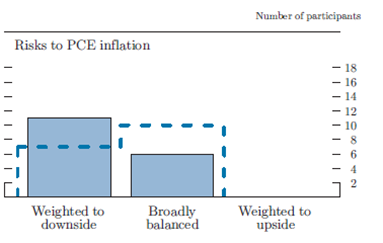

Most participants saw risks to inflation projections tilted to the downside, as some perceived unimpressive long-term inflation expectations data and others cited possible persistence of energy price declines.

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

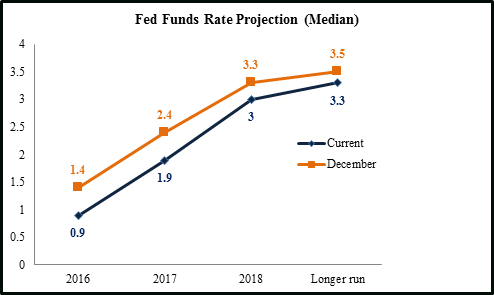

The Fed Emphasizes a “Wait-and-See” Approach

Although there was some dissent among participants regarding the appropriate pace of the Fed funds rate hikes, the committee consensus leaned toward a more accommodative stance at the April meeting. While the fed funds rate remained unchanged at the 0.25-0.50 percent range, further hikes are likely to facilitate inflation moving to the 2% level over time. Accordingly, the projected fed funds rate trajectory has shifted downward from December’s projections.

Source: Minutes of the Federal Open Market Committee, March 15–16, 2016

With the target set at 0.9 percent for 2016, we can expect only two rate hikes this year versus the previously expected four. With a more cautious approach to interest rate policy, the Fed has expressed that incoming domestic and global economic data will be crucial in guiding the timing and the pace of rate hikes.

Bottom Line for Investors

By adopting a “wait-and-see” approach, the Fed clearly demonstrated their sensitivity to market volatility and global economic conditions. At the same time, by not hurrying rate hikes, the central bank should assuage fears of increasing debt burdens, especially for U.S. sectors like energy and exports that already feel the pinch of global weakness. The economy and the stock market should have no problem absorbing a measured approach of rising rates over the course of 2016.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.