Gross Domestic Product measures the goods and services produced in an economy annually and is generally seen as an essential metric when measuring the stability and prosperity of a country. With that, America’s low GDP growth has sparked worries. But, we may be ignoring facts which lend a less gloomy picture.

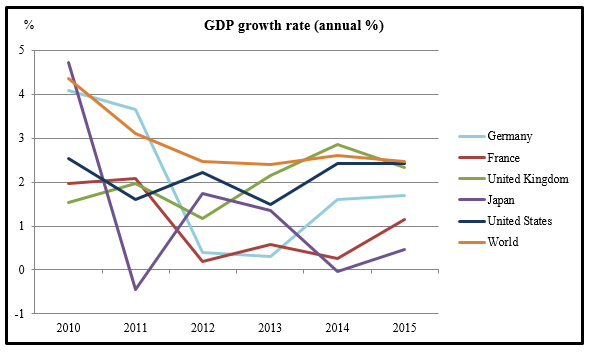

U.S. GDP annual growth rate in the 50-plus years up till 2008 averaged +3.5%. This dropped to +2.1% over the last six years. Nevertheless, it’s still in the positive territory, having bounced back quite nicely after the Great Recession. And, the growth rate as of 2015 is higher than rates of the advanced economies of the U.K., Japan, France and Germany.

Data Source: World Bank

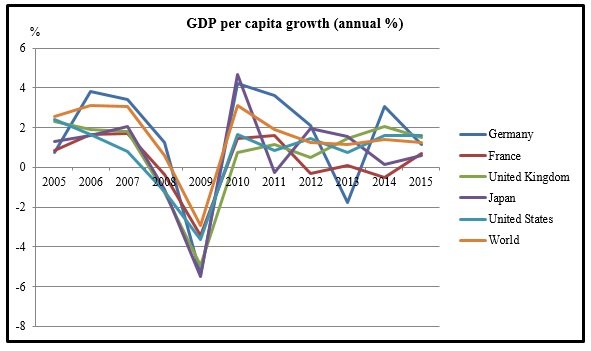

Moreover, an advanced/developed economy that ranks amongst the largest in the world can grow only so much after a certain point. For such economies, what matters more for the long-term is how the wealth is allocated. America’s median income as of 2014 was 4% less than that in 2000, notwithstanding positive economic growth (barring two years) during the period. Also, there are still around 43 million people living in poverty in the country (According to The Atlantic). This indicates distributional issues in the U.S. But we see progress as the nation has managed to edge past France, Germany, U.K., Japan and the world, in terms of per capita GDP growth in 2015 (According to World Bank).

Data Source: World Bank

Also, GDP’s position as the yardstick of economic growth may be debatable. It’s a volume-centric metric, and therefore, could underestimate the quality of output. That could be a hurdle in assessing developed nations’ performance, since their GDP volumes already rank among the largest in the world and therefore, it is factors like quality and functionality of products that determine these economies’ progress on the global platform.

Some instances that show how GDP may not be sufficient to gauge an economy’s growth/potential:

- The wealth of information available to us instantly from websites like Google, Facebook and Twitter, can’t be fully appreciated by the mere internet connection charges.

- A smartphone, with its increasing multi-functionality, has replaced the need for a lot of gadgets including watches, calculators, traditional pay-TV subscriptions and even PCs for many consumers. But the declining trend in so many goods would be counted as deductions from GDP, without fully accounting for the efficiencies resulting from the substitution of so many products by a single device.

- Furthermore, the burgeoning platter of items (including video streaming of TV shows, movies, etc.) available for mobile viewing could be an added convenience for many people, contributing to their well-being – something that GDP may not be able to quantify.

- That’s also the case with services bearing no price tag. A 2012 study by the Bureau of Economic Analysis estimated that including value of non-market household production raised U.S. nominal GDP by 26% in 2010. These “unaccounted” items may include household chores, family members tendering care to elderly/sick relatives, pro-bono work and even free use of parks and bridges.

Bottom Line for Investors

Although global weakness does pose concerns for America’s income growth, the nation’s far from stagnation. The economy’s sturdy domestic fundamentals against external turmoil reaffirm its resilience. Moreover, as pointed out earlier, GDP is not a perfect reflection of an economy’s potential, especially an advanced one. Until we have a parameter that can account for more aspects of prosperity and well-being, speculations about America’s slowing progress could be far-fetched.

To get a deeper look into additional factors that are currently affecting the state of the economy, check out our just-released Stock Market Outlook report. This report offers critical predictions and a great deal more that can give you a significant leg-up over other investors. Download our Stock Market outlook report today by clicking on the link below:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.