The signs are everywhere – inflation is on the move. The economy has been humming on the heels of the tax cut, labor markets are tight, and the consumer remains optimistic. I think these factors, combined with pricing pressures from wages and tariffs, are all contributing to the firming inflation we’ve been seeing – and may continue to see going forward.

The numbers bear it out. Corporations from every corner of the U.S. economy are raising prices on a range of goods from paint to plane tickets to Jimmy John’s sandwiches (+6% for a turkey sandwich) and Starbuck’s coffee (+8.9% for a “Grande”). Apple Inc. recently increased prices on their new MacBook Air and iPad Pro gadgets by about 20% and 25%, respectively.

In Q3 earnings reports, airlines reported paying about 40% more for jet fuel versus a year ago, and trucking companies saw a stout 7% jump in September from costs a year ago. In the private sector at large, the Labor Department reported a 3.1% increase in wages and salaries in the quarter ending September 30th. U.S. manufacturers reported paying roughly 8% more for aluminum and 38% more for steel than a year ago, a majority of which can be attributed to tariffs.1 Companies ranging from JetBlue, to Chipotle, to Unilever, to Procter & Gamble and UPS have all indicated plans to raise prices in the future.2

All told, I could see core U.S. inflation rising to a post-recession high sometime next year, which could mean approaching the 4% level within twelve months.

_______________________________________________________________________________________________

2019 is Almost Here! Are You Prepared?

As a service to Mitch on the Markets readers, Zacks’ updated our Stock Market Outlook and is available today absolutely free!

This 22-page report is packed with key forecasts and facts to consider a:

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- What produces U.S. optimism on the coming year?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the December 2018 Stock Market Outlook Now3 >>

______________________________________________________________________________________________

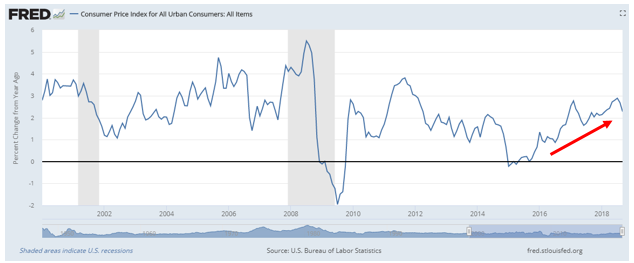

Figure 1. Inflation has been Steadily Increasing Since 2015

Source: Federal Reserve Bank of St. Louis

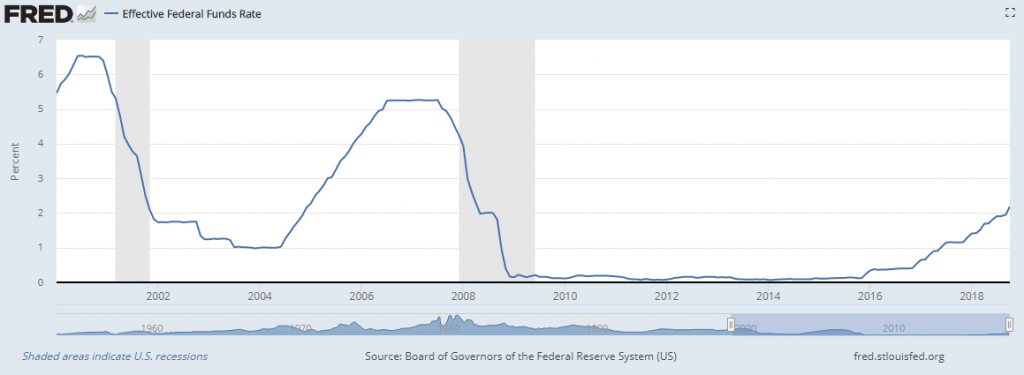

Inflation by itself is not necessarily a recession indicator. It’s what comes with – and after – inflation that can hurt the economy. Most readers will probably know what I’m referring to: rising interest rates. By comparing the chart below to the chart above, you can see how rising inflation has spurred rising interest rates at the Federal Reserve, which has peaked before recessions in the past.

Figure 2. The Effective Federal Funds Rate, Set by the Federal Reserve

Source: Federal Reserve Bank of St. Louis

Much like inflation, rising interest rates alone do not necessarily cause recessions. But rising rates can lead to adjustments in consumer habits and business investment, which combined can be a drag on economic activity. Borrowing becomes more expensive for consumers, housing activity tends to soften, spending slows, and businesses become more reluctant to borrow and invest.

But perhaps most importantly, higher interest rates give investors another option in the search for yield. In the era of near zero interest rates that followed the Great Recession, investors were arguably left with little choice in their search for yield and capital appreciation. Bonds were of little use, and investors turned to equities instead. As that trend perhaps unwinds with rising interest rates, we could see less enthusiasm for equities in a world of higher rates.

Is It Time to Get Bearish?

Using the Consumer Price Index for all Urban Consumers (CPI) as the metric for inflation, we note that the September year-over-year reading came in at 2.3%, according to the Bureau of Labor Statistics.4 At the end of October, the yield on the 10-year US Treasury was 3.15%.5 The napkin math tells us that puts the inflation-adjusted yield at a meager 0.85%, which is far from a desirable return.

In the 20-year period preceding the financial crisis and the 2007-09 recession, the 10-year Treasury bond yield and the CPI averaged 6.1% and 3.1%, respectively, which gave investors an average inflation-adjusted yield of around 3% over that time.6 In short, I expect the 10-year Treasury to keep going up and for the inflation-adjusted yield to keep rising with it, but I don’t necessarily expect investors to ditch stocks and head for Treasuries right away.

Bottom Line for Investors

Many of the narratives surrounding rising inflation and rising interest rates tend to overly frame these two factors as imminently bearish, or at least right around the corner from being bearish. But I tend to think a bit differently about the issue, and consider the Federal Reserve’s tightening regime as largely squared with economic growth and inflation trends. In other words, for the time being, I think there’s a good balance between what’s happening with interest rates, inflation, and growth.

The caveat, however, is to make sure you’re staying on the right course. At Zacks Investment Management, we can help with that, and for starters I invite you to download our Just-Released Stock Market Outlook Report >>

This Special Report is packed with newly revised predictions. For example, you’ll discover Zacks’ view on:

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- What produces U.S. optimism on the coming year?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest, get your portfolio better prepared for 2019 by reading this new report today.

Disclosure

2 The Wall Street Journal, October 26, 2018. https://www.wsj.com/articles/are-companies-price-increases-painting-them-into-a-corner-1540566598?mod=article_inline

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

4 Bureau of Labor Statistics, November 6, 2018, https://www.bls.gov/cpi/

5 U.S. Department of The Treasury, November 6, 2018, https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldYear&year=2018

6 The Wall Street Journal. October 3, 2018. https://www.wsj.com/articles/a-looming-recession-look-at-interest-rates-1538603219

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.