The broad outlook for U.S. corporate earnings is getting weaker, seemingly by the day.

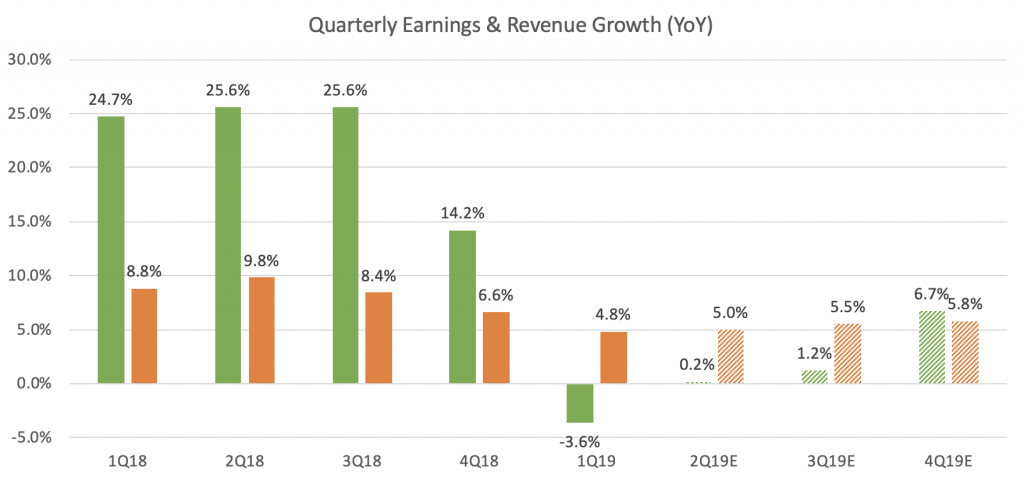

For Q1 2019, total S&P 500 earnings are expected to decline -3.6% from the same period last year, though on +4.8% higher revenues. Growth is expected to be negative for 9 of the 16 Zacks sectors, with Technology and Energy as the biggest drags. All that said, we could be looking at the first earnings decline since the second quarter of 2016.

Technology sector earnings are expected to decline -10% from the same period last year on +3% higher revenues, with the semiconductor space potentially serving as the biggest drag. But even if we remove tech’s impact on total S&P 500 earnings for the quarter, we would still get a negative reading by our estimates: down -1.5% from a year ago.1

——————————————————————

Focus on Quality with Our Stock Market Outlook Report!

Let’s face it – this bull market is old. And this means investors need to consider how to posture portfolios for a late cycle, mature bull market. In my opinion, that means shifting your portfolio management mindset to focus on quality and reliable earnings.

Where should you look to find this quality? Our just-released Stock Market Outlook report can help you

keep an eye on key economic indicators to help you focus on quality and base

your investments on hard data.

This 22-page report contains some of our key forecasts to consider such as:

- Will 2019 stay bullish or is a bear around the corner?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released Stock Market Outlook2 >>

——————————————————————

As you can see from the chart below detailing quarterly earnings and revenue growth, there’s a stark contrast from last year’s performance to this year’s expected result:

The Sugar Rush of the Tax Cut May be Fading Fast

Indeed, for full-year 2019, total earnings for the S&P 500 index are expected to be up a paltry +2.5% on +4% higher revenues, which is obviously a far cry from the robust +23.3% earnings growth on +8.8% higher revenues we saw in 2018.3

In short, the immediate impact of the tax cut was significant and the growth created was substantial, but the momentum may be fading just as fast. The challenge for investors will be to find companies that continue generating solid profits even as wage pressures rise, credit markets tighten, tariffs weigh, and broad GDP growth levels off.

One place to look may be in the “Value” category or within defensive categories, like Staples and Utilities. Over the course of this entire bull market, growth stocks (like FAANG) have far outpaced value stocks (think blue chips). If one compares the Russell 3000 Value Index to the Russell 3000 Growth Index, this outperformance is plain to see.4

Which brings up a valid argument – is it possible that Value is poised to outperform Growth looking ahead, in a period when economic growth is expected to be modest and interest rates are expected to be higher? I think it’s a distinct possibility in the medium term, and perhaps a strong possibility in the short term. If uncertainty about the growth outlook grows with time, and as corporations reduce earnings expectations, investors may pivot to favoring companies with reliable earnings. And those companies, generally speaking, often reside in the Value and defensive categories.

Bottom Line for Investors

The very strong growth we experienced in 2018 was primarily because of the tax cut legislation, in my view. The pure arithmetic of the lower corporate tax rate represented a one-time boost to corporate bottom lines, which will be part of base comparisons for this year – and will also serve to make earnings in 2019 look weak by comparison. On top of this comparability issue is the impact of slowing economic growth, particularly beyond U.S. shores.5

What’s more, these low growth expectations for the coming quarters still remain vulnerable to further downward revisions, which would only serve to increase uncertainty. In uncertain times, investors may be best served looking for reliable earnings.

To help you get a closer look into earnings and more, I am offering all readers our Just-Released April 2019 Stock Market Outlook Report.

This Special Report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Will 2019 stay bullish?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today! 6

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Zacks.com, March 20, 2019. https://www.zacks.com/commentary/362428/weak-earnings-growth-ahead

4 Real Clear Markets, December 7, 2018. https://www.realclearmarkets.com/articles/2018/12/07/amid_stock-market_corrections_the_boring_becomes_beautiful_103525.html

5 Zacks.com, March 20, 2019. https://www.zacks.com/commentary/362428/weak-earnings-growth-ahead

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.