The Heartbeat of the Stock Market: Earnings

There are a myriad of factors influencing market movements right now: trade issues with China, the Federal Reserve’s new approach to monetary policy, Brexit uncertainties, new appointments to the Fed, and so on down the line. But I would argue that no factor contributes more to the long-term direction of domestic stock prices than U.S. corporate earnings.

Q1 2019 earnings are hitting the tape daily, so this week I’ll give readers a synopsis of what we know to date and what I think we can expect looking ahead.

As of the end of last week (April 18), 77 S&P 500 members had reported earnings results, and the numbers were far from inspiring: +0.2% earnings growth on +2.5% higher revenues. The same 77 companies grew earnings +13.9% on +5.4% in the previous quarter, creating a contrast that easily has raised some eyebrows.1

As I’ve stated before, I believe the key in terms of the market’s movement relative to economic and earnings data is not necessarily whether the outlook is positive or negative, but rather, whether the earnings expectations already being priced into the market are met or exceeded.

_______________________________________________________________________

Time to Focus on Fundamentals!

Now more than ever, I think it is best to stick to hard data and keep an eye on economic indicators as opposed to making emotional, knee-jerk reactions. To help you do this, we are offering all readers a first look into our just-released May 2019 Stock Market Outlook report.

This report gives you our forecasts along with additional factors to consider:

- Will the bullish market continue…and for how long?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors should you focus on?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- …And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released Stock Market Outlook2

_______________________________________________________________________

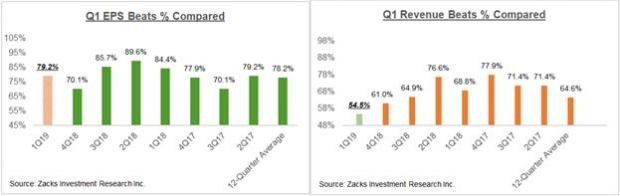

Thinking within this framework, the earnings results so far in Q1 don’t look so bad. Of the 77 reporting companies, 79.2% have beaten earnings-per-share (EPS) estimates and 54.5% have beaten revenue estimates. The comparison charts below put this performance in historical context for these 77 index members. As you can see, EPS beats are nicely in-line with averages, while revenues are a bit on the low side.3

Driving the expected Q1 earnings decline are broad-based margin pressures across all major sectors, with net margins for companies in the S&P 500 sitting at 11.1%, down from 12% a year earlier and 11.8% in the preceding quarter. The Utilities sector is the only sector expected to have unchanged net margins in Q1 2019 relative to the year-earlier period, with margins expected to be lower for all of the remaining 15 sectors.

Looking at Q1 as a whole, combining the actual results that have come out from the 77 S&P 500 members with estimates for the still-to-come companies, total earnings for the quarter are expected to be down -3.2% from the same period last year on +4.6% higher revenues. If actual 2019 Q1 earnings growth turns out to be negative, it will be the first earnings decline since the second quarter of 2016.4

The market appears to be looking at this growth picture as a function of tough comparisons following the tax-cut boost to corporate profitability in 2018 – which is also arguably why we haven’t seen much market response to the weak earnings picture. This view is paired with one where growth ramps up in the second half of the year and accelerates into next year, with full-year 2020 earnings growth for the index expected to reach double digits following tepid +2% expected growth in 2019.

The counter narrative is that we have reached the end of the economic cycle when growth inevitably turns south. Macroeconomic data doesn’t support this narrative currently, and while I acknowledge the weakness in Europe, the outlook for the U.S. economy continues to be positive, with growth modestly below the preceding year’s level – but still very stable. Other key regions of the world, particularly China, are also showing signs of ‘green shoots.’

Bottom Line for Investors

Expectations for Q2 2019 and the following quarters will evolve as companies report Q1 results and provide commentary about ground-level business conditions. We will be keeping a close eye on this revisions trend. Looking ahead, total Q2 earnings for the S&P 500 index are expected to be down -0.3% from the same period last year on +4.9% higher revenues,5 which seems like bad news – but when one notes that the pace and magnitude of negative revisions to Q2 estimates are lower than what we had been seeing at the comparable period in the preceding quarters, it’s not so bad after all. Again, the central question for investors should consistently be: What are the earnings expectations versus the earnings realities?

To help you get the answer to this question and many more, we are offering all readers a first-look into our just-released Stock Market Outlook report.

This report will provide you with our forecasts along with additional factors to consider:

- Will the bullish market continue…and for how long?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors should you focus on?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- …And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!6

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Zacks.com, April 18, 2019. https://www.zacks.com/commentary/388664/3-trends-emerging-from-the-q1-earnings-season

4 Zacks.com, April 18, 2019. https://www.zacks.com/commentary/388664/3-trends-emerging-from-the-q1-earnings-season

5 Zacks.com, April 18, 2019. https://www.zacks.com/commentary/388664/3-trends-emerging-from-the-q1-earnings-season

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.