What a difference six months can make.

In December of 2018, the Federal Reserve made a slight adjustment to its rate forecast for 2019 – it was planning to raise rates only two times in 2019 instead of three. The language in the December 2018 Fed statement still called for “gradual” rate hikes, however, and they were careful to reiterate that the U.S. economy was growing at a strong rate.1

Fast forward six months to July 2019, and we have broad-based consensus that the Federal Reserve is going to actually cutrates during their July 30-31 meeting. The debate is no longer about whether the Fed will cut rates this year – it is now about how much and how often they will loosen monetary policy in 2019.

__________________________________________________________________________

Could the Fed’s Actions Lead to a Volatile Market or Sharp Correction?

How do you prepare for the possibility of volatility or a correction? In my view, it is essential not to let your emotions get the best of you and instead to keep an eye on key economic indicators like inflation, trade and the yield curve. To help you do this, we are offering all readers a first-look into our just-released July 2019 Stock Market Outlook report.

This report will provide you with our forecasts along with additional factors to consider:

- For how long will 2019 stay bullish?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released July 2019 Stock Market Outlook2

________________________________________________________________________

So how did we get here?

Federal Reserve Chairman Jerome Powell cited growing uncertainties in the global economy, which arguably was in reference to downstream impact of the ongoing trade dispute between the United States and China. The trade impasse, coupled with an economic expansion now in its 10th year, have resulted in slow deterioration in business sentiment and global decline in manufacturing PMIs – a leading indicator. Even though in my view the base case for U.S. and global economic growth remains 2% or more for 2019, the Fed appears poised to act proactively to protect against downside risks.

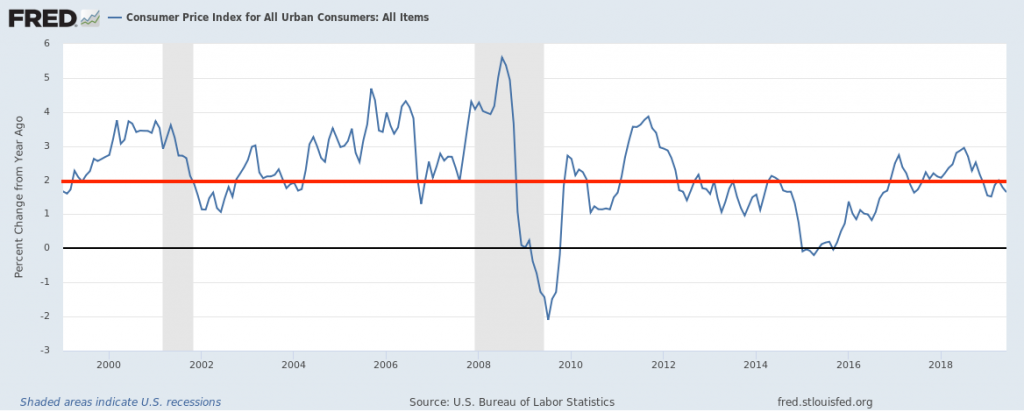

Then there’s the issue of inflation. Mr. Powell noted this week that there was once a time when central bankers were primarily concerned with too much inflation in the economy. Today, the challenge is just the opposite – not enough inflation even as the unemployment rate hovers below 4%.3 As you can see on the chart below, before the 2008 Financial Crisis inflation would regularly run higher (above the red line) than the target 2%. But since the Financial Crisis, from 2009 to today, inflation has struggled to sustain above 2%.

Inflation Has Struggled Over the Last Decade to Remain Above 2% (red line)

Source: Federal Reserve Bank of St. Louis4

It is debatable whether lowering rates now would provide any trigger for inflation, as I would argue that lower rates probably won’t lead to wage pressures and definitely won’t lead to growth in M2 money supply. Instead, lowering rates now seems to be a move designed to sustain an expansion that is dying of natural causes, in my view. Business cycles have historically always come to an end.

The stock market offers a different narrative as it relates to rate cuts. In December of last year, the S&P 500 had touched bear market territory just days before Mr. Powell made his announcement to be “patient” in the Fed’s monetary policy approach. Almost to the day that the Fed changed their stance, the market started to rally and is up over 20% year-to-date (as I write). In my view, there is no denying that the market’s current rally is tied to the Fed’s actions.

Bottom Line for Investors

What I believe we’re left with now is a heightened possibility of a negative surprise. What if the Fed does not lower interest rates at the July meeting? What if the Fed only chooses to lower rates once in 2019? Will the market be disappointed, volatile, and possibly enter another sharp correction? I believe so.

I think the Federal Reserve has effectively painted themselves into a corner where anything less than two rate cuts in 2019 will result in a ‘tantrum’ in the equity markets. Strong earnings reports could neutralize the impact of not lowering rates two times or more, but I strongly believe now that the stock market’s fate in 2019 is wound up in Fed policy.

Now the question remains, how do you prepare for the possibility of volatility or a correction? In my view, it is essential to keep an eye on key economic indicators like inflation, trade and the yield curve. To help you do this, we are offering all readers a first-look into our just-released July 2019 Stock Market Outlook report.

This report will provide you with our forecasts along with additional factors to consider:

- Inside the China tariff war

- Why are Zacks strategists (including me) staying bullish?

- Stock market returns expectations for 2019

- Small-cap and large-cap outlook in 2019

- What of cuts in global growth?

- What produces 2019 Optimism?

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 The Wall Street Journal, July 16, 2019. https://www.wsj.com/articles/powell-says-fed-must-pay-greater-attention-to-global-developments-11563296473?mod=hp_lista_pos5

4 Federal Reserve Bank of St. Louis, July 11, 2019. https://fred.stlouisfed.org/series/CPIAUCNS#0

5 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.