With all the recent talk on weak manufacturing numbers, endless trade wars, and the impeachment inquiry, few commentators have pointed out that we may be in the midst of a technical earnings recession. And given the high value we place on corporate earnings here at Zacks Investment Management, this is a factor we’re most certainly monitoring closely.

The background: As I write, we now have Q3 results from 74 S&P 500 members, which account for about 20% of the index’s total market capitalization. So far, the results are mixed – total earnings (aggregate net income) for these 74 companies are down -3% from the same period last year on +3.2% higher revenues. When we combine the results from these 74 companies with our estimates for the yet-to-report companies, total earnings are expected to be down -4% from the same period last year on +4.1% higher revenues.1

In the second quarter, the blended earnings decline for the S&P 500 was -0.4%, which was about the same as the decline in Q1. Put this all together, and that’s where the earnings recession narrative comes from.

It may feel to many readers like the odds are stacked against this bull market, and an earnings recession may be one more reason to err on the side of caution. But before changing your mind – and potentially your asset allocation – consider a few silver linings in the earnings story.

More…

—————————————————————-

Stay Steady & Focus on Fundamentals!

Before I dive deeper into the earnings story, I want to

point out how important it is to keep an eye on economic indicators as opposed

to making emotional, knee-jerk reactions. This can be difficult to do,

especially in the midst of so many negative news stories and fear of a recession.

So, to potentially help you do this, we are offering all readers a look into

our just-released November 2019 Stock Market Outlook report.

This 22-page report contains some of our key forecasts to consider:

- What produces U.S. optimism in 2019?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- Which sectors are hot and which are not?

- What industries within those sectors most merit your attention?

- Odds of recession

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released November 2019 Stock Market Outlook2 >>

——————————————————————

Let’s start with the second quarter. The blended earnings rate for the S&P 500 was indeed -0.4% from the previous year, but 75% of all companies reported a positive earnings-per-share (EPS) surprise and 56% of companies reported a positive revenue surprise. The 5-year average of companies beating earnings expectations is 72%, so even with negative year-over-year EPS growth the 75% beat rate is ultimately a positive result.1

Fast forward to Q3, and we’re seeing a similar trend forming. So far, 83.3% of reporting S&P 500 companies have beaten EPS estimates and 59.5% have reported beating revenue estimates. Assuming this trend largely holds, we could see another quarter where more companies are beating earnings expectations than normal. And that’s a good thing.

There is another factor in play, too, that I believe investors should bear in mind. S&P 500 companies are facing an uphill battle for earnings growth, considering the tough comparisons to last year when growth was boosted by the tax cut legislation. We expected this to weigh on earnings growth in 2019, and many corporations warned that this would be the case. I think that’s one of the reasons why we’re seeing strong performance from the S&P 500 this year, even as year-over-year earnings come in slightly negative.

The sector with some of the toughest comparisons is Tech. The Tech sector is the biggest earnings contributor in the S&P 500 index, bringing in 22.9% of the index’s total earnings in the forward four-quarter period. It follows that weak earnings in tech can be a major drag to total S&P 500 earnings. If we are excluding the tech sector’s drag, the estimated total earnings growth for the remainder of the index would be down only -1.8% (-4% with tech included).

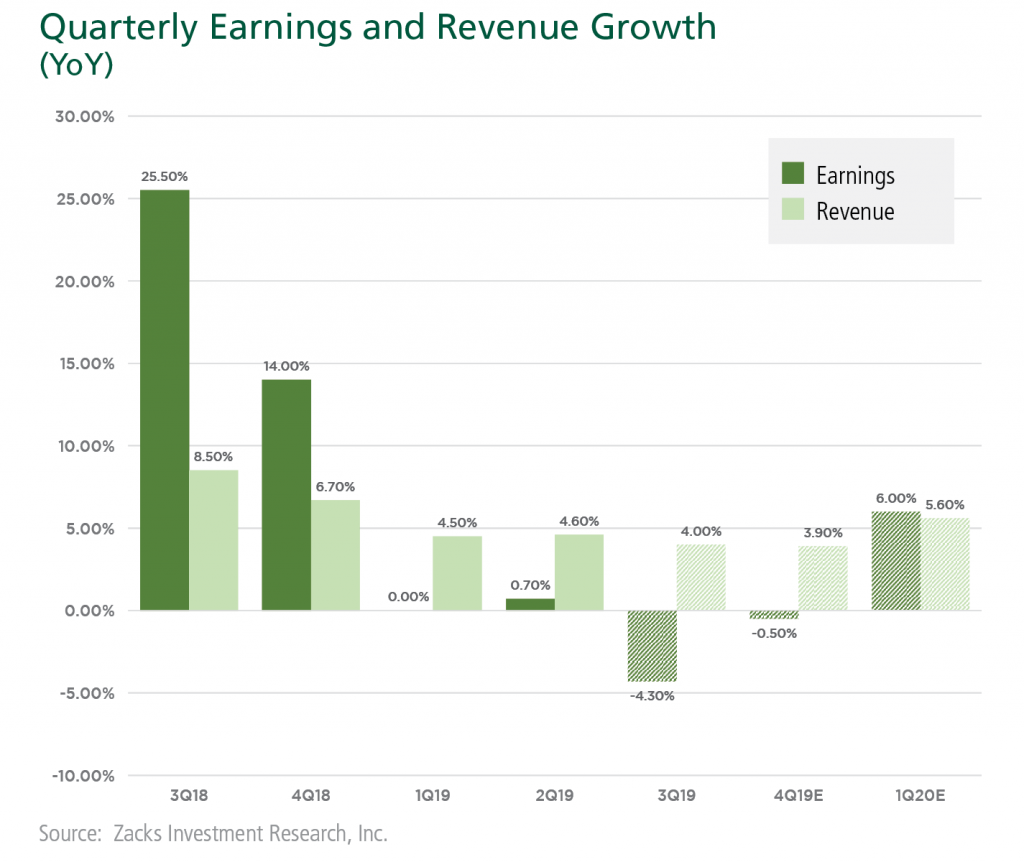

As we drift further from the effect of the tax cut, we expect the year-over-year comparisons to normalize a bit with earnings growth coming back into the positive in the quarters ahead:

Source: Zacks.com1

Bottom Line for Investors

Moderating U.S. economic growth and notable slowdowns in other major global economic regions are certainly a factor in the S&P 500 year-over-year earnings declines. Uncertainty about the global trade regime and increasingly protectionist policies are not helping matters either. But investors should consider that S&P 500 companies are currently facing very tough comparisons from last year, and even still, more companies than average are reporting better-than-expected results. As we drift away from the tough comparisons and maybe – just maybe – get some clarity on trade, I think the earnings picture will improve and return to positive year-over-year growth.

In the meantime, one way to stay focused on the long-term, and not get swept up in short-term emotional reactions, is to focus more on the fundamentals than day-to-day price movements. To help you do this, I invite you to download our Just-Released November 2019 Stock Market Outlook Report.

This Special Report is packed with our newly revised predictions for 2019. For example, you’ll discover Zacks’ view on:

- Should you stay bullish?

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- What produces U.S. optimism in the coming year?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest, learn how you may be able to prepare your portfolio for changes in the economy by reading this new report today.3

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.