A few weeks ago, I wrote in a Mitch on the Markets column that I’d been observing a notable rotation in the equity markets. I saw a significant shift away from cyclical sectors and towards defensive sectors. I noted in the column that in Q3 2019, the traditionally defensive Utilities and Consumer Staples sectors had been outperforming Information Technology by a ratio of at least 2-to-1, and that there were nearly 2.5 times the amount of put options on the S&P 500 Index as there were call options.

It was clearly a signal, in my view, that investors were worried about economic and equity market performance going forward, and that they were hedging against downside risk as a result.

My conclusion in that column was that investors were overpaying for this defensive posture. I believed better-than-expected economic news could drive mean reversion in the equity markets, with cyclicals outperforming. That’s what we’ve seen so far in Q4.

——————————————————————

Keep Your Eye on the Long-Term with Our Just-Released Report!

I suggest avoiding the urge to get caught up in day-to-day

movements, and instead focus on economic data releases, earnings reports, and

other economic factors! To help you do this, I am offering all readers a first

look into our just-released December

2019 Stock Market Outlook report.

This 22-page report contains some of our key forecasts to consider in 2019:

- Stock market returns expectations for 2019 and 2020?

- Forecast for the S&P

- What of slowing foreign growth?

- Can the U.S. stock market rally stick?

- Which sectors are hot and which are not?

- What industries within those sectors most merit your attention?

- Odds of recession

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released December 2019 Stock Market Outlook1

——————————————————————

Over the last month, cyclical sectors like Financials, Industrials, Information Technology, and Materials have outperformed while non-cyclical, defensive sectors like Utilities and Consumer Staples have sagged. Here is a snapshot look at performance over the last month2 for these sectors:3

- Financials: +8.79%

- Industrials: +8.41%

- Information Technology: +7.36%

- Materials: +7.33%

- S&P 500: +5.23%

- Consumer Staples: -0.15%

- Utilities: -4.25%

It’s clear to see that the sectors generally labeled as defensive have gotten beaten up during the current market rally. In my view, this divergence of performance marks a clear pendulum swing back into riskier categories, which one might classify as the market environment being “risk-on” again.

There is other evidence to support this shift in investor sentiment. Two exchange-traded funds (ETFs) that brand themselves as “low volatility” – the Invesco S&P 500 Low Volatility ETF and iShares Edge MSCI Min Vol USA ETF – have experienced large outflows in November and have underperformed the S&P 500 this month. Investors seem to be fleeing the defensive, worried-about-recession trades in favor of higher risk/reward categories like cyclicals.4

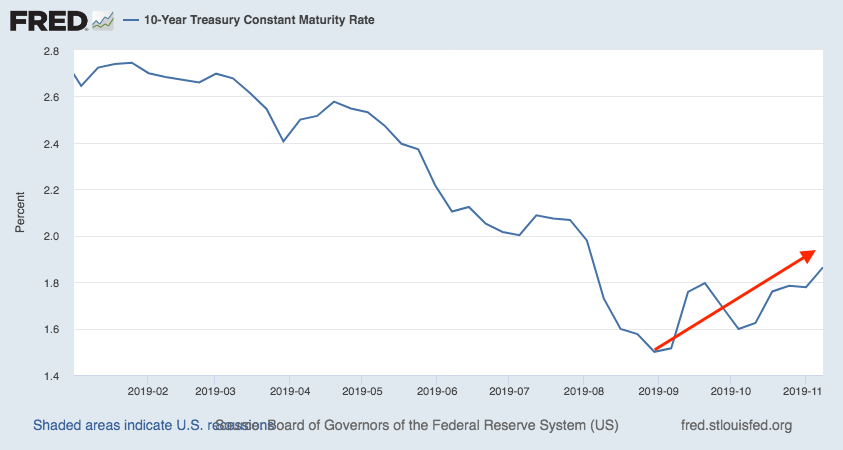

The bond markets are also reflecting this potential “risk-on” shift. Over the past couple of months, the 10-year Treasury yield has rebounded to its highest level since July, which is a signal that investors have been selling bonds. As you can see in the chart below, the uptick in bond yields has corresponded fairly tightly with the Q4 market rally, which I’d take as further evidence of a rotation.

10-Year Treasury Bond Yields Have Risen Over the Past Couple of Months

Source: Federal Reserve Bank of St. Louis5

To be fair, these are all short-term moves. As a long-term oriented investor, I do not put a whole lot of stock in month-to-month or even quarter-to-quarter changes in prices across sectors and asset classes. But it is interesting to note that the prevailing recession sentiment (and the corresponding ‘wall of worry’) has seemingly been replaced with renewed optimism for stocks and growth in the US economy.

So, what’s changed? In my view, pretty much nothing at all! The media narrative on trade has changed slightly, as hopes of “Phase 1” of a trade deal between the U.S. and China may include the reduction or elimination of some tariffs between the world’s two largest economies. Time will tell.

The other, less frequently cited reason for renewed optimism and support for stock prices comes in the form of better-than-expected earnings results from Q3, in my view. To me, this offers a better explanation for why stocks have performed well recently. Total earnings (or aggregate net income) for the 469 S&P 500 companies that have reported results as of November 20 are down -1.2% (year-over-year) on +4.3% higher revenues, but a stout 72.7% of them beat EPS estimates and 57.6% beat revenue estimates.6 The takeaway: American corporations have not fared as badly as many expected.

Bottom Line for Investors

Much of this week’s column has focused on short-term price movements in the equity markets. Regular readers of my column know that I, and by extension Zacks Investment Management, place far greater importance on longer-term trends and the value of investing in stocks for 10, 20, and 30 years – not 10, 20, and 30 days or months.

Short-term shifts in investor sentiment are interesting to observe, but I hope that readers can see the folly in attempting to toggle back and forth from “risk-on” to “risk-off.” Doing so increases the risk of mistiming the markets, and in my view, will almost certainly compromise one’s ability to generate attractive long-term returns.

My recommendation: Avoid the urge to get caught up in day-to-day movements, and instead focus on economic data releases, earnings reports, and other economic factors! To help you do this, I invite you to download our Just-Released December 2019 Stock Market Outlook Report.

This Special Report is packed with newly revised predictions for the remainder of 2019 and 2020 that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Stock market returns expectations for 2019 and 2020?

- Forecast for the S&P

- What of slowing foreign growth?

- Can the U.S. stock market rally stick?

- Which sectors are hot and which are not?

- What industries within those sectors most merit your attention?

- Odds of recession

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!7

Disclosure

2 Fidelity, November 14, 2019. https://eresearch.fidelity.com/eresearch/markets_sectors/sectors/sectors_in_market.jhtml

3 Performance by sector from October 13, 2019 – November 13, 2019

4 The Wall Street Journal, November 11, 2019. https://www.wsj.com/articles/november-rally-weighs-on-low-volatility-funds-11573493124

5 Board of Governors of the Federal Reserve System (US), 10-Year Treasury Constant Maturity Rate [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, November 14, 2019.

6 Zacks.com, November 20, 2019. https://www.zacks.com/commentary/629846/weak-retail-sector-earnings

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.