In my weekly columns, I frequently point out that widely-known information does not have much pricing power in the equity markets. If you read a story in the newspaper or hear it on the news, you can rest assured that this information is not very valuable to future price movements. It’s already baked into stock prices, in my view.

That’s why when making forward-looking forecasts, it’s important to look where few other people are looking. What are the possible ‘surprises’ – positive or negative – that could move markets?

Below, I take a look at four potential market surprises for 2020. These are four events I believe have a low probability of actually occurring as described. But the probability is still non-zero, and it’s worth exploring these scenarios so we’ll know how to respond if they do, indeed, come to fruition.

______________________________________________________________________________

Focus on Key Economic Indicators

Before I dive into these market surprises, I want to emphasize the importance of avoiding the urge to get caught up in day-to-day movements, and instead focus on economic data releases, earnings reports, and other economic factors!

To help you do this, we are offering all readers a look into our just-released January 2020 Stock Market Outlook report.

This report will provide you with our forecasts along with additional factors to consider:

- Should you stay bullish?

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- What produces U.S. optimism in the coming year?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released January 2020 Stock Market Outlook1

______________________________________________________________________________

Market Surprise #1: Stagflation

I think there’s a very low probability that we have runaway inflation next year or anytime soon. But the Fed’s accommodative stance – and seeming return to bond purchases (QE) – could result in higher inflation and inflation expectations, which could drive longer-term interest rates up. This scenario could inspire the Fed to raise rates, too.

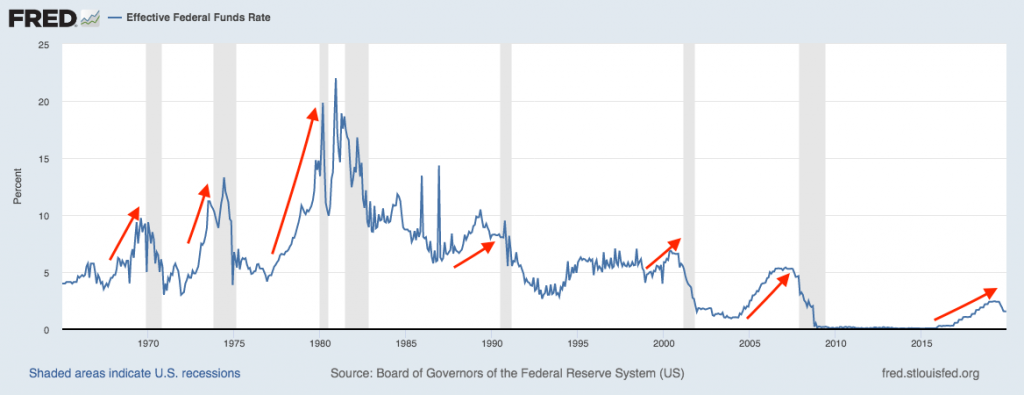

A negative surprise, in this case, would be if interest rates start going up while corporate earnings start going down. Throughout history, market losses have occurred when such dynamics (rising rates, falling earnings) are present. It’s more-or-less a perfect storm for equity markets. In the chart below, you can see the effective fed funds rate over the last 50+ years, and it’s easy to see that rising rates have preceded recessions almost every time.

Recessions Have Generally Followed Periods of Rising Rates

Source: Federal Reserve Bank of St. Louis2

Market Surprise #2: Geopolitical Strife

What if the trade war escalates to the point that it results in actual war? Or, in a less dramatic but still consequential outcome, a Cold War with China? It is not unfathomable, in my view, to see this trade war with China extending throughout 2020 and resulting in the two sides drifting further and further apart. Considering conflict in the South China Sea, the U.S.’s recent show of support for Hong Kong, and President Trump’s willingness to raise tariffs further, it’s not difficult to envision a scenario where economic cooperation is further severed. The ripples through the global economy would be palpable.

Then there’s Iran, and the ever-present conflict in the Middle East. Recent reports indicate that the Trump administration is weighing whether to send up to 14,000 more troops to the Middle East to counter Iran and up the ante on the pressure campaign.3 One wrong step could result in war.

Market Surprise #3: A Frenzy of Free Trade Deals

The world is currently tilting in the direction of protectionism. The U.S. and China’s trade war endures, the UK is actively trying to leave the free trade union in Europe, and new tariffs are seemingly cropping up everywhere. But what if 2020 brought the surprise outcome of a frenzy of new trade agreements?

On the table is the ratification of the USMCA (the new NAFTA), a breakthrough between the U.S. and China, and the UK striking a deal to remain in the free trade bloc. Multiple pressure points on free trade could be released, which in my view would translate into a material positive for stocks. Businesses may be inspired to make new investments in the wake of certainty, driving up cyclical activity and pushing stocks even higher.

Market Surprise #4: Market Euphoria

At present, base case expectations are for ‘muddle-through’ growth of ~2% in the U.S. and the world, with another year spent worried that a recession is just around the corner.

But what if positive developments (better-than-expected growth, a trade deal) result in rapidly rising stock prices, which drives investor optimism higher in the process? That would create a scenario where the market is trading at a high multiple and investors are optimistic about more gains ahead – a bad signal of things to come, in my view. The end result might be a solid year of gains for part or all of 2020, but it would also probably mean the end of the bull market altogether, in my view.

Bottom Line for Investors

As I mentioned at the outset of this piece, all of these scenarios have a low likelihood of actually occurring, in my view. But as investors, it’s always important to scan outlier scenarios and to try imagining ‘unfathomable’ outcomes. Because in my opinion, it’s these outlier scenarios that have the most pricing power in equity markets, not the stories and events that are widely known and ‘priced-into’ the markets.

Additionally, I recommend focusing on the fundamentals instead of the daily price movements with our Just-Released January 2020 Stock Market Outlook Report.

This Special Report is packed with newly revised predictions to consider for 2020 that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Why you should stay bullish?

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- What produces U.S. optimism in the coming year?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!4

Disclosure

1 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

2 Board of Governors of the Federal Reserve System (US), Effective Federal Funds Rate [DFF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFF, December 9, 2019.

3 The Wall Street Journal, December 4, 2019. https://www.wsj.com/articles/trump-administration-considers-14-000-more-troops-for-mideast-11575494228?mod=djem10point

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.