Zacks Investment Management sees the U.S. economy growing at a 2% to 2.5% clip in 2020,1 which is arguably reason enough to be bullish in the new year. However, below we give you our three additional reasons to maintain a constructive outlook on stocks heading into 2020.

Reason #1: Election Year = Political Gridlock2

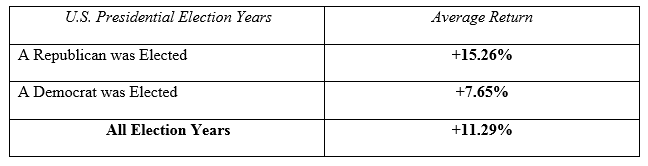

In any given year, the stock market’s performance is influenced by a myriad of factors – economic growth, corporate earnings, inflation, interest rates, and valuations, just to name a few. But, in our view, ongoing analysis of S&P 500 returns in U.S. presidential election years reveals a common trend: Stocks deliver positive returns a majority of the time.

Going a step further to analyze the performance data, we found that – on average – the stock market delivers double-digit positive returns in U.S. presidential election years.

___________________________________________________________________________

Do You Know How These Economic Indicators Could Affect Your Investments?

It can be challenging as an investor to stay on top of all the important news stories and economic indicators that shape the market.

You don’t need to become an expert. However, having a grasp of key economic and financial statistics—from the inflation rate to the new corporate tax rate—can provide insight into how key variables might influence your returns, and could potentially help you reach your financial goals with more confidence.

If you have $500,000 or more to invest, get our free guide, 6 Essential Concepts to Help You Pursue Investing Success.3 It’s https://go.steadyinvestor.com/download-data-checklist?source=website=&medium=blog&term=steadyinvestor_blog_2019_12_16&content=data_check_list_guide a valuable resource that walks you through influential data, from the unemployment rate to corporate earnings, and our views on how these factors could affect your investments.

Download Our New Guide – 6 Essential Concepts to Help You Pursue Investing Success

___________________________________________________________________________

S&P 500 Index Total Returns During Presidential Election Years (1928 – 2016)

Source: First Trust4

In our view, these are more than just number-crunched statistics and it is more than just coincidence that stocks have tended to do well in election years. We believe that the equity markets ‘like’ political gridlock and political certainty. It generally means that new, consequential laws won’t get passed and businesses can operate without worry or concern that property rights, taxes, or regulations may suddenly change. In U.S. presidential election years, legislative efforts usually ground to halt as all attention and time is focused on the campaign. 2020 does not look to be any different.

With 2020 being a presidential election year, and based on historical data detailed above, can we reasonably expect positive returns for the S&P 500 Index next year? With the U.S. and global economy expected to produce modest but positive growth in 2020, and with corporate earnings poised to rebound from sluggish 2019 growth rates, we don’t see why not.

Reason #2: Corporate Earnings are Poised to Rebound

2018 was a year where most U.S. corporations greatly benefitted from tax cuts, posting sizable quarter-over-quarter earnings growth rates along the way. It follows that 2019 was a year where corporations had very high comparisons when it came to measuring growth, which predictably led to flat and negative earnings growth in multiple quarters throughout the year. Looking a bit deeper into the data, however, it is important to note that revenues and sales were on the rise even as earnings declined in Q3, which to us was a signal that underlying demand was/is holding up.

Looking ahead into 2020, S&P 500 corporations now have to meet a lower threshold (with 2019 comparisons) to post solid quarterly growth, and we’re expecting full year growth closing in at 10%.5 Though valuation multiples expanded in 2019 with the S&P 500’s strong rise, I still believe with close to 10% earnings growth there should be more wiggle room for the equity markets to track higher.

Reason #3: Everyone’s Worried About a Recession

Many ‘experts’ have been fearing a trade war since the trade war began, but worries have been gaining real traction since the yield curve inverted in May (it’s not inverted anymore) and data confirmed substantial weakness in the global and U.S. manufacturing sector.

Back in Q3, the Institute for Supply Management (ISM) reported that U.S. manufacturing remained firmly in contractionary territory, hitting its lowest level since June 2009. Everything was down: new orders, production, employment, imports, exports, and prices. Additionally, global manufacturing contracted in September, with nearly every major economy taking a hit.6

The “wall of worry” grew and is still growing, in our view, which we think should make you more bullish. The more that fear gets baked into the market, the higher the probability of a positive surprise driving markets higher, in our view. When an investor ignores the noise and analyzes the broader economic fundamentals, it becomes evident that the recession card may be overplayed – with the risk of recession already discounted into the market. In 2020, unexpected surprises on trade, growth, and earnings have the potential to rally the market and even potentially stimulate a broad rotation back into cyclicals.

It can be challenging as an investor to stay on

top of the unexpected surprises, important news stories and economic indicators

that could shape the market in 2020. In addition to keeping up with news that

could impact the market, it is important to understand key economic indicators

and financial statistics that could influence your investments.

From the inflation rate to the new corporate tax

rate, insight on these factors can help you better understand how these

variables might influence your returns, and could potentially help you reach

your financial goals with more confidence.

If you have $500,000 or more to invest, get our

free guide, 6 Essential Concepts to Help You Pursue Investing Success.7 It’s

a valuable resource that walks you through influential data, from the

unemployment rate to corporate earnings, and our views on how these factors

could affect your investments.

Disclosure

2 First Trust, S&P 500 Index Returns in U.S. Presidential Election Years. Data Source: Morningstar/Ibbotson Associates

3 ZIM may amend or rescind the guide “6 Essential Concepts to Help You Pursue Investing Success” for any reason and at ZIM’s discretion.

4 First Trust, S&P 500 Index Returns in U.S. Presidential Election Years. Data Source: Morningstar/Ibbotson Associates

5 Zacks Investment Management, Nov/Dec Stock Market Outlook Report by John Blank.

6 Institute for Supply Management, October 1, 2019. https://www.instituteforsupplymanagement.org/about/MediaRoom/newsreleasedetail.cfm?ItemNumber=31150&SSO=1

7 ZIM may amend or rescind the guide “6 Essential Concepts to Help You Pursue Investing Success” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.