What economic developments, key factors and questions should you consider when looking at your investments? In today’s Steady Investor, we take a look into some of this week’s top stories such as:

- The latest inflation reading and what it could mean for 2020

- The U.S. and China sign a limited trade deal. Now what?

- Deficit spending supports economic growth

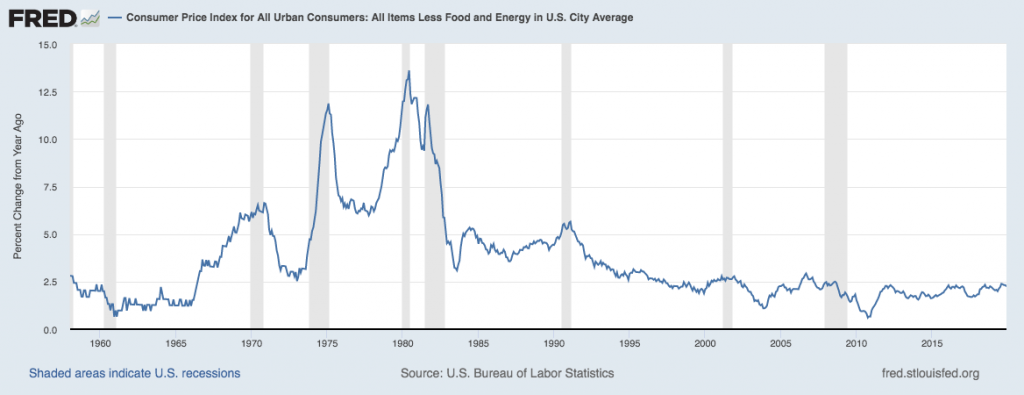

Inflation in Check – The latest inflation reading from December 2019 confirmed what has been the case for the better part of the entire decade: inflation remains in check. The consumer price index showed a year-over-year increase of +2.3% in December for all goods, largely in-line with the Federal Reserve’s 2% target. For the decade, prices climbed at their slowest pace since the Great Depression, which we would argue was driven partly by technological advances (which put downward pressure on input costs, production, and cost of goods sold) and largely by the massive amount of spare capacity created as a result of the 2008 financial crisis and recession.1 While the costs of many consumer goods continue to decline or remain steady, other areas have experienced rapid inflation, such as medical care and the cost of education. As you can see in the chart below, inflation growth has not been this slow since the 1960s, but that period was also followed by a significant spike that few expected. In our view, one of 2020’s surprises could be that inflation rises at a faster clip than many expect (though nowhere near what we saw in the late 1960s).

______________________________________________________________________________

How Can You Prepare for Rising Inflation and Other Retirement Uncertainties?

There are so many unknowns that come with planning your retirement – what if the market crashes or a medical emergency arises? No one can predict if these what-ifs will materialize—but there are simple steps you can take NOW to help ensure your secure and comfortable retirement.

Get our practical advice that is based on decades of experience and can potentially guard your retirement assets against the “what ifs” in life, including:

- How to counteract the effects of rising inflation

- Ideas to allocate your assets to defend against a correction or crash

- Strategies to deal with financial emergencies without liquidating investments

- Tax planning ideas to help avoid unpleasant surprises

- Plus more ways to help protect yourself and your family against retirement unknowns

If you have $500,000 or more to invest, download our Retirement Uncertainties…and How to Breeze Through.3

______________________________________________________________________________

U.S. and China Sign Limited Trade Deal – Over the past year, businesses and markets have grappled with uncertainty stemming from the U.S. – China trade dispute. Business investment fell significantly between the two countries in 2019, and total trade between the two nations also dropped. 2019 figures show that China exported 12.5% fewer goods to the U.S. while importing 21% fewer goods. Though economic activity between the two nations suffered in 2019, it was not enough to derail the economic expansion at home or abroad. Enter 2020, and the U.S. and China are at the table signing “Phase 1” of a trade deal, one that aims to increase Chinese purchases of U.S. goods and services, further open Chinese markets to foreign companies (particularly in the realm of finance), and provides stronger protections for intellectual property and against forced technology transfer. Many provisions in the trade deal benefit U.S. companies, but it remains to be seen how China follows through – or whether they do at all. For instance, the language in the deal states that neither party (U.S. or China) will require or pressure persons to transfer technology, but China stopped short of agreeing to any law changes. In fact, the U.S. request for China to change laws was one of the reasons previous talks collapsed. There is also the fact that tariffs on some $370 billion in Chinese goods remain in place, which keeps price pressure on many U.S. multi-nationals.4

Deficit Spending Supports Economic Growth – Overall economic growth is driven by consumer spending, investment, government spending, and trade. While investment and trade have experienced some headwinds associated with the U.S. – China trade dispute, the other two categories – consumer spending and government spending – have not blinked. The U.S. consumer remains healthy amidst strong job growth and modest, but positive, wage growth. The U.S. government has also demonstrated a healthy penchant for spending, even as revenues have not grown as anticipated with the tax cut. In the twelve months ending December 2019, the federal deficit totaled $1.02 trillion, which marked the first time the deficit has creeped over the trillion mark since the aftermath of the 2008 financial crisis. Tax receipts grew 5% in 2019 but outlays grew by 7.5%, providing support to U.S. GDP growth in the calendar year.5

Just as we cannot predict exactly how these stories will pan out, we also cannot predict life’s uncertainties when it comes to retirement planning. No matter how carefully you prepare for retirement, life’s unknowns can throw your plans off track.

- The effects of inflation could diminish the real value of your nest egg

- A stock market correction or crash may cause your net worth to plummet

- Changes in your personal situation—such as a health emergency—could have an enormous impact on your nest egg

But you can take steps to prepare yourself and help protect your secure and comfortable retirement.

If you have $500,000 or more to invest, get our free guide, Retirement Uncertainties…and How to Breeze Through Them.6 It provides advice, based on our decades of experience, that we believe can help ensure that your golden years will be comfortable and secure.

Disclosure

2 U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average [CPILFESL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPILFESL, January 16, 2020.

3 ZIM may amend or rescind the “Retirement Uncertainties…and How to Breeze Through Them” guide for any reason and at ZIM’s discretion.

4 The Wall Street Journal, January 15, 2020. https://www.wsj.com/articles/u-s-china-to-sign-deal-easing-trade-tensions-11579087018?mod=djem10point

5 CNBC, September 12, 2019. https://www.cnbc.com/2019/09/12/budget-deficit-smashes-1-trillion-mark-the-highest-in-seven-years.html

6 ZIM may amend or rescind the “Retirement Uncertainties…and How to Breeze Through Them” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.