Many readers are likely growing concerned about the spread of the coronavirus and the potential impact on the market (and your health). I understand the emotional difficulty of the moment, and I understand the challenges of keeping a cool head amidst the media and market frenzy. Market volatility, accompanied by a blitz of negative news coverage, will make any situation feel totally dire.

In times like these, it often feels like the worst-case scenario is the only possible outcome…even though history consistently implores us not to think this way. It’s not our fault – humans are hard-wired to overreact to the negative while underplaying the positive, which I think describes the current investment environment. Panicking now means giving into this classic investment error, in my view, and is also the precise reason many investors fail to achieve their desired long-term investment outcomes.

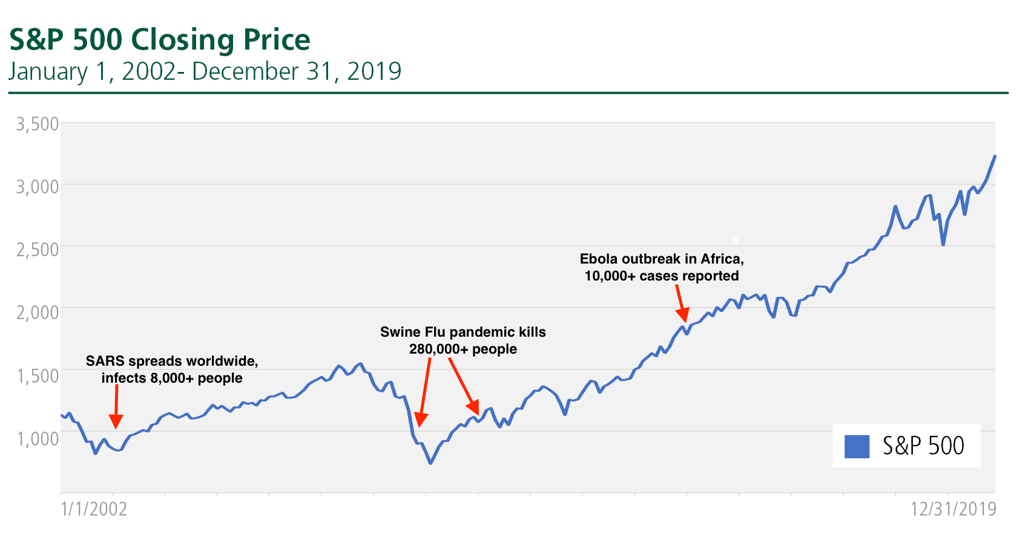

Throughout history, there have been dozens of virus outbreaks, epidemics, and a handful of pandemics. Virtually all of them resulted in short-term volatility and downside, followed by long-term price appreciation. In my view, it is very reasonable to expect a wild ride for the next few weeks. But that does not mean the right move now is to sell or panic. Longer-term, the actual impact to the equity markets has almost always been fleeting.

_________________________________________________________________________

Brace Yourself for More Volatility with Our Stock Market Report

At the end of the day, equity value is based on longer-term corporate earnings generation, which is driven by interest rates, inflation, business investment, innovation, and the regulatory environment – All of which are still conducive to growth, even as the virus spreads.

So, in the

midst of volatility, I recommend focusing on the long-term and not giving into the

fearful narrative that surrounds current volatility.

Our just-released Stock Market Outlook report can

help you do just that. This report contains some of our key forecasts to

consider such as:

- U.S. returns expectations for 2020

- What Produces 2020 Optimism?

- What of U.S. GDP Growth?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released March 2020 Stock Market Outlook1

______________________________________________________________________

The Virus Cycle: Short-Term Pressure Followed by Longer-Term Recovery

Source: Charles Schwab2

A closer look at more recent outbreaks unveils a similar pattern to what we’re seeing today. Historically, the number of confirmed cases in various epidemics has tended to rise sharply for 8 to 10 weeks, then peaked. A short-term dip in stocks generally accompanies the initial (frantic) rise in confirmed cases, with a recovery in prices as the situation comes under control. Over a 38-day trading period during the height of the SARS virus back in 2003, the S&P 500 index fell by -12.8%. During the Zika virus, which occurred at the end of 2015 and into 2016, the market fell by -12.9%. Panic-selling episodes happen, but they have never lasted.

The 1957 Asian flu pandemic was another very significant pandemic in modern history. Advancements in scientific and medical technology allowed the virus to be detected and treated within a year, a time frame we might reasonably expect to be 1-2 months today. The S&P 500 went up +24% in 1957 and 2.9% in 1958.3

Even though it was only 10 years ago, many people forget the scope and gravity of the Swine Flu pandemic. The Centers for Disease Control estimates that from April 12, 2009 to April 10, 2010, there were 60.8 million cases, 274,304 hospitalizations, and 12,469 deaths in the U.S. alone. Globally, the numbers approached 1 billion infected and some 280,000 deaths.4 But as the virus spread and hysteria enveloped the media and the world, the S&P 500 was beginning one of the biggest bull runs of all time. Selling into the Swine Flu pandemic would have been a mistake.

Historically, Selling into Virus Outbreaks Has Been Proven Costly

Source: Zacks Investment Research5

The Bottom Line for Investors

My goal in this column is not to downplay the seriousness of the coronavirus outbreak. As of this writing, there are over 90,000 confirmed cases and over 3,000 deaths.6 But at the same time, history tells me – as an investor – that that the fear of the virus outbreak will likely far outweigh the actual economic and market impact it will have. Selling now, in my opinion, would mean pricing-in a lengthy recession and bear market—neither of which seem likely.

In my view, selling into virus outbreaks has proven costly throughout history because the stock market’s value is not based on what happens in the next quarter or two. Equity value is based on longer-term corporate earnings generation, which is driven by interest rates, inflation, business investment, innovation, and the regulatory environment. I think these macro conditions are still conducive to growth, even as the virus spreads.

To help you focus on these macro conditions and the long-term outlook, I am offering all readers our Just-Released March 2020 Stock Market Outlook Report.

This Special Report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- What Produces 2020 Optimism?

- Our global outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!7

Disclosure

2 Listed returns are for the MSCI World Index, price returns. Past performance is no guarantee of future results.

Charles Schwab, February 24, 2020. https://www.schwab.com/resource-center/insights/content/market-volatility

3 Fidelity, April 6, 2019.

4 Centers for Disease Control and Prevention, June 11, 2019. https://www.cdc.gov/flu/pandemic-resources/2009-h1n1-pandemic.html

5 Zacks Investment Research

6 The World Health Organization, March 3, 2020. https://www.who.int/emergencies/diseases/novel-coronavirus-2019/situation-reports/

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.