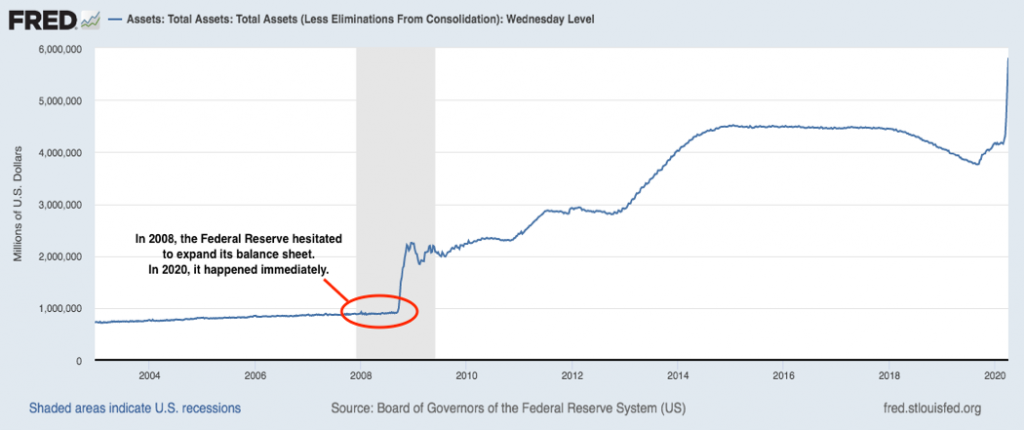

Many readers may not recall this detail specifically, but when the financial crisis first took hold in the fall of 2007, the Federal Reserve and Congress’s initial response was to do very little and nothing, respectively.

The Fed made modest rate cuts in late 2007 and into 2008, but the full force of quantitative easing (QE) and lending facilities did not arrive until March 2008 – about five months into the financial crisis. Congress did not pass the American Recovery and Reinvestment Act – which committed about $800 billion in fiscal spending across various areas of the economy – until February 2009.1 The bill represented meaningful action, but it is also true that the recession ended just a month later. Better late than never?

To be fair, the scale of the 2008 global financial crisis was unprecedented, and the Federal Reserve and Congress were working with virtually no playbook and “on the fly.” No one knew exactly how to manage the most complex credit/liquidity freeze the world has ever known. Some of the stimulus bore fruit and generated positive results, while other actions fell flat. At the end of the crisis, however, a common refrain was that our institutions were essentially writing the playbook needed to battle the next crisis effectively and efficiently.

Well, the next crisis has arrived, and the Federal Reserve and Congress waited just weeks (instead of months or years) to take actions that far exceed the measures taken during the 2008 financial crisis. There was basically no debate – as there was in 2008 – about whether or not the Federal Reserve should offer lifelines to corporations or whether Congress should act to cushion households with cash payments and increased unemployment benefits. It all just happened, and fast.

________________________________________________________________________

How Can You Survive this Crisis?

Many investors are wondering what they should do in response to this crisis and how they should respond to protect their investments. At the end of the day, I think the key for investors is to try and focus on the hard data. Bear markets do not last forever, in fact, they are generally much shorter than bull markets.

I recommend that investors remain calm, focus on the long-term and not let your emotions take control of your investments. To help you do this, I am offering all readers our just-released April Market Strategy report. This report contains some of our key forecasts & factors to consider such as:

- The major market-relevant risk for 2020

- Factors behind challenging times & a recession in the cards

- Inside US GDP growth

- A look at past epidemics and pandemics. How did the market react?

- Our recommendation for investors

- And much more…

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released April 2020 Market Strategy Report2

________________________________________________________________________

The Federal Reserve Expanded Its Balance Sheet Almost Immediately

Source: Federal Reserve Bank of St. Louis3

The Fed’s current actions take it farther afield from its 2008 tactic of cutting interest rates progressively over time and buying government securities to inject liquidity into the financial system. In the current crisis, interest rates went almost straight to zero and the Fed deployed never-before-used tactics:4

- Committed to a virtually unlimited QE program;

- Created a new facility to buy investment grade corporate bonds and bond ETFs;

- Relaxed bank capital rules to encourage more lending;

- Added extra liquidity to aid money markets, commercial paper and muni debt;

- Essentially became the “lender of last resort,” extending loans directly to businesses large and small.

The hundreds of billions of dollars of liquidity available to help industry can also reportedly be leveraged ten times by the Fed through various lending facilities, which implies an astounding $7 trillion of available funds – or almost 10 times the stimulus provided in 2008-2009 to fight the Great Recession. There are signs the credit markets are already beginning to stabilize in the wake of Fed action. Large-cap companies like Oracle and CVS Health Corp. have borrowed money at a record pace, and in all some $104 billion of investment-grade bonds (a record) were sold last week – pointing to strong demand. The previous record for investment-grade bonds was made the previous week, at $73 billion. Mortgage rates have also come down and even companies with higher credit risk, like Carnival Cruises, have been able to access the debt markets to raise cash.5

On the federal government side, I mentioned before that the American Recovery and Reinvestment Act of 2009 committed some $800 billion of fiscal spending, which seemed like an exorbitant sum of money at the time. Within weeks of the current crisis, Congress passed the $2 trillion CARES Act, which equates to 9.5% of GDP. There are other aspects of the bill as well designed specifically to help households:6

- Required Minimum Distributions (RMDs) are optional for 2020;

- Early 401(k) withdrawals without penalty are permitted in certain cases;

- Many households will soon receive ‘helicopter money’ via checks in the mail;

- $500 billion in loans and business assistance programs for big companies;

- Small businesses will have access to a separate $350 billion facility.

Bottom Line for Investors

While this type of economic crisis is unprecedented, the fiscal and monetary responses to support the economy are also unprecedented – even when considering what the Federal Reserve and Congress did in 2008-2009. Alleviating the hardship from job losses and maintaining liquidity in the financial system is crucial, and for now, the government and central bank responses look adequate, in my view.

The wild card here is that with all of the stimulus deployed so quickly and profoundly, we have effectively increased the probability that a powerful wave of pent-up demand is ready to be unleashed once the virus is contained. Time will tell when that moment arrives, but I’m confident this fiscal and monetary stimulus will still be in the economy long after the virus is gone.

As we wait for the virus to pass and the economy to recover, many investors may be wondering what they can do now as we wait. In the meantime, I recommend that investors remain calm, focus on the long term and not let emotions take control of their investments. To help you focus on the fundamentals instead of the fearsome headlines, I am offering all readers our Just-Released April 2020 Market Strategy Report.

This Special Report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- The major market-relevant risk for 2020

- Factors behind challenging times & a recession in the cards

- Inside US GDP growth

- A look at past epidemics and pandemics. How did the market react?

- Our recommendation for investors

- And much more…

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!7

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

3 Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations From Consolidation): Wednesday Level [WALCL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WALCL, April 6, 2020.

4 Forbes, March 31, 2020. https://www.forbes.com/sites/michaelcannivet/2020/03/31/stay-agile-investing-in-the-ides-of-march/#4714fb671faf

5 The Wall Street Journal, April 6, 2020. https://www.wsj.com/articles/credit-markets-show-signs-of-stabilizing-after-historic-fed-intervention-11586165402

6 Forces, March 31, 2020. https://www.forbes.com/sites/michaelcannivet/2020/03/31/stay-agile-investing-in-the-ides-of-march/#4714fb671faf

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.