Many readers have probably seen the headlines and stories claiming this recession could be as bad – or worse – than the Great Depression. To that I say, don’t take the bait.

The Great Depression was a slow, long, grinding downturn for the U.S. economy. From 1929 to 1933, the economy shrank for 43 consecutive months, with unemployment hovering around 25% for years. Even as the jobs picture improved over the course of the decade, unemployment remained over 10%.

In the coming month, it looks like U.S. unemployment could push past 20% (it stood at 14.7% in April data).1 It’s this piece of data that is drawing the biggest comparison to the Great Depression, but I think the argument is misguided and incomplete. I don’t see this recession coming close to the Great Depression in terms of severity or duration, and I’ll give you three reasons why.

_________________________________________________________________________

Responding with Fear Could Be Costly. Focus on the Fundamentals Instead

Instead of letting fearful headlines, like those that say this recession could be worse than the Great Depression, cause you to make knee-jerk responses, I recommend making decisions based on data and fundamentals. To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Top four “stay-at-home” sectors at play

- What stocks would come to life with a vaccine?

- Top stocks in top industries

- Global outlook and job market

- What of consumer confidence?

- U.S. return expectations for 2020

- Is it time to buy stocks in May?

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released June 2020 Stock Market Outlook2

_________________________________________________________________________

1 – Unemployment Figures Do Not Paint a Complete Picture

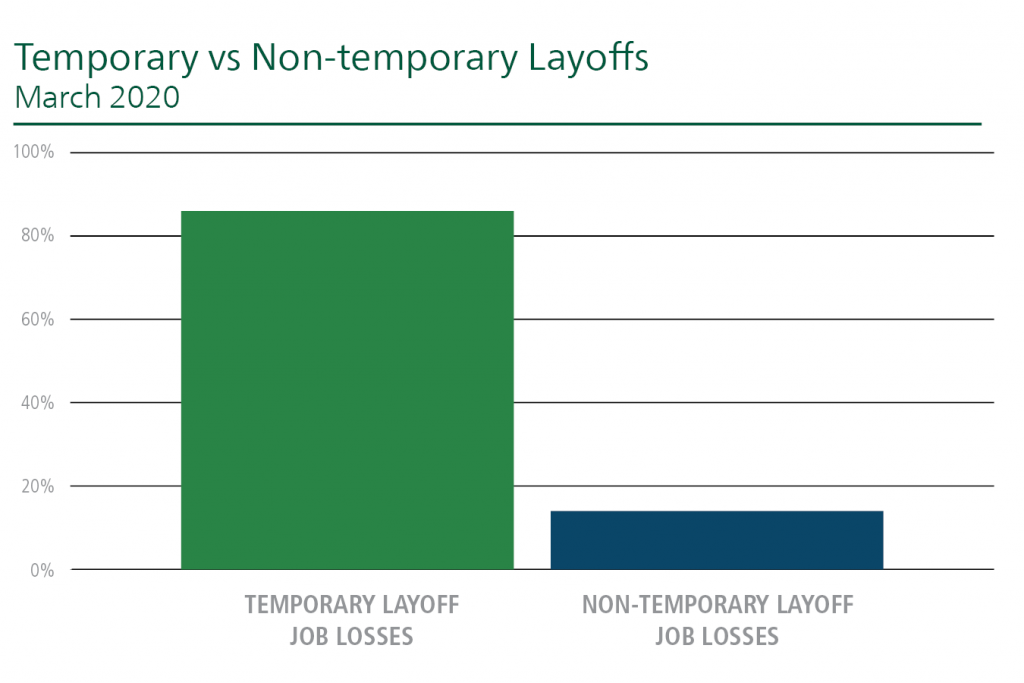

The U.S. economy is losing millions of jobs – there is no sugar coating this fact. But if we take a very close look at the job losses across the economy, we find that a large percentage are furloughs (temporary layoffs) as opposed to permanently shrinking the workforce (data below):

Source: Zacks Investment Research3

In the current environment, employers appear to be keeping employees close by, in anticipation of the economy’s reopening. A recent survey conducted by Morning Consult found that two-thirds of workers believed that they would return to work for their current employer, which could help restart business much more quickly than if the employer had to rehire. 4 When employees are asked to return to work, there’s no need for training, recruitment, job search, background checks, ‘onboarding,’ etc., all of which are costly and time-consuming. Workers can return to their jobs and immediately be productive.

Additionally, more than half of job losses have come from hospitality, accommodation, food services, retail trade and other service-sector jobs. Those who can work remotely – typically in high-skilled, higher-income jobs in tech, finance, management, professional services – saw a much smaller change to payrolls in March and April. The implication here, in my view, is that the majority of layoffs come from industries that could resume operations immediately when lockdowns and restrictions are lifted – which is beginning to happen now.

Jobs disappeared during the Great Depression because there was no demand, no capital, no functioning Federal Reserve or financial system. Companies had to permanently restructure – or declare bankruptcy – in droves. There was no safety net during the Great Depression.

Today, businesses are struggling in major ways, but they are also receiving financial support from the government with payroll loans that are in many cases forgivable, and workers across many industries are seeing close to full replacement of income from unemployment insurance under the CARES Act.5 This is not a Depression-like outcome.

2 – Event-Driven Shock Versus a Structural/Financial Crisis

The collapse of the financial system was one of the major causes of the Great Depression. Today, banks are very well capitalized and the credit markets remain stable. Comparing the financial system during the Great Depression to the financial system today is essentially comparing night to day.

Because the causes of the Great Depression were structural, industrial production fell by more than half during the entirety of the 1930’s. Back then, industrial production was a critical component of the economy. Production trickled higher over a four-year stretch during the mid-1930’s, only to plummet sharply again in 1937-1938. 6 Again, the Great Depression was a long, grinding decline.The current lapse in production and services is expected to last a few quarters – not years.

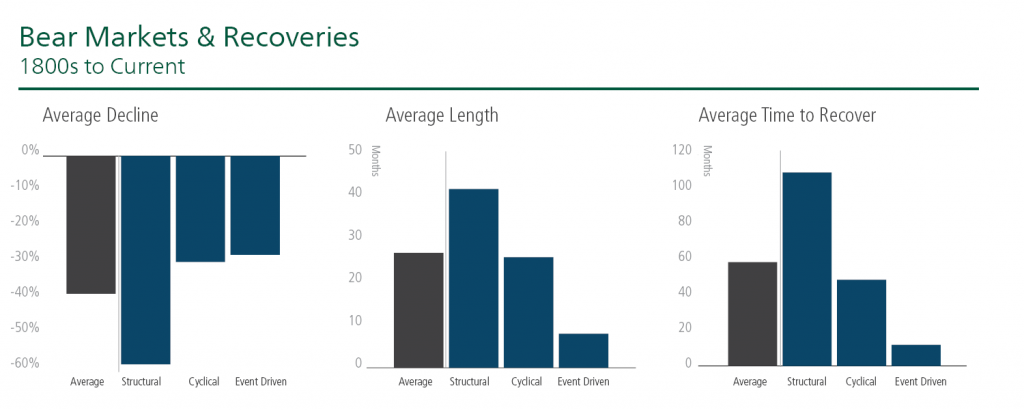

Historically, “event-driven” bear markets (which is how I would characterize the current downturn) have been shorter, less severe, and take less time to recover from than structural or cyclical downturns. I do not believe this time will be different.

Source: Goldman Sachs7

3 – Policy Mistakes Drove the Great Depression Deeper

Governments and central banks failed miserably in their response to the Great Depression, doing basically the opposite of what needed to be done.

In the midst of the 1930’s downturn, central banks tightened monetary policy in order to maintain the gold standard, resulting in severe deflation which raised the cost of debt and lowered real incomes. The U.S. government equally fumbled the response by putting austerity measures in place (cutting spending) just as the economy needed it most. The government also passed the Smoot-Hawley Tariff Act in 1930 in an effort to help domestic producers, but it only resulted in more pain due to the loss of global demand.

The policy response in the current crisis has drawn from lessons learned during the Great Depression, and the government and central bank are essentially doing the opposite of what they did during the Depression. The U.S. government has spent some $2.9 trillion in stimulus to boost the economy, and the Federal Reserve slashed rates to the zero bound in addition to offering basically unlimited liquidity to the capital markets.8 The difference in responses is night and day.

Bottom Line for Investors

I strongly believe the current recession will be shorter, less painful, and will inflict far less damage on households and businesses than the Great Depression. But that’s not to say it will be an easy and painless downturn. All recessions hurt the economy and society at-large, and it will take time to rebuild.

In my view, however, getting the economy back to a strong position may require about 15-18 months, versus the 10+ years that were needed to recover from the Depression. There’s no comparison, in my view.

Instead of letting fearful headlines influence your investment decisions, I recommend staying focused on the fundamentals and the long-term view during this recession. To help you do this, I am offering all readers our Just-Released June 2020 Stock Market Outlook Report.

This Special Report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Top four “stay-at-home” sectors at play

- What stocks would come to life with a vaccine?

- Top stocks in top industries

- Global outlook and job market

- What of consumer confidence?

- U.S. return expectations for 2020

- Is it time to buy stocks in May?

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!9

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Zacks Investment Research

4 Morning Consult, May 6, 2020. https://morningconsult.com/2020/05/06/analysis-coronavirus-jobs-april/

5 The Wall Street Journal, May 10, 2020. https://www.wsj.com/articles/coronavirus-slump-is-worst-since-great-depression-will-it-be-as-painful-11589115601

6 The Wall Street Journal, May 10, 2020. https://www.wsj.com/articles/coronavirus-slump-is-worst-since-great-depression-will-it-be-as-painful-11589115601

7 Goldman Sachs, Bear Essentials: a guide to navigating a bear market. March 9, 2020.

8 The Wall Street Journal, May 10, 2020. https://www.wsj.com/articles/coronavirus-slump-is-worst-since-great-depression-will-it-be-as-painful-11589115601

9 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.