In today’s Steady Investor, we look at key factors that we believe are currently impacting the market, such as:

- The fate of extra stimulus spending

- State and local reduced spending

- A step in the direction of alternative energy sources

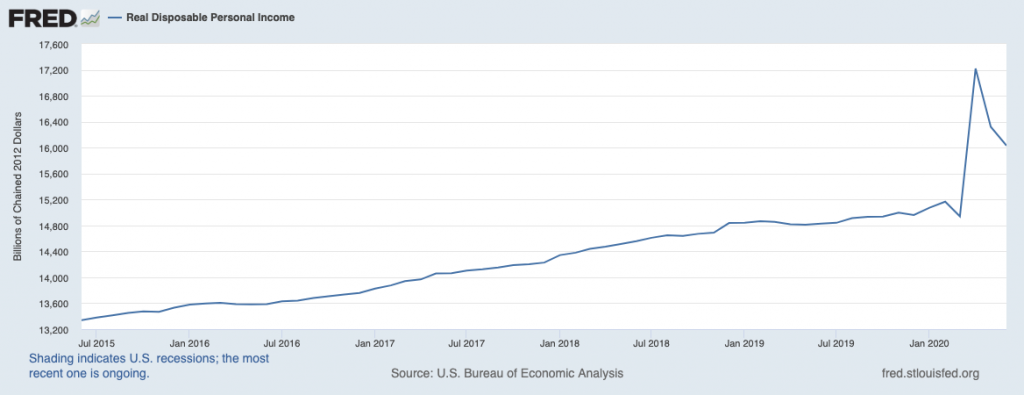

The Fate of ‘Extra’ Unemployment Benefits (and other stimulus) – The U.S. government’s decision to provide an extra $600-a-week in unemployment benefits led to a jump in real disposable income – even in the midst of the economic crisis (see chart below). This jump in income arguably boosted spending and dampened the severity of the economic downturn, but the extra benefit expired on July 31. Its fate going forward is very much in question. Congress has not mustered the votes to pass another stimulus bill, and at last glance Republicans and Democrats are still very far apart on reaching a deal. President Trump signed an executive order to extend the benefit by $300-a-week, but it is unclear how long the benefit can last given the executive branch cannot authorize new spending (Congress controls spending). Some estimates show the executive branch has roughly $44 billion in funds to spend on the unemployment benefit, but analysis shows that the government spent $250 billion to provide the $600-a-week from early April to the end of July. Also on the table is additional stimulus spending for schools, the U.S. Postal Service, and state and local governments, though time will tell if a deal ultimately gets done.1

Real Disposable Personal Incomes Shot Higher with Federal Stimulus

Download Our Dean’s List of Investment Strategies!

You can’t predict when Congress will decide upon another stimulus package or when we will have a vaccine for COVID-19. But the right investment strategy can make a huge difference in preparing your long-term investments for success and helping you navigate these challenging and unprecedented times.

To help you learn more about strategies that cater to different investment objectives, we have created our Dean’s List of Investment Strategies. Our Dean’s List describes five of our investment strategies that are ranked in the top of their respective classes by Morningstar (as of 6/30/20).3

If you have $500,000 or more to invest and want to learn about five of our top strategies, click on the link below.

Learn More About Our Top-Ranked Strategies!4

The Weakening Outlook for Muni Bonds – State and local governments reduced spending by a 5.6% annual rate in Q2, as the economic recession forced municipalities to lay off workers and reduce services. With recessions come falling tax revenues, which sets into motion the need for austerity measures so as not to spur significant budget deficits. With state and local economies still struggling to contain the virus and economic growth only trickling back to life in many places, the cuts are likely to continue. According to Moody’s, states will need somewhere in the neighborhood of $500 billion over the next two years to offset budget holes being created today. For context, in the last economic stimulus package states and local governments received $150 billion in aid, but the money was largely limited to coronavirus-related expenses. Most of that money is already spent, and many states are looking straight ahead at a major budget crisis. The Fed has stepped in and said it will lower interest rates by 0.5% for cities and states seeking short-term loans, but the U.S. Treasury needs to approve any such measure.5 For municipal bond investors, it could make sense to use caution and diligence in selecting bonds.

Introducing: The “Scanalyzer” – In an Arizona desert south of Phoenix, a 70-foot-tall robot called a “Field Scanalyzer” is probing fields of sorghum, lettuce, wheat, and other crops to closely analyze the temperature, shape, color, and angle of each leaf. As the world’s largest agricultural robot, the Scanalyzer is designed to collect reams of data in an effort to identify and refine optimal crops for producing biofuels, while also identifying crops that can thrive in drier and hotter climates as the planet changes. The project is being funded by the U.S. Department of Energy and the Bill and Melinda Gates Foundation, and may prove a stepping stone in the transition away from fossil fuels and towards alternative energy sources.6

There is no way to know exactly how this pandemic

will continue to impact markets and economies around the world, but finding the

right investment strategy can make a huge difference when managing the highs

and lows of the market. To help you learn more about strategies that cater to

different investment objectives, we have created our Dean’s List of Investment

Strategies.7

Our Dean’s List describes five of our investment

strategies that are ranked in the top of their respective classes, according to

Morningstar (as of 6/30/20).8 If you have $500,000 or more to

invest and want to learn more about these strategies, click on the link below

to see how they could potentially benefit you.

Disclosure

2 U.S. Bureau of Economic Analysis, Real Disposable Personal Income [DSPIC96], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DSPIC96, August 12, 2020.

3 ZIM may amend or rescind the “Dean’s List of Investment Strategies” guide for any reason and at ZIM’s discretion.

4 These rankings may not be representative of any one client’s experience. In addition, they are not indicative of future performance

5 The Wall Street Journal, August 11, 2020. https://www.wsj.com/articles/fed-to-lower-rates-for-cities-states-seeking-short-term-loans-11597180634?mod=searchresults&page=1&pos=2

6 The Wall Street Journal, August 12, 2020. https://www.wsj.com/articles/how-a-30-ton-robot-could-help-crops-withstand-climate-change-11597237276?mod=djem10point

7 ZIM may amend or rescind the “Dean’s List of Investment Strategies” guide for any reason and at ZIM’s discretion.

8 These rankings may not be representative of any one client’s experience. In addition, they are not indicative of future performance

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.