In today’s Steady Investor, we look at key factors that we believe are currently impacting the market and what could be next for the markets such as:

- Housing demand soars amid historic housing shortage

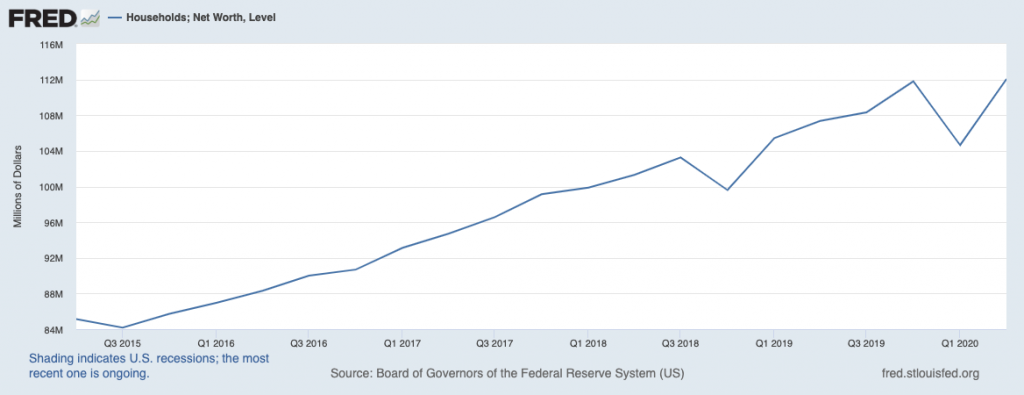

- Household net worth hits record highs even with the economic downturn

- New obstacles for the European recovery

A Historic Shortage of Existing Homes – Americans are on the move, creating what may be seen as a ‘good’ problem. On the one hand, the migration out of cities and into the suburbs has resulted in strong demand in the housing market, giving the sector a stiff tailwind even as the broad economy struggles to recover. On the other hand, rising demand is not being met with supply, which is driving prices higher and crowding-out many lower income buyers. According to the National Association of Realtors, there were 1.3 million single-family homes for sale in the U.S. – the lowest level for any July going back to 1982. In the week that ended September 12, total for-sale inventory had declined -29.4% from the year before. The end result in the housing market is stiffly rising home prices, with the median existing home price crossing above $300,000 for the first time ever. For August, the median existing-home price jumped 11.4% from the same month a year before, also a record.1 The existing trend of homebuyers rushing out to get more space (think home office) while sellers hang onto properties may not last, however. What we’re seeing could be a reactionary pendulum swing in response to the new work-from-home normal set by the pandemic, which may not be as permanent as many think.

____________________________________________________________________________

How to Survive this Market’s Extreme Volatility?

The pandemic ended what was the longest bull market in history and caused what could be one of the shortest bear markets. And now there are worries a market correction is around the corner. This year has proven just how quickly things can change. That’s why there is no better time for investors to gain a better understanding of bear markets and how they work.

To help you understand market downturns and steps you can take to protect your assets during the next bear market, you’re invited to get our free guide – Everything You Need to Know About Bear Markets.2

If you have $500,000 or more to invest, get this helpful guide today. It walks through the history and types of bear markets, how investors typically react to extreme volatility, and what we can learn from the history of bear markets and pandemics.

Download – Everything You Need to Know About Bear Markets

____________________________________________________________________________

A Tale of Two Recoveries – The Federal Reserve released data this week showing household net worth at record highs (see chart below). Many readers may be wondering, how is this possible with the pandemic and economic downturn? There are a few explanations, in our view. For one, the economic downturn may not have been as severe on the downside as many anticipated, and the recovery may be occurring more robustly than meets the eye. Event-driven recessions tend to ‘shock’ the system but may not lead to major market dislocations that take years to mend, such as the financial system in the wake of the financial crisis. Another reason for the rebound in household net worth is the rebound we’ve seen in the equity markets, which is a key driver of wealth but not necessarily for all American households. Which brings us to the tale of two recoveries – as some Americans remain largely unscathed (or even better off) in the wake of the pandemic, many Americans who work in the service sector have lost income and may not own stocks.3 This dynamic is what many refer to as the “K-shaped” recovery, the reckoning of which we may not fully understand for months or years to come.

The European Recovery May Be Stalling – Developed economies around the world posted a late-summer recovery once the strictest of lockdowns were lifted, but in Europe there are signs the recovery is plateauing. Surveys of purchasing managers in France, Germany, and Japan showed business service weakness in September, with output still lagging pre-pandemic levels. Much of the recovery in July and August was recovering the slack from lockdowns, but the prospect of a return to growth is less clear. To make matters more complicated, Europe is currently experiencing a surge in new Covid-19 cases, with France and Spain posting higher per million infection rates than the United States. In the U.K., Prime Minister Boris Johnson announced this week a series of new restrictions to try and contain a second wave of outbreaks.5 The global economic recovery was already fragile – fresh restrictions are a headwind.

At the beginning of this

year, we were still in the longest bull market. But the pandemic led to what

could be one of the shortest bear markets in history, followed by fears of a

potential market correction. This year has shown us just how quickly the stock

market can change and proven just how critical it is for investors (especially

those in or near retirement) to know how bear and bull markets work.

To help you

understand market downturns and steps you can take to protect your assets

during the next bear market, you’re invited to get our free guide – Everything

You Need to Know About Bear Markets.6

If you have

$500,000 or more to invest, get this helpful guide today. It walks through the history

and types of bear markets, how investors typically react to extreme volatility,

and what we can learn from the history of bear markets and pandemics.

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Everything You Need to Know About Bear Markets offer at any time and for any reason at its discretion.

3 The Wall Street Journal, September 21, 2020. https://www.wsj.com/articles/u-s-household-net-worth-hits-highest-level-ever-11600705010

4 Board of Governors of the Federal Reserve System (US), Households; Net Worth, Level [BOGZ1FL192090005Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FL192090005Q, September 23, 2020.

5 The Wall Street Journal, September 23, 2020. https://www.wsj.com/articles/faltering-service-sector-weighs-on-global-recovery-as-infections-rise-11600853490

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Everything You Need to Know About Bear Markets offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.