As we draw closer to the U.S. presidential election, I’ve had an increasing number of readers concerned about trouble ahead. Some are concerned about a Trump re-election, others worry about a Biden win and a “blue wave,” and still others fear a contested election will send the economy back into recession. In my view, while such concerns are valid, they are also probably placing too much importance on the political cycle and not enough importance on the business cycle.

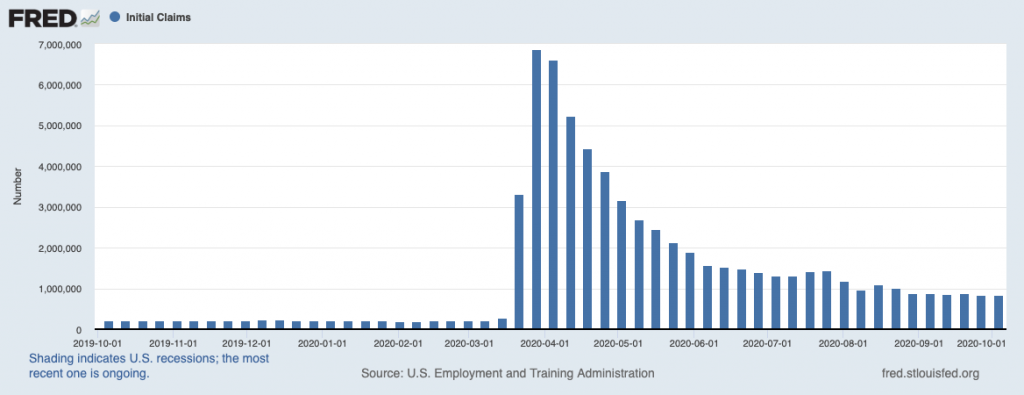

It is important to remember the 2020 recession was caused by a self-induced shutdown and not structural or cyclical imbalances. As such, and with the help of absolutely massive global fiscal and monetary stimulus, the economy was able to restart fairly quickly. The U.S. has now replaced 11.4 million of the 22 million jobs lost to the pandemic, and several economic indicators have clawed back to pre-pandemic levels.1 One key indicator of whether the economic recovery is on track is initial jobless claims, which continue marching lower – a good sign.

There is no doubt a long road ahead for a full economic recovery, but in my view, the economy is on it – and the election is not likely to reverse these gains.

_________________________________________________________________________

In Times Like These, Focusing on Data and Not Media Hysteria is Key!

2020 is more than half way over, and it has been a chaotic year of events to say the least. Still, there is money to be made. So instead of focusing on the “what if’s” that saturate the media, I recommend staying calm and focusing on the fundamentals. To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- A look at potential Covid-19 vaccines

- What produces 2021 optimism?

- What of U.S. GDP growth?

- What should you think about Covid-19 era jobs data?

- An update on U.S. fiscal stimulus

- Zacks Rank S&P 500 sector picks

- International update on key global regions

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released November 2020 Stock Market Outlook3

_________________________________________________________________________

One underappreciated factor in the economic recovery, in my view, is the greater understanding we now have of the virus and the pandemic. The daily infection rate has held fairly steady – and fairly high – for months, but the lower incidence of deaths may help explain the relatively muted market response to rising infections. I also believe the U.S. health system has seen significant improvement in its ability to handle and treat cases, which lowers the risk of another round of lockdowns.

Many see additional fiscal stimulus as an ‘x-factor’ in the recovery. Should Congress and the White House remain at an impasse over more stimulus, many of temporary job losses could turn permanent, which would in effect turn event-driven losses into cyclical ones. I too see this as a risk, but only in terms of prolonging the recovery – not reversing it.

For the Federal Reserve’s part, we know the central bank is now willing to let inflation overshoot its targets in an effort to push unemployment back to its maximum level. 17 Fed officials said they believed rates would stay near zero until at least the end of 2021, with 13 officials pushing the date further out to 2023. The Federal Reserve has essentially codified ‘lower for longer’ interest rates, which should support the recovery in the coming years.4

Q3 earnings season is now underway, and while total S&P 500 earnings are expected to decline -22.3% on -2.9% lower revenues, it is a marked improvement from the -26.5% earnings decline expected at the start of July and the -32.3% earnings drop in Q2. Banks kicked off earnings season, and what we are seeing are banks largely in good fundamental health. Insofar as banks are a proxy for the economy’s health, the outlook for growth is likely better than most think.

Most sectors will again show steep drops in earnings in Q3, but investors should note the earnings declines are likely to be less dramatic than Q2; expectations are for an average -21% decline, versus the -31% contraction of Q2, when coronavirus-linked lockdowns decimated economic activity.5 Overall, this earnings season is expected to show continued improvement in the overall outlook, a trend that has been in place since early July and has been showing up in steadily rising earnings estimates.

Bottom Line for Investors

Investors should remember that economic recessions end when the economy begins to grow – even if the growth is only a trickle at first. At this stage, in my view, the biggest risk to the economic recovery is another round of lockdowns – the likelihood of which is very low. We know enough about the virus, and the health system is robust enough, to avoid shutting the economy down completely.

Another round of stimulus is likely needed to bridge many Americans to normal life after the pandemic, which could be several months away. While I expect market volatility as stimulus talks drag on, I do not think the economy will slip back into recession without a large stimulus package. What we might see instead is a prolonging of the economic recovery, but not a reversal of gains made to date.

This is why it’s important to look at the whole picture and have a diversified approach to your portfolio. To help you do this, I am offering all readers our Just-Released November 2020 Stock Market Outlook Report.

This report looks at several factors that are producing 2020 optimism right now and contains some of our key forecasts to consider such as:

- A look at potential Covid-19 vaccines

- What produces 2021 optimism?

- What of U.S. GDP growth?

- What should you think about Covid-19 era jobs data?

- An update on U.S. fiscal stimulus

- Zacks Rank S&P 500 sector picks

- International update on key global regions

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!6

Disclosure

2 U.S. Employment and Training Administration, Initial Claims [ICSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ICSA, October 13, 2020.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

4 Bloomberg, October 12, 2020. https://www.bloomberg.com/graphics/recovery-tracker/

5 Zacks.com, October 7, 2020. https://www.zacks.com/commentary/1072598/q3-bank-earnings-in-the-spotlight-next-week

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.