There is a hearty amount of excitement surrounding the U.S. economic recovery and life after the pandemic. The U.S. jobs market is piping hot, restrictions are falling away across the country, and U.S. households are armed with savings. Perhaps most importantly, corporate earnings nicely exceeded expectations in Q1, which is a fundamental we track very closely at Zacks Investment Management. Above all else, earnings drive our portfolio decision-making across client accounts.

From a high level, positive economic momentum abounds. But there is also a growing concern over the sustainability of the U.S.’s fiscal and monetary experiment. I have written about inflation concerns in this space previously. This week, I address worries over the value of the U.S. dollar.

____________________________________________________________________________

Inflation Concerns? Turn to Fundamentals and Hard Data!

Taking your cues from financial headlines of the day can be a costly mistake. That’s why it is important to stick to the hard data during this significant time of economic recovery. Even with inflation concerns, don’t give in to fear and emotions. I recommend keeping your focus on long-term financial success!

To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks June view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Top stocks in top industries

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released June and July 2021 Stock Market Outlook1

____________________________________________________________________________

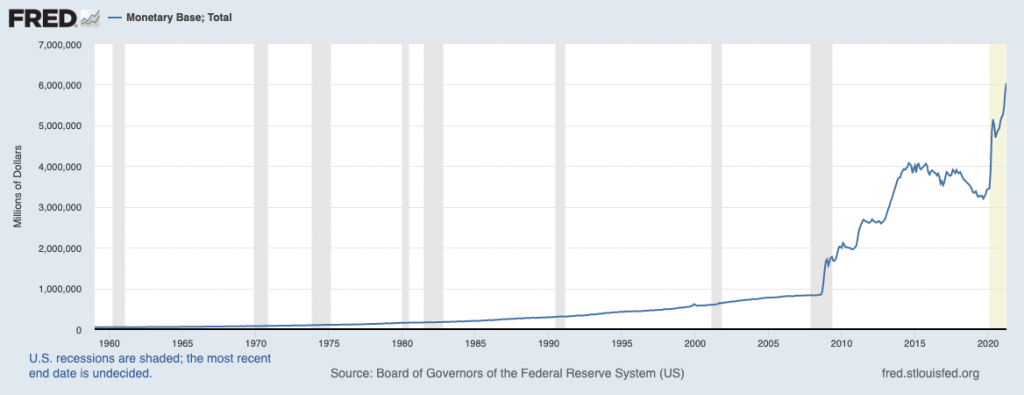

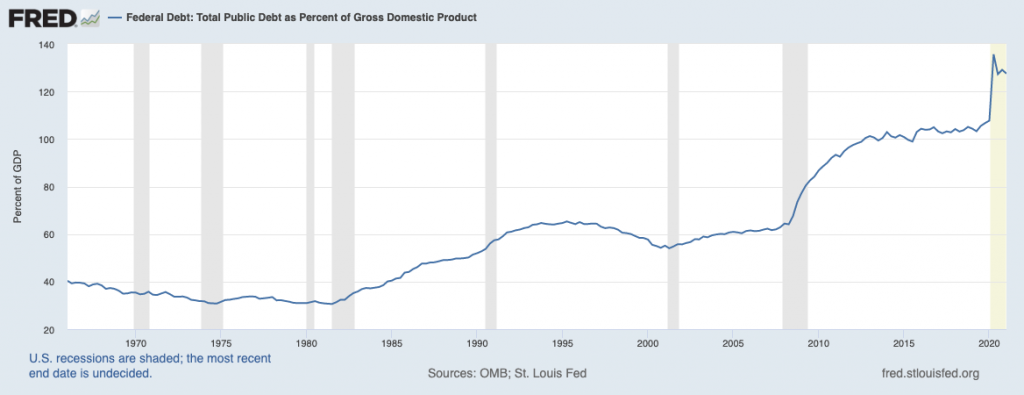

At the outset of 2021, many believed that trillions of new dollars in fiscal stimulus, combined with a maximally accommodative Federal Reserve and twin government budget and trade deficits, would substantially weaken the dollar. The charts below put these fears into perspective. In the first chart, you can see how the U.S. monetary base has swelled above $6 trillion for the first time, while the second chart shows the spike-up in total U.S. debt relative to GDP:

Monetary Base Reaches All-Time High…

While the Debt-to-GDP Ratio Climbs Well Above 100%

You wouldn’t be the only one to see these two charts and conclude that the U.S. has printed money at too frenzied a clip, which therefore means the dollar is destined to weaken considerably from here.

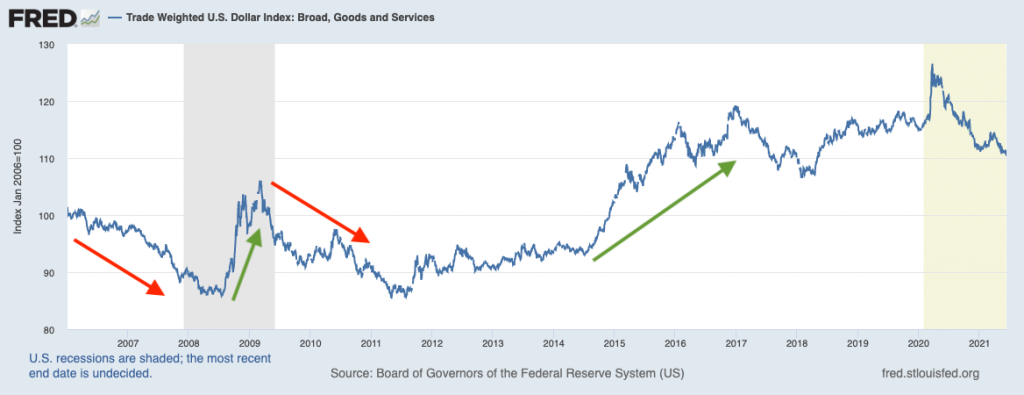

The dollar has indeed weakened from March 2020 levels when the pandemic started, but it strengthened throughout Q1 2021. More importantly, if investors zoom out and analyze longer periods of time, one would find the U.S. dollar index weakened at a similar rate from 2017 to 2018. During both periods of weakening in the U.S. dollar, the S&P 500 rallied.

What’s interesting about the dollar debate is that you can almost always find an equal amount of ‘experts’ on both sides of the table. Some see the strong dollar as good, while others advocate the benefits of a weaker dollar. If one side wants a weaker dollar for its impact on U.S. exports and emerging markets (since EM countries typically borrow in U.S. dollars), the other side views a stronger dollar as better for attracting foreign capital and empowering the U.S. consumer. History tells us the stock market generally has no preference.

For investors, it is important to remember that relative dollar strength or weakness is just one factor of many when it comes to driving stock market performance. Many assume that a weaker dollar must be bad for stocks, but that is not necessarily true. As you can see in the chart below, there have been periods when the dollar has weakened and the stock market performed well (red arrows), and times when the dollar has strengthened and the stock market performed poorly (green arrow during 2008). There are plenty of historical examples where the opposite is true. The dollar alone does not determine stock market direction.

As for the effect of the alarming amounts of money printing and debt accumulation, there are arguments for positives here too. Consider 2020 when the U.S. debt increased by $4 trillion, a significant 25% jump from 2019 levels. But here’s the kicker: while absolute levels of debt increased dramatically, the interest payments on that debt decreased by 8%.5For new or existing homeowners who decided to refinance or buy a second home (or a bigger home) during this period of ultra-low interest rates, you can understand the appeal of borrowing more when it’s inexpensive to do so.

As a general rule, if the economic growth rate is higher than long-term interest rates (10-year and 30-year U.S. Treasuries), then countries should be able to run moderate budget deficits while maintaining a reasonable cost of servicing debt. Today, we’re expecting 2021 and 2022 GDP growth above 2%, and as I write the 10-year U.S. Treasury is around 1.50%.6 The cost of servicing debt is pretty attractive right now, and demand for U.S. debt has been strong. This keeps my worries about the U.S. dollar at bay, at least for now. I do not think investors should worry, either.

Bottom Line for Investors

In my view, the direction of the dollar is not a tell-all for what to expect out of economic growth or stock prices, and I do not think investors should treat it like one. Much like the global economy can absorb regional weaknesses (Emerging Markets, Europe) and external shocks, it can also absorb currency swings, in my view.

At the end of the day, there are too many other factors—domestic demand, trade, rising incomes, improving labor markets, productivity gains, technology, and innovation—that ultimately outweigh the impact of a stronger or a weaker dollar. Investors should remember to keep focused on the larger picture.

Focusing on the larger picture also includes keeping an eye on key data points that could impact your long-term investments. To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks June view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Top stocks in top industries

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Fred Economic Data. May 25, 2021. https://fred.stlouisfed.org/series/BOGMBASE

3 Fred Economic Data. June 2, 2021. https://fred.stlouisfed.org/series/GFDEGDQ188S

4 Fred Economic Data. June 11, 2021. https://fred.stlouisfed.org/series/DTWEXBGS

5 Wall Street Journal. July 13, 2020. https://www.wsj.com/articles/coronavirus-spending-pushed-u-s-june-budget-gap-to-864-billion-treasury-says-11594663634?mod=djem10point

6 U.S. Department of Treasury. June 14, 2021. https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/textview.aspx?data=yield

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.