Following the 2008 – 2009 Global Financial Crisis, U.S. consumers were in bad shape. Housing prices were depressed, many workers were out of a job, and household wealth declined sharply. For many years after the crisis, Americans paid down debts and worked to get their financial houses in order.1

Fast forward to the 2020 pandemic-induced recession, and the setup for U.S. consumers couldn’t look more different. This time around, debt levels have fallen, the personal savings rate soared, housing prices are shattering records, and wages are on the rise. About $6 trillion in stimulus money is swishing around, and more appears to be on the way.

After the Financial Crisis, China led the recovery with massive fiscal spending. After the pandemic-induced economic crisis, it’s the U.S. consumer leading the way.

____________________________________________________________________________

Not Sure What’s Next for the Market? Download Our Stock Market Outlook Report!

The pandemic-induced economic crisis is now showing signs of recovery, but investors should always be prepared for what’s to come. One way to prepare is taking the what-if’s into account. What if there are possible risks down your financial timeline?

That’s why investors should stick to the facts and hard data. Don’t try to time the market and give in to fear and emotions! Instead, we recommend keeping your focus on the long-term by looking into key economic indicators that can make a positive impact on your financial success.

To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Top stocks in top industries

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released July 2021 Stock Market Outlook2

____________________________________________________________________________

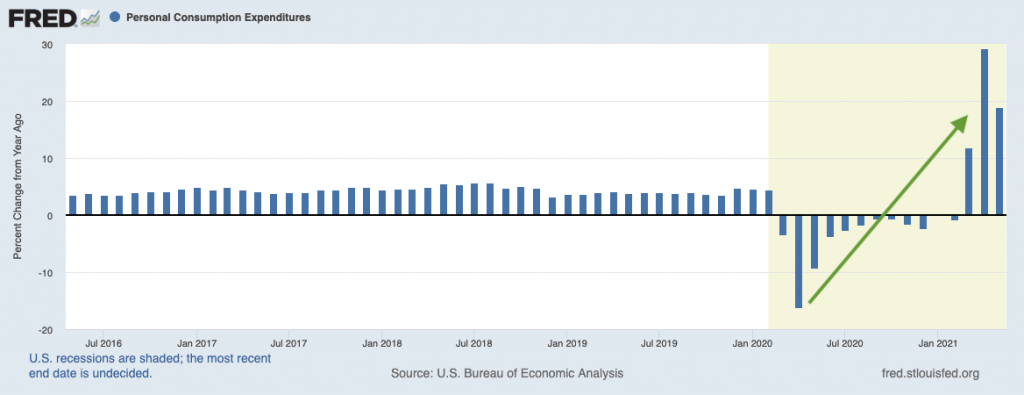

U.S. Consumer Spending Has Jolted Higher, Pulling the Global Economy Higher

The strength of the American consumer is critical for the global economy, and it also bears quite a bit of weight in the analysis we conduct at Zacks Investment Management. If earnings are central to our investment approach and the theses we develop, then it follows that tracking the U.S. consumer is crucial. Americans drive spending, and spending drives earnings.

Indeed, Americans account for over one-quarter of all spending worldwide, with China far behind at 11%. For 2021, U.S. consumer spending is expected to rise 10% (year-over-year) after adjusting for inflation, which would mark the strongest performance since 1946.

Demand for U.S.-made goods and services is strong, but Americans also buy significant amounts of foreign-made goods. By some estimates, the U.S. will spend an additional $170 billion in imports each year for the next 5 years, and will also post a record trade deficit of $876 billion this calendar year alone.

For many countries, a strong U.S. consumer is an economic blessing, and U.S. fiscal spending is icing on the cake. Government spending in the U.S. is expected to lift GDP in Japan, China, and the eurozone by at least 0.5% in the next year, and perhaps even up to 1% in Canada and Mexico.

All of the additional spending is welcomed, but it also poses some challenges for businesses and non-U.S. economies. Many businesses currently do not have the personnel or production capacity to meet current demand, and supply chains are still facing bottlenecks. Surging demand for consumer goods is thus putting price pressure on a broad array of products and inputs, which raises the costs of goods globally. This price pressure poses a risk for the recoveries of other countries.

One example is the rising demand for personal computers. Over the past year, sales of personal computers (PCs) have risen by 50% or more each quarter, as workers set up home offices and as families acquired computers for remote learning. This demand has put immense pressure on supply chains for semiconductors, making them scarce in the global economy. Analysts predict even more PCs will be sold as the hybrid work model takes hold, and as home education becomes more commonplace.

In this sense, the U.S. consumer is largely responsible for price pressure on a consumer good – personal computers – and on the availability of semiconductors. The U.S. consumer is a force for good, but such strong demand also creates logistical challenges and dislocations across the global economy.

Bottom Line for Investors

The U.S. consumer is the most powerful force in the global economy, and all signs point to a strong year for spending.

But strong demand comes with risks and challenges: rising prices for consumer goods in countries where the economic recovery is still in early stages; businesses scrambling to increase production and hire enough workers to meet demand; wage pressures; and, scarcity of inputs in supply chains. These all represent good problems, of course, and in the months ahead there will be many opportunities for businesses to capitalize. From an investor’s perspective, finding those businesses is the key.

In addition to keeping an eye on these businesses, we also recommend that investors keep a diversified approach when investing. In such early stages of recovery, it’s good to stay focused on the facts and key data points that can positively impact your long-term investments.

To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Top stocks in top industries

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Fred Economic Data. June 25, 2021. https://fred.stlouisfed.org/series/PCE#0

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The MSCI ACWI captures large and mid-cap representation across 23 Developed Markets (DM) and 27 Emerging Markets (EM) countries. With 2,986 constituents, the index covers approximately 85% of the global investable equity opportunity set. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI UK All Cap Index captures large, mid, small and micro cap representation of the UK market. With 819 constituents, the index is comprehensive, covering approximately 99% of the UK equity universe. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.